Texas modestly grows with soft landing likely

Texas firms reported below-average output growth to start 2023, while employment and wage gains remained elevated despite indications of a softening labor market.

Price and wage inflation are expected to slow this year but remain above historical averages. Given the current economic headwinds, employment growth is expected to slow across the state in 2023, although Texas will likely avoid going into recession this year.

Business output barely expanding

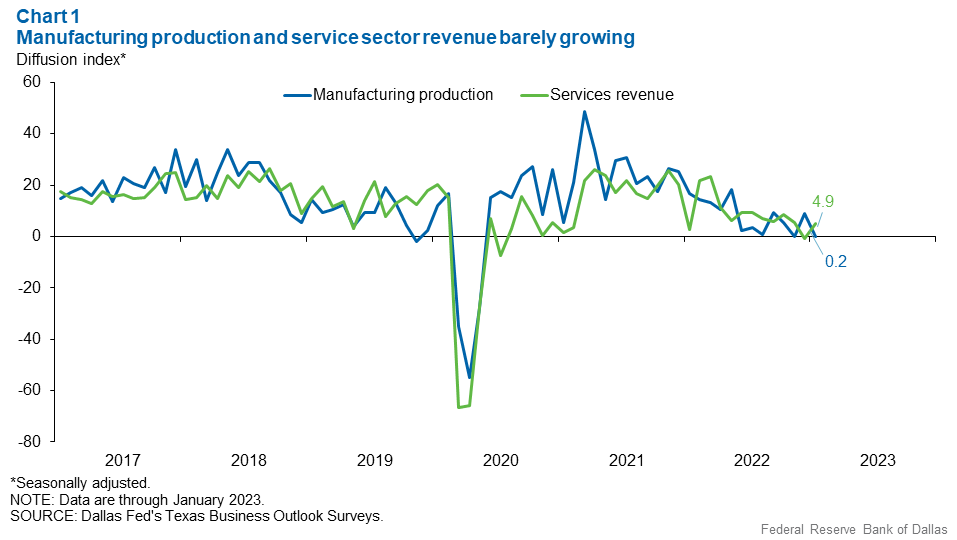

Coming into the new year, services and manufacturing were both barely in expansionary territory. The Dallas Fed’s Texas Business Outlook Surveys (TBOS) manufacturing production index—calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase—has been near 0 since mid-2022. This suggests overall weak growth but not outright contraction (Chart 1).

The manufacturing new orders index posted an eighth consecutive negative reading in January, but advanced from -11.0 to -4.0, indicating the pace at which new orders declined has eased.

The services revenue index trended down throughout 2022, falling to zero at year-end before picking up slightly in January. Most services industries noted weakening revenues, with contacts citing high inflation and rising interest rates.

Tentative signs of labor market cooling emerge

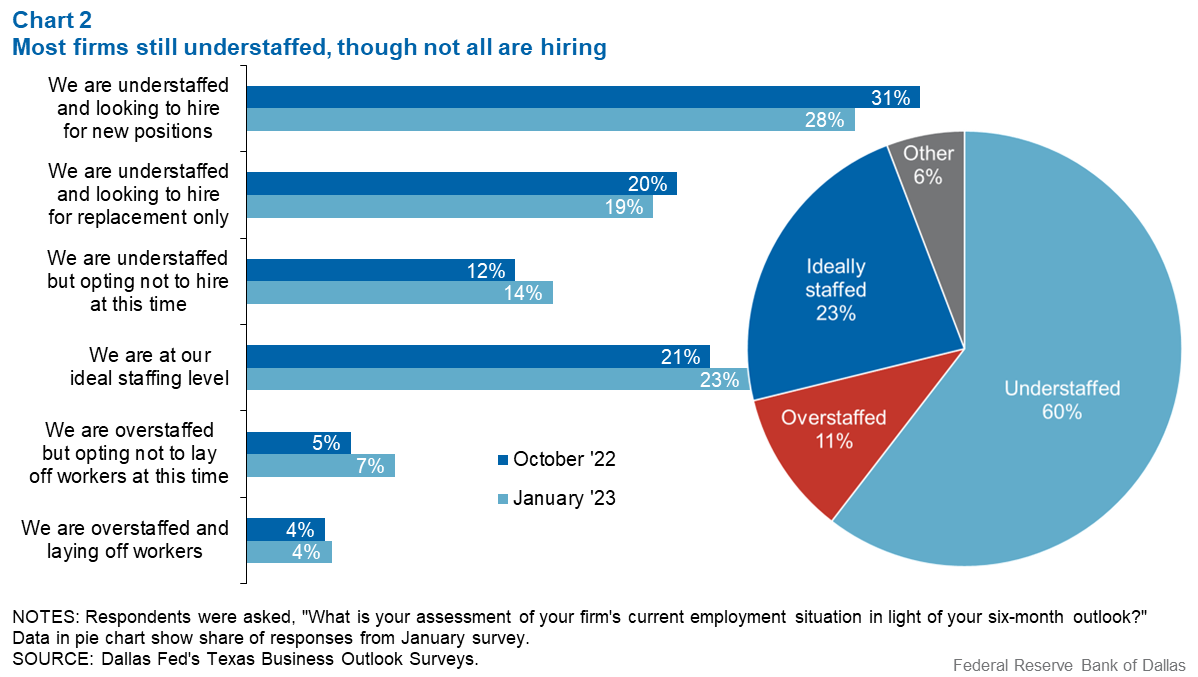

The TBOS employment indexes remain elevated—advancing in January—despite slower-than-normal growth in services and manufacturing, a product of worker shortages and a still-tight labor market. Firms are still hiring to backfill open positions and remain hesitant to let go of workers because of difficulties recruiting candidates. Nevertheless, the share of firms looking to hire fell to 50 percent in January from 68 percent a year prior.

Still, a majority of firms remain understaffed, though an increasing share are opting not to hire at this time (Chart 2).

There was also an uptick in the share of firms reporting they are overstaffed but not laying off, indicative of labor hoarding. “We are likely overstaffed by about 15 percent right now but are not willing to lay off or cut hours, as we're unsure if things will pick up,” a manufacturing contact reported.

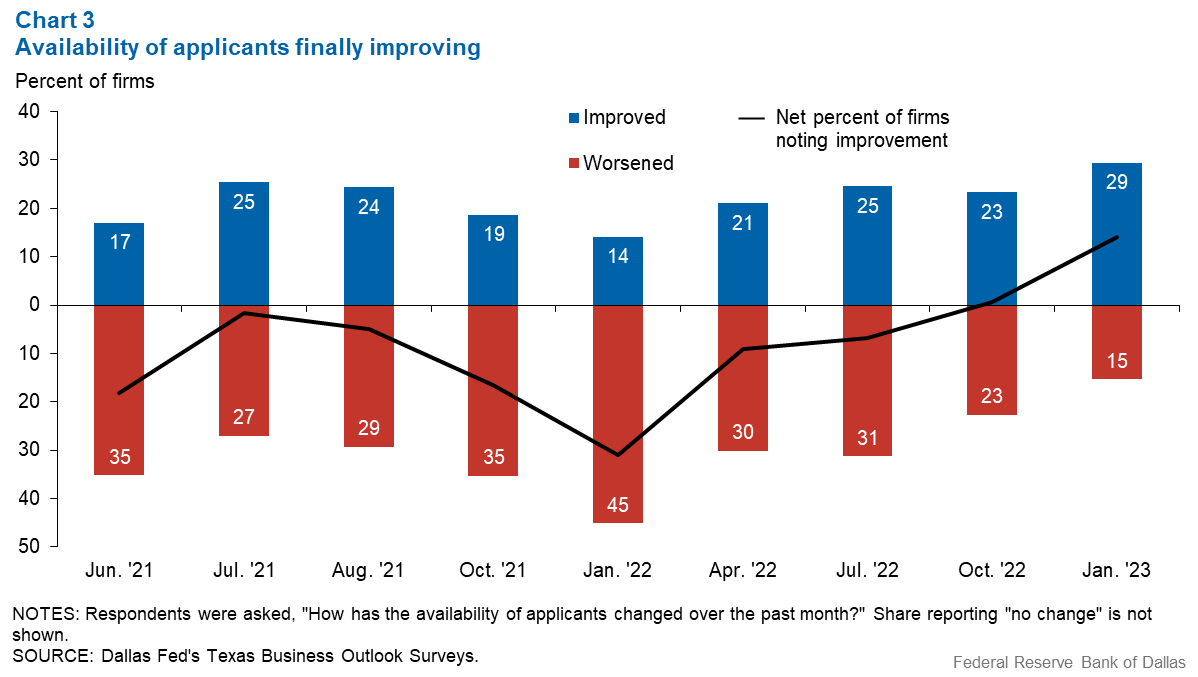

A lack of applicants remains a primary impediment to hiring. But when asked how the availability of job seekers has changed over the past month, more firms noted an improvement rather than a worsening for the first time since this question was added to the survey in June 2021 (Chart 3).

A retailer noted, “Hiring was more difficult a few months ago, but it seems to have eased a bit.” A contact in health care said, “The employment pool has improved in both quantity and quality of applicants; the phenomenon of ‘ghosting’ [abruptly terminating contact with] the employer … has been reduced.”

Slower wage growth expected in 2023

Firms normally do not raise wages frequently—three-quarters of TBOS respondents typically report no wage change in any given month. Amid surging wage pressure in 2022, the share of firms increasing wages month to month reached 40 percent.

While still elevated, wage growth has trended lower since mid-2022. “We provided significant (10 percent or more) raises in December after a mid-year raise in July 2022,” a manufacturing contact said. “We felt that this was essential in order to keep our employees, and we have successfully retained everyone we wanted to keep. We hope not to need to do another round of raises mid-year.”

TBOS firms reported lower expected wage growth in 2023 than in 2022, the December special questions indicated. Overall, TBOS firms on average expect 5.6 percent wage growth in 2023, down from 7.6 percent recorded in 2022. Even with the anticipated deceleration, wage growth is projected to remain elevated. One technology services contact said, “Wage demands are higher than ever,” while an apartment management firm noted that “workers are holding us hostage for higher wages.”

Texas employment growth to slow in 2023

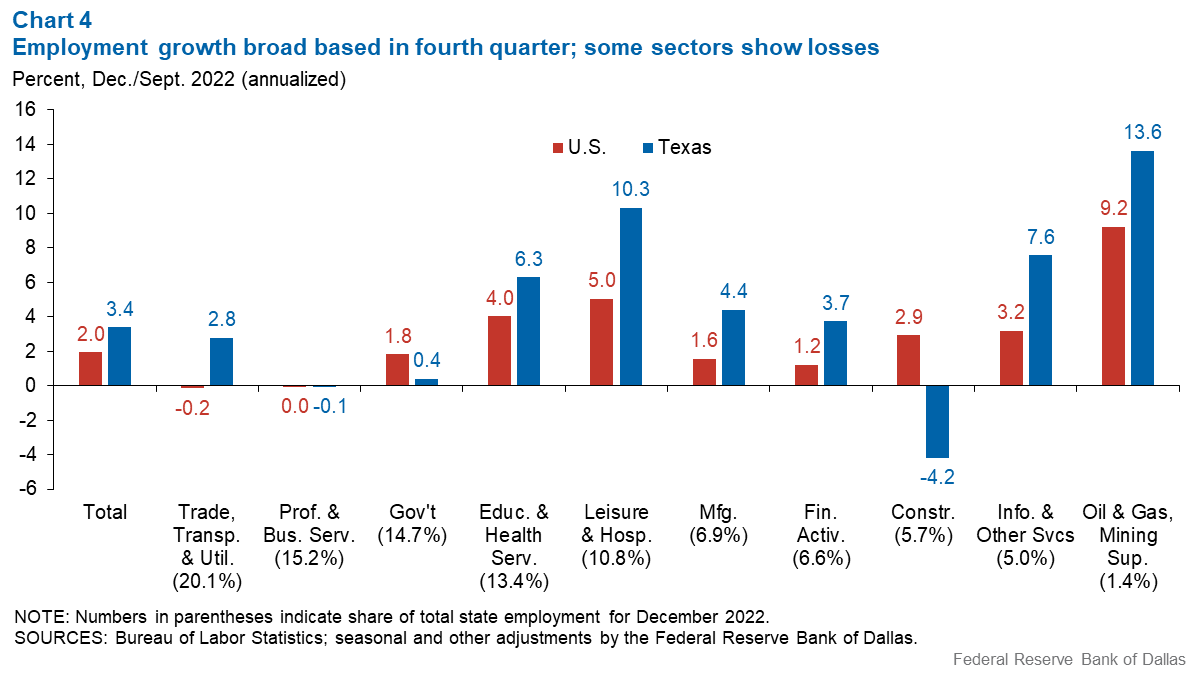

Texas employment grew 3.4 percent in the fourth quarter 2022, though job gains may be revised downward following benchmarking, which adjusts payroll survey data to better quantify actual job growth. Data for the first half of 2022 were sharply lowered following such a revision.

Employment growth was led by increases in information services, energy, health care, leisure and hospitality, and trade, transportation and utilities (Chart 4). Job losses occurred in professional and business services, and construction.

Texas outpaced the nation in job growth in 2022, even after the benchmark revisions, which also reduced employment numbers nationwide. Those revisions, which will be folded into the Bureau of Labor Statistics’ state payroll employment data in March, were historically large and indicate a cooler labor market than initially suggested (national benchmark revisions, in contrast, are not incorporated into official data until January 2024).

With slower momentum heading into 2023, lower oil prices and declines in both the U.S. and Texas leading indexes, the Dallas Fed’s Texas employment forecast for 2023 December-over-December job growth is 1.4 percent, with an 80 percent confidence interval of 0.7 percent to 2.2 percent.

This would mean growth below the state’s 2 percent long-term trend, but not a recession. Risks are weighted to the downside, with Texas businesses voicing concern over weakening demand, labor market tightness, inflation and rising interest rates.

About the authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.