Emerging-market countries insulate themselves from Fed rate hikes

The Federal Reserve has engaged in its fastest tightening cycle since the early 1980s. The 5.25-percentage-point increase in the federal funds rate from March 2022 through July 2023 far exceeds the 3 percentage points of Fed tightening in 1994 and is only eclipsed by the 10-percentage-point increase in the first year-and-a-half of the Volcker Fed, 1979–80.

Those earlier episodes of sizable Fed tightening preceded destabilizing currency devaluations in emerging markets, precipitating sovereign debt and banking crises in many of those economies.

However, this time it appears emerging-market authorities helped insulate their economies against sudden shifts in capital flow by undertaking proactive rate increases, improving fiscal discipline and external balances, as well as accumulating higher stocks of foreign exchange reserves.

Emerging-market resilience during the current tightening cycle

In 1982, after a sizable Fed tightening, a basket of emerging-market currencies depreciated 30 percent against the dollar, and the Mexican peso fell 80 percent. Over the same period, the dollar gained 10 percent against a basket of advanced economy currencies.

The pattern repeated during the Fed tightening cycle from 1994 to mid-1995, when the same basket of emerging currencies slumped 20 percent and the Mexican peso fell by half versus the dollar. Meanwhile, the basket of advanced economy currencies appreciated 13 percent against the dollar.

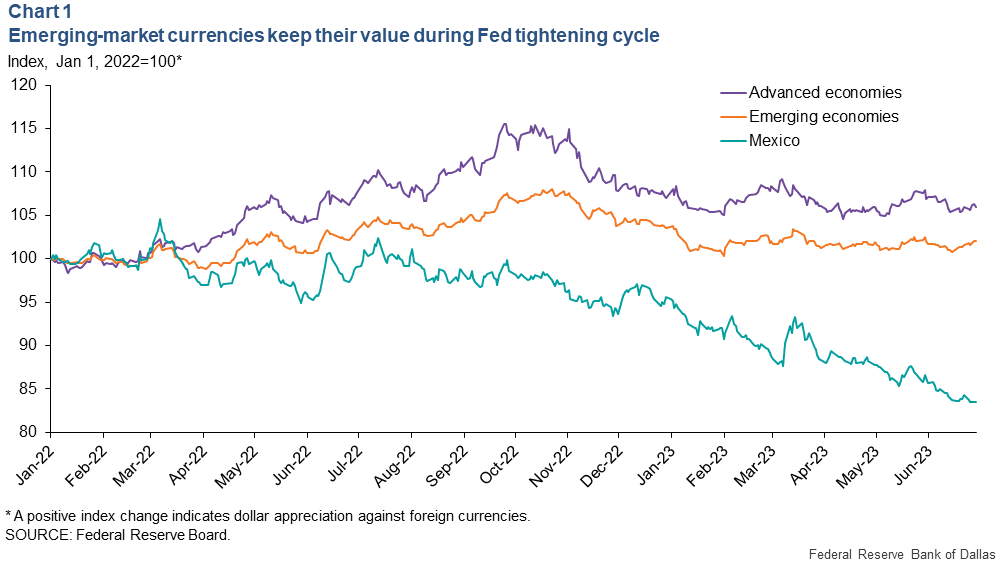

By comparison, from early 2022 to mid-2023, emerging-market currencies depreciated only modestly based on a trade-weighted index of the dollar exchange rate of major U.S. trading partners, and the Mexican peso appreciated 15 percent against the dollar (Chart 1). At the same time, advanced economy currencies depreciated more than emerging-market currencies during this tightening cycle.

Changing nature of emerging-market debt

A number of factors have contributed to the relative strength of emerging-market currencies, key among them policy rate increases early in the tightening cycle. Brazil in February 2021—followed soon by Mexico, Chile and South Africa central banks—began raising interest rates well before the Fed initiated its actions in March 2022, a notable contrast to prior Fed rate-increase periods.

Some emerging markets have raised their policy rates by substantially more than the Fed’s 5.25-percentage-point increase. Those preemptive rate hikes led to a notable widening in interest rate differentials between emerging markets and advanced economies throughout 2021–22, which increased the real return on emerging-market assets. Those returns provided a meaningful support for the countries’ exchange rates relative to advanced economy currencies.

Another important factor—although not as widely recognized—is the changing nature of emerging-market external debt. In the 1980s and 90s, nearly all emerging-market public debt held abroad was denominated in foreign currencies. Emerging markets were historically prone to periods of home currency instability and high inflation, prompting most foreign investors to prefer debt denominated in a hard currency (usually dollars or a European currency).

But this preference itself was a source of instability. An abrupt local currency depreciation would raise the debt burden—it would take more of the local currency to make dollar-denominated interest and principal payments. This raised the probability of default for sovereign or financial sector debt, potentially making a currency crisis self-fulfilling, as during the Mexico’s Tequila Crisis in 1994.

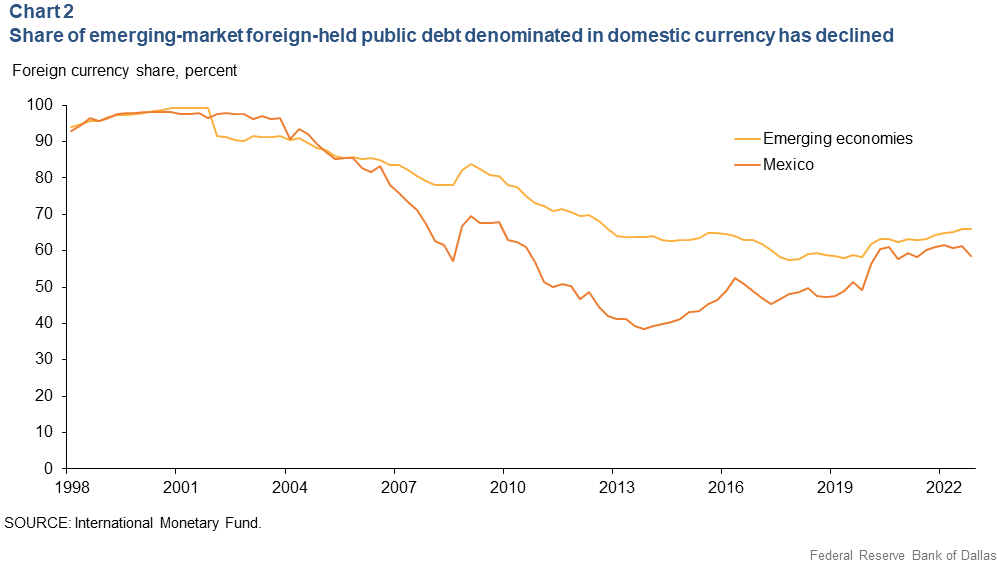

Denominating nearly all emerging-market external debt in foreign currencies was dubbed the original sin in economics literature. The term was coined around the turn of the century. Over the past two decades, the situation has changed. The foreign-currency share declined notably, from 100 percent 20 years ago, to around 60 percent now (Chart 2). This transition to domestic-currency debt is mostly a feature of foreign-held public debt. Many corporate issuers of foreign-currency debt are exporting firms with significant foreign-currency-denominated assets or revenue.

Improved monetary policy credibility in emerging markets has coincided with the increased domestic currency share of emerging-market external debt. Foreign investors shunned local currency debt in the latter 20th century because issuing countries were subject to macroeconomic mismanagement, sudden capital flight and high and variable inflation.

Additionally, many emerging-market countries maintained a fixed or heavily managed exchange-rate regime. As a result, the countries’ ability to use monetary policy for domestic objectives, such as reducing inflation, was constrained, diminishing policy credibility.

Widespread adoption of formal inflation targets around 2000 improved transparency and credibility. Banco de México, for example, adopted an inflation target in 2002. Mexico was joined by the Czech Republic, Poland, Brazil, Chile, Colombia, South Africa, Thailand, Hungary, Peru and the Philippines, which adopted inflation targeting around the turn of the century.

Measuring monetary policy transparency

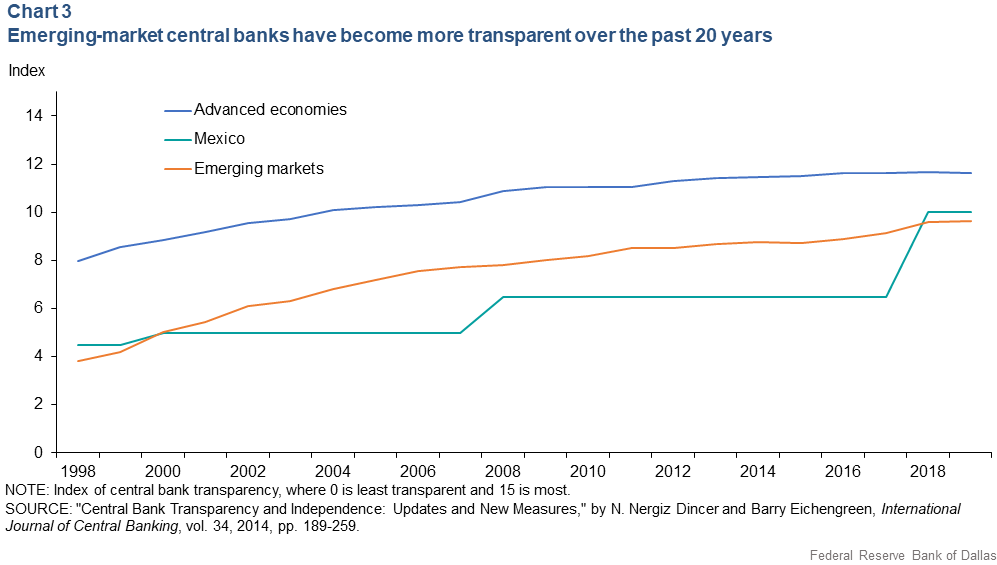

Economists Barry Eichengreen and N. Nergiz Dincer compiled a measure of central bank transparency based on the clarity of bank policy objectives and operations, the process for decision-making and the economic data informing bank actions. Central banks in emerging markets have become more transparent over the last 20 years (Chart 3). The authors show that greater central bank transparency is associated with lower and more stable inflation.

The economists’ index of central bank transparency is a 0-to-15 scale. Advanced economy central banks scored around 8 in 1998, and emerging markets, including Mexico, scored around 4. Over the past 20 years, the index rose to 12 in advanced economies and 10 in emerging markets; improved transparency has halved the difference between the two groups.

Foreign-currency debt and vulnerability to Fed tightening

Because a large share of foreign-currency-denominated debt can leave a country vulnerable to shifting investor sentiment, a Fed tightening cycle could motivate investors to reallocate toward higher-yielding U.S. assets, leading to capital outflows. Foreign-currency depreciation might follow, raising the probability of debt default.

To mitigate the impact of capital outflows, emerging-market central banks hold reserves—liquid, foreign-currency-denominated assets. These reserves provide foreign-currency liquidity to domestic borrowers at times when it may be difficult to obtain liquidity elsewhere, thus enabling domestic borrowers to finance current account deficits and roll over maturing debt.

Central banks determine an appropriate reserve level to assuage investor concerns. Pablo Guidotti, a former deputy finance minister in Argentina, reached a conclusion about the “appropriate level,” which was later popularized by then-Fed Chair Alan Greenspan in a 1999 speech: “Countries should manage their external assets and liabilities in such a way that they are always able to live without new foreign borrowing for up to one year.”

The Guidotti-Greenspan rule leads to a simple measure of a central bank’s reserve adequacy: foreign exchange reserves minus the sum of short-term foreign-currency-denominated external debt, minus the current account deficit.

Short-term foreign-currency-denominated external debt (both public and private) is one of the three components in the measure of reserve adequacy. Key to determining a country’s foreign exchange reserve adequacy is whether those reserves can cover foreign-currency-denominated debt in the coming year.

When more foreign-owned debt is denominated in the local currency, the central bank needs to hold fewer foreign exchange reserves. Declining amounts of foreign-currency-denominated public debt contributed to improved emerging-market reserve adequacy.

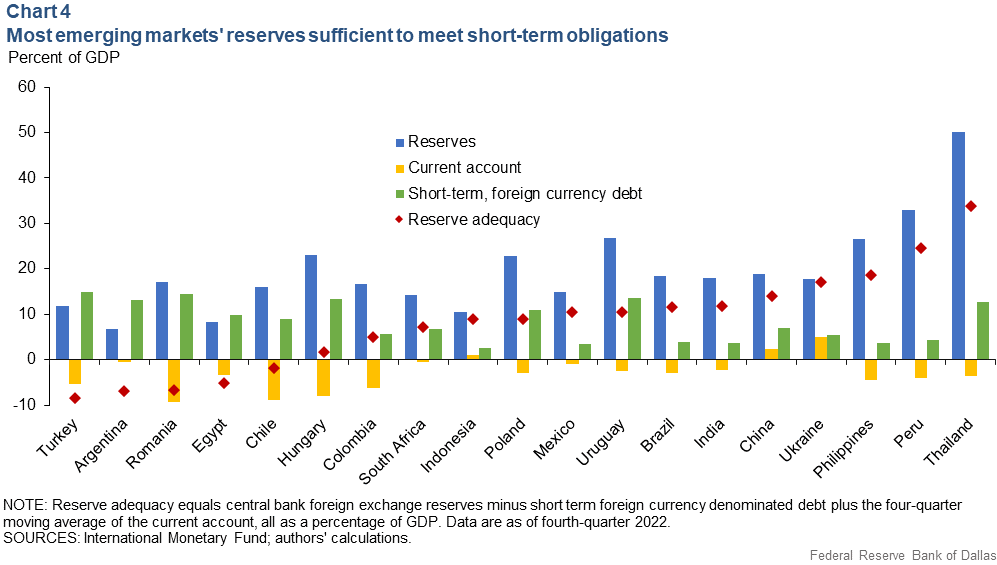

Most emerging markets are at a comfortably positive level of reserve adequacy (Chart 4). The countries with low or negative reserve adequacy all have some combination of low central bank foreign exchange reserves (Argentina and Egypt), high foreign-currency-denominated short-term debt (Turkey and Romania) or high current account deficits (Chile and Hungary).

Mostly, countries with the highest levels of short-term foreign-currency debt also have the least reserve adequacy. Exceptions such as Uruguay and Thailand have high levels of foreign debt but also keep sizeable foreign exchange reserves.

Improved policies, fundamentals boost emerging markets

Broad, long-term improvement in emerging markets’ macroeconomic policies and fundamentals has bolstered the resilience of their currencies during the ongoing tightening cycle for the Fed and other advanced economy central banks. These policies have increased foreign investors’ appetite and comfort for emerging-market local-currency debt.

The difference between emerging market and advanced economy interest rates has narrowed during the current tightening cycle as the Fed and its advanced economy counterparts continue to combat what appears to be persistent global inflationary pressure. To maintain monetary policy credibility, emerging-market policymakers must remain vigilant battling inflation.

About the authors

The views expressed are those of the author and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.