Texas economic activity expands modestly; labor market remains healthy

Texas economic activity expanded at a modest pace in April. While the manufacturing sector rebounded, the service sector slowed.

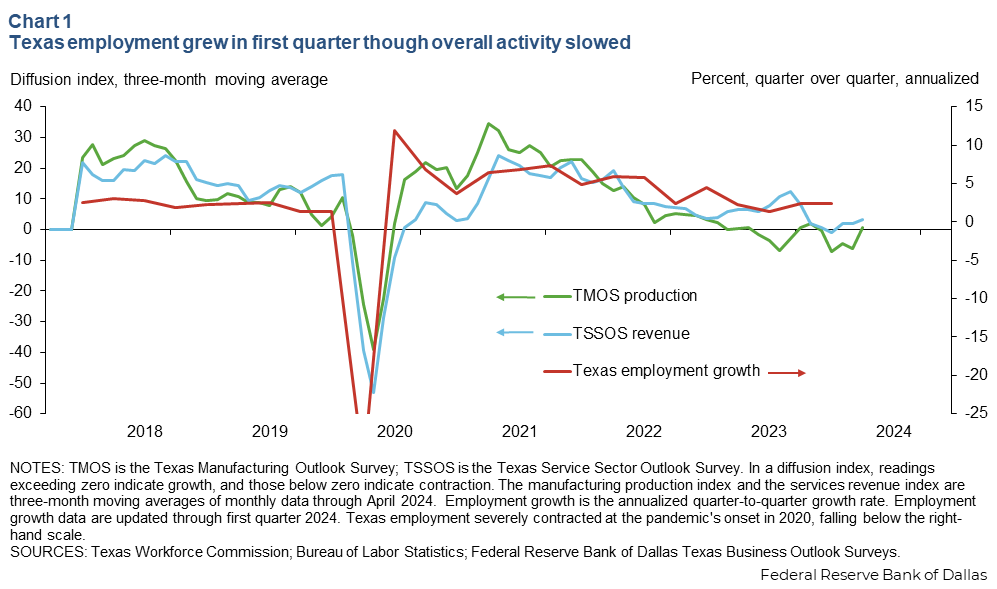

Texas employment growth was moderate in the first quarter, slightly above the state’s roughly 2 percent long-run trend. The unemployment rate held steady.

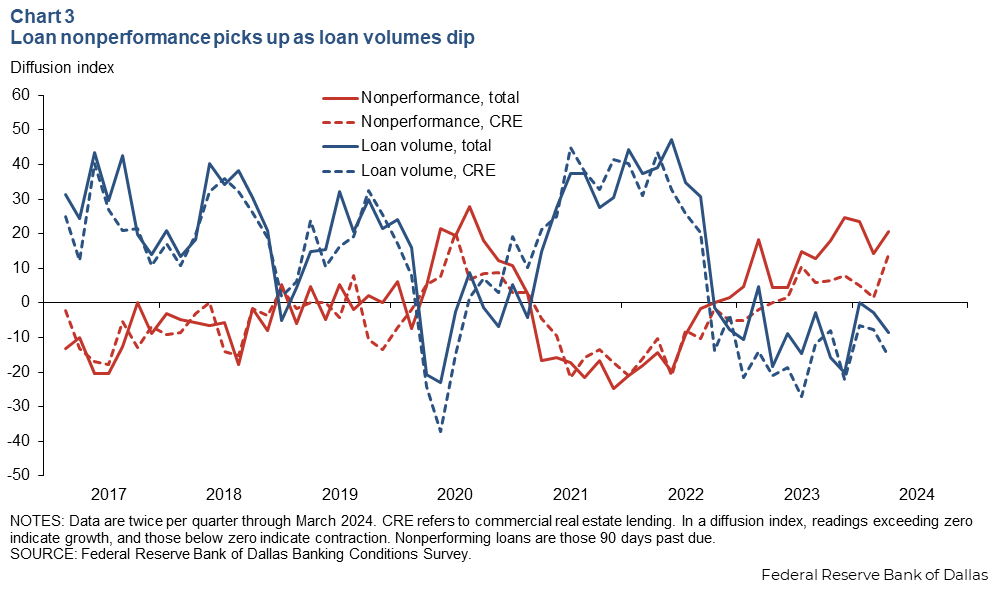

Additionally, there were no signals of weakness in labor market indicators such as layoff notices and jobless claims. Price pressures have eased, and banks reported slowing loan demand and an uptick in nonperforming loans.

Overall, the outlook remains positive, and Texas firms expect stronger activity in the coming six months.

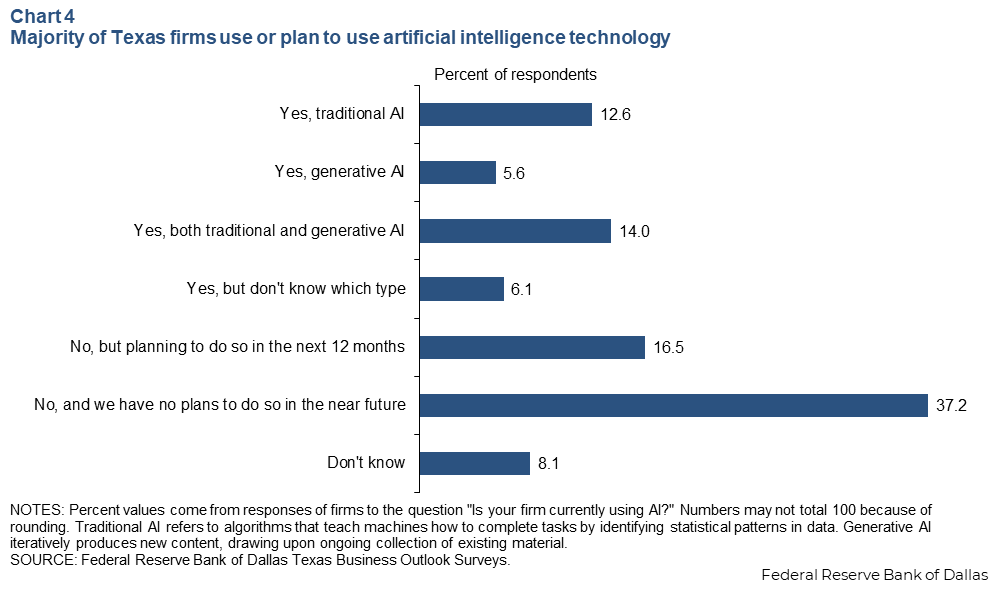

Separately, a majority (55 percent) of respondents to the Dallas Fed’s Texas Business Outlook Surveys (TBOS) special questions in April said they are using or planning to adopt artificial intelligence (AI) technologies.

Job growth dips in March, but labor market stays stable

Texas job growth dropped to an annualized 1.6 percent in March (18,400 jobs), down from a downwardly revised 4.1 percent growth rate in February. The state’s performance trailed the nation’s 2.3 percent job growth in March. However, first-quarter performance was unchanged from fourth quarter 2023 at 2.4 percent (Chart 1).

First-quarter job growth was led by other services (maintenance and personal services), leisure and hospitality, and professional and business services. The Texas unemployment rate was unchanged at 3.9 percent in March, while the state’s labor force increased an annualized 1.7 percent.

Other labor market indicators largely corroborate the health of the Texas labor market. Initial claims for unemployment benefits, Worker Adjustment and Retraining Notification (WARN) layoff announcements, the intensity of job postings and the layoff rate for Texas were mostly stable over the past month, indicating no obvious sign of weakened hiring or an impending spike in layoffs.

Overall economic activity slowed in Texas, according to the April TBOS. While the manufacturing sector rebounded from contraction in March and expanded in April, activity in the much-larger service sector stagnated.

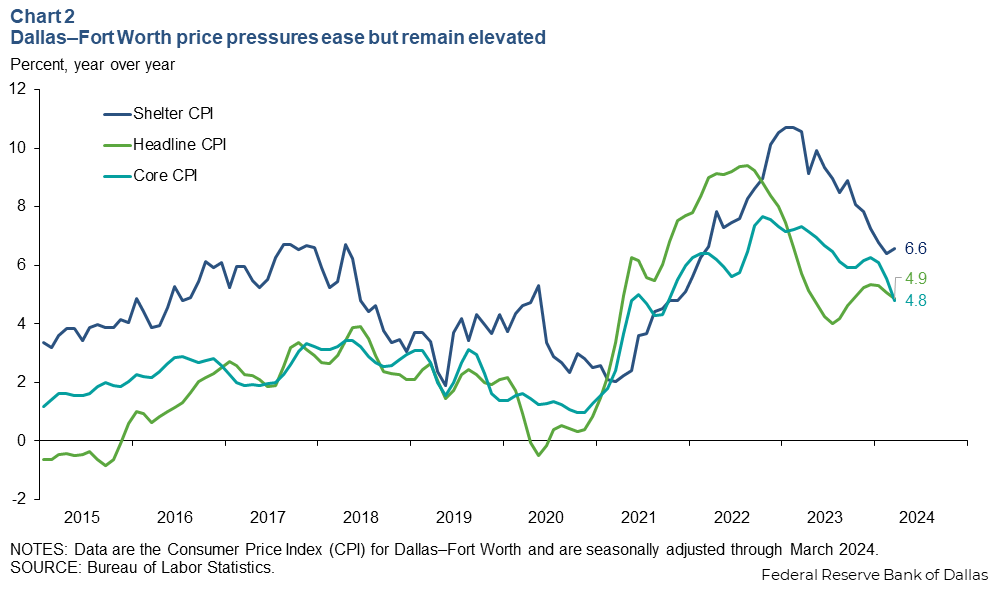

The headline Consumer Price Index (CPI) for Texas and the state core CPI (excluding food and energy) continued declining in the most recent data, though they remained elevated. Dallas–Fort Worth year-over-year CPI growth declined in March 2024, to 4.9 percent overall from 5.1 percent in February, while core CPI decreased to 4.8 percent from 5.5 percent. Shelter CPI ticked up to 6.6 percent in March from 6.4 percent in February (Chart 2).

Notably, both the DFW rent and owners’ equivalent rent (OER) CPI growth declined slightly in March on a year-over-year basis. The high CPI growth in shelter is likely attributable to a recent spike in home insurance costs.

Housing inventory continues to rise, although the median home price in Texas in March was largely unchanged from a year ago.

Loan demand and loan volume fell across loan categories in March, according to the Dallas Fed’s Banking Conditions Survey. Overall loan nonperformance rose, especially in commercial real estate, highlighting the pressure from office vacancies that have remained high since the pandemic began and remote work expanded. Nonperforming loans are those 90 days past due (Chart 3).

Firms adopting AI technologies for a broad range of purposes

A majority of the TBOS-surveyed firms responding to special questions in April said they are either using or expecting to use AI in the near future for a broad range of purposes (Chart 4). In general, AI refers to algorithms that teach machines how to complete tasks by identifying statistical patterns in data, rather than following preset instructions provided by humans—the basis of the technology developed during the automation revolution. Generative AI iteratively produces new content, drawing upon ongoing collection of existing material.

Marketing and advertising are the leading reasons for using AI. Business and predictive analytics, automation and customer service are the other most-cited purposes.

Most of the surveyed Texas firms either have not seen any impact or do not expect any impact from AI on employment. But, among the firms that see or expect to see AI affecting employment, 40 percent said they experienced or anticipate decreased employment, and 11 percent experienced or foresee an increase. Many firms see or expect to see a change in the types of workers but not the overall numbers of workers needed.

When asked about the jobs impact by skill level among firms that report employment effects, the average firm sees or expects to see high-skilled employment increase due to AI. In contrast, the average firm sees or expects to see decreases in low- and middle-skilled employment due to this technology.

The result regarding high-skilled employees highlights the likelihood that while tasks performed by such workers might be vulnerable to competition from AI, many other irreplaceable tasks performed by high-skilled workers may be complementary to AI technologies. This suggests demand for high-skilled workers capable of performing specialized tasks aided by AI technologies could potentially increase. Thus, the availability of and the access to AI technologies could also boost demand for high-skilled workers, depending on the relative strengths of the substitution and the complementary effects.

Firms reported that increasing productivity, access to timely information and better customer relations are the top AI benefits. Misinformation, privacy compromises, surveillance, bias or discrimination, and difficulty hiring workers with AI skills were reported by many respondents as concerns.

Outlook generally optimistic, though contacts cite uncertainty

The April Texas Employment Forecast indicates jobs will increase 2.3 percent (329,400 jobs) in 2024. The forecast suggests job growth will exceed the state’s long-term average of about 2.0 percent, and employment in December 2024 will reach 14.4 million, with growth through the remainder of the year also at 2.3 percent.

Texas businesses expressed slight pessimism and heightened uncertainty regarding their current business outlook. Still, far more businesses expect production and revenue to be higher six months from now than anticipate a decline in those areas. Thus, despite a high level of uncertainty, businesses foresee improving economic conditions.

About the authors