Texas overcomes mid-summer doldrums as economic prospects improve

Economic expansion in Texas accelerated during September and October, pointing toward an improving regional economy after summer weakness. Leading indicators were consistent with an upturn, including more Texas firms seeking credit, with fewer of them encountering difficulties obtaining it.

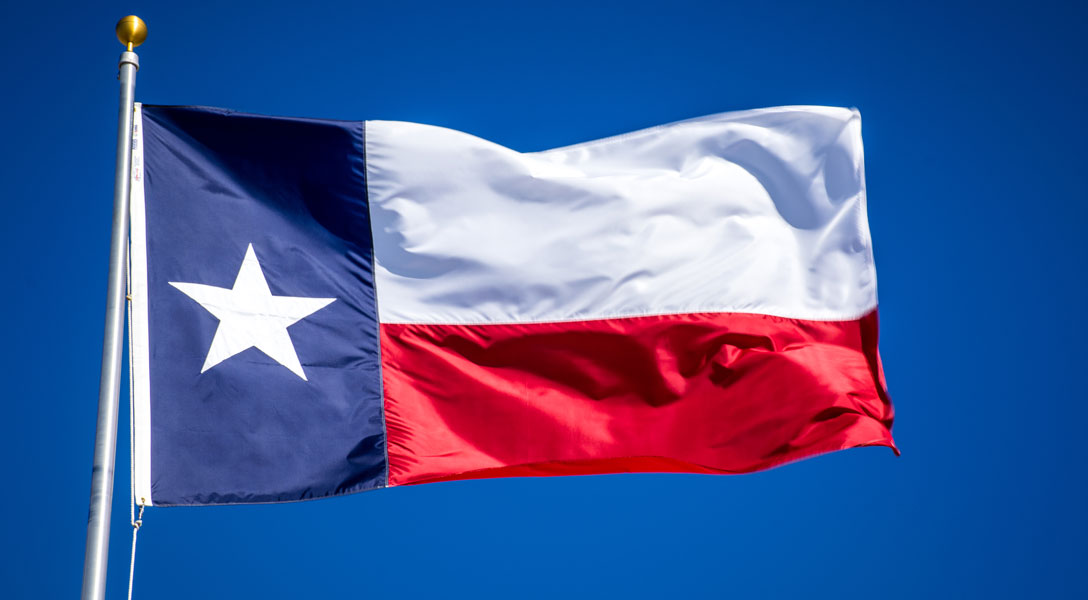

Texas job growth picked up, with an annualized 2.9 percent increase over the three months ended in September (Chart 1). August payrolls were revised higher.

Job growth was broad based, as large sectors such as retail and wholesale trade, professional and business services, and health care logged significant gains. Jobs in construction, a cyclical sector, increased at the fastest pace since January 2023.

The latest performance contrasted with a slowing expansion in early summer. Weakening employment services payrolls, often a leading indicator, signaled a possible sharp decline in overall activity. Strong employment growth in August and September eased concerns, suggesting the sluggishness was a byproduct of wind storms in May and Hurricane Beryl, which left much of Houston in the dark for nearly a week in July.

The state unemployment rate held steady at 4.1 percent for a third consecutive month in September, even as the labor force expanded at a 4.1 percent annualized rate in September from a healthy 3.3 percent in July. As the number of people working or seeking work in Texas increased, data suggest firms were ready to hire them.

Texas firms indicate business expansion likely

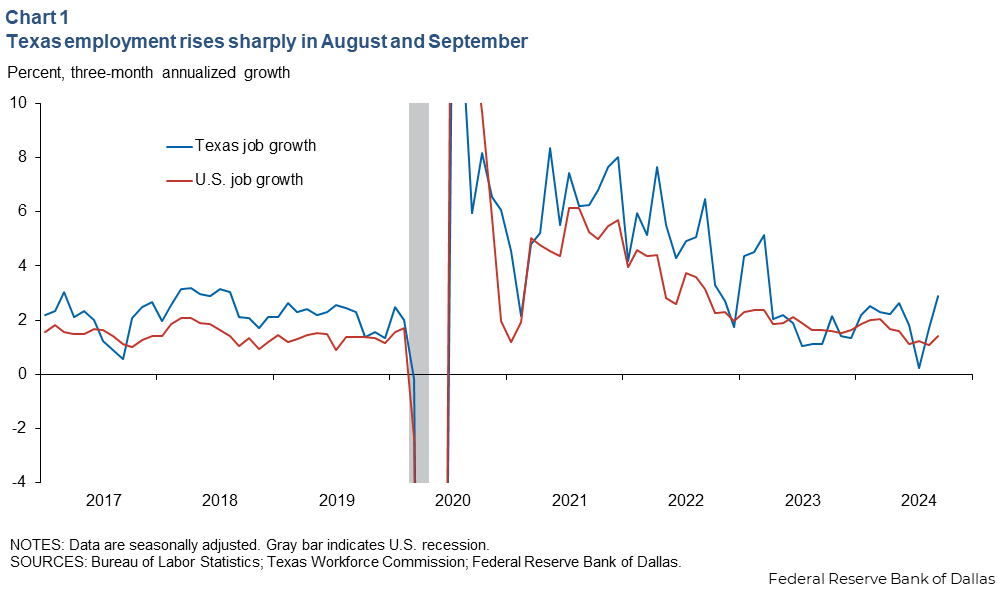

Texas Business Outlook Surveys (TBOS) data in October signaled an expansion for both services and manufacturing for the first time since mid-2022.

The manufacturing production index, which had been little changed over the preceding six months, increased to 14.6 in October from -3.2 in September. The three-month average rose to 4.3, its strongest reading in 22 months. The service sector revenue index was little changed at 9.2, extending a trend of broadening increases in revenue.

Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. Index numbers greater than zero indicate expansion; those below zero signal contraction.

A composite of the five Federal Reserve banks conducting regional business surveys indicated an upturn in production and revenue indexes and an improved outlook over September results. A three-month moving average of a composite index of manufacturing production rose from -5.0 to -3.0 in October, while the services revenue index increased from 2.8 to 5.9 (Chart 2).

Taken together, the surveys point to growing services sectors and stabilizing manufacturing activity, with Texas helping lead the way.

Other leading indicators point to pickup, stabilization

Texas leading indicators can indicate where the economy is headed. A moving average of manufacturing hours worked in Texas increased to 43.7 hours in September from 43.4 in May, while the U.S. held steady at 40.1 hours. While volatile, both series have generally strengthened or stabilized over the past six months.

Manufacturing hours worked is considered a leading indicator, as employers are more likely to vary hours worked by existing staff before adjusting payrolls. The manufacturing sector is highly cyclical, sensitive to changes in the trajectory of the economy. Over the past several months, job growth in Texas manufacturing has slowed but remained positive.

Manufacturing new orders, another leading indicator, signaled modest softening. The three-month moving average of the Texas Manufacturing Outlook Survey (TMOS) new orders index rose to -4.4 in October from -7.4 in September. The five Federal Reserve banks’ regional survey composite new orders index also indicated improvement, advancing to -8.4 from -9.9, although both the Texas and composite indexes remained in contractionary territory.

With big one-month improvements in current production and in the outlook for October, the lack of a commensurate improvement in new orders suggests a significant acceleration is unlikely.

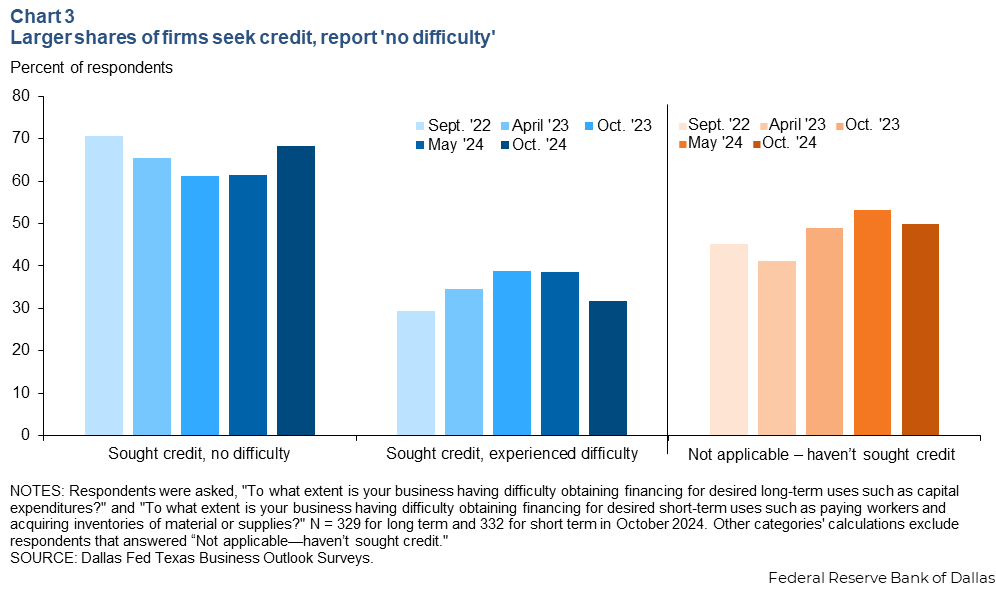

Credit conditions stabilize as more businesses seek to borrow

The Dallas Fed’s Banking Conditions Survey indicated an improved outlook. Future loan demand reached a 22-month high in October, while a measure of growth in nonperforming loans was at its lowest point since May 2023, reflecting a drop in the share of banks reporting increases in delinquent loans. Residential lending improved the most, while commercial and industrial and consumer loan nonperformance indexes rose, and commercial real estate delinquencies leveled off.

The Banking Conditions Survey also indicated declining loan pricing (interest rates and fees) and a modest tightening of credit standards and terms.

The improved banking outlook came as more Texas firms sought credit, with fewer firms reporting difficulty securing it. The share of firms seeking credit increased to 50.2 percent in October from 46.9 percent in May, the last time TBOS respondents were asked this question, according to the TBOS special questions in October. Among the firms seeking credit, the share reporting “no difficulty” rose to 68.4 percent in September from 61.3 percent in May (Chart 3).

Among the nearly half of responding firms who said they aren’t seeking credit, most said they either had enough funds or no expenses requiring funding.

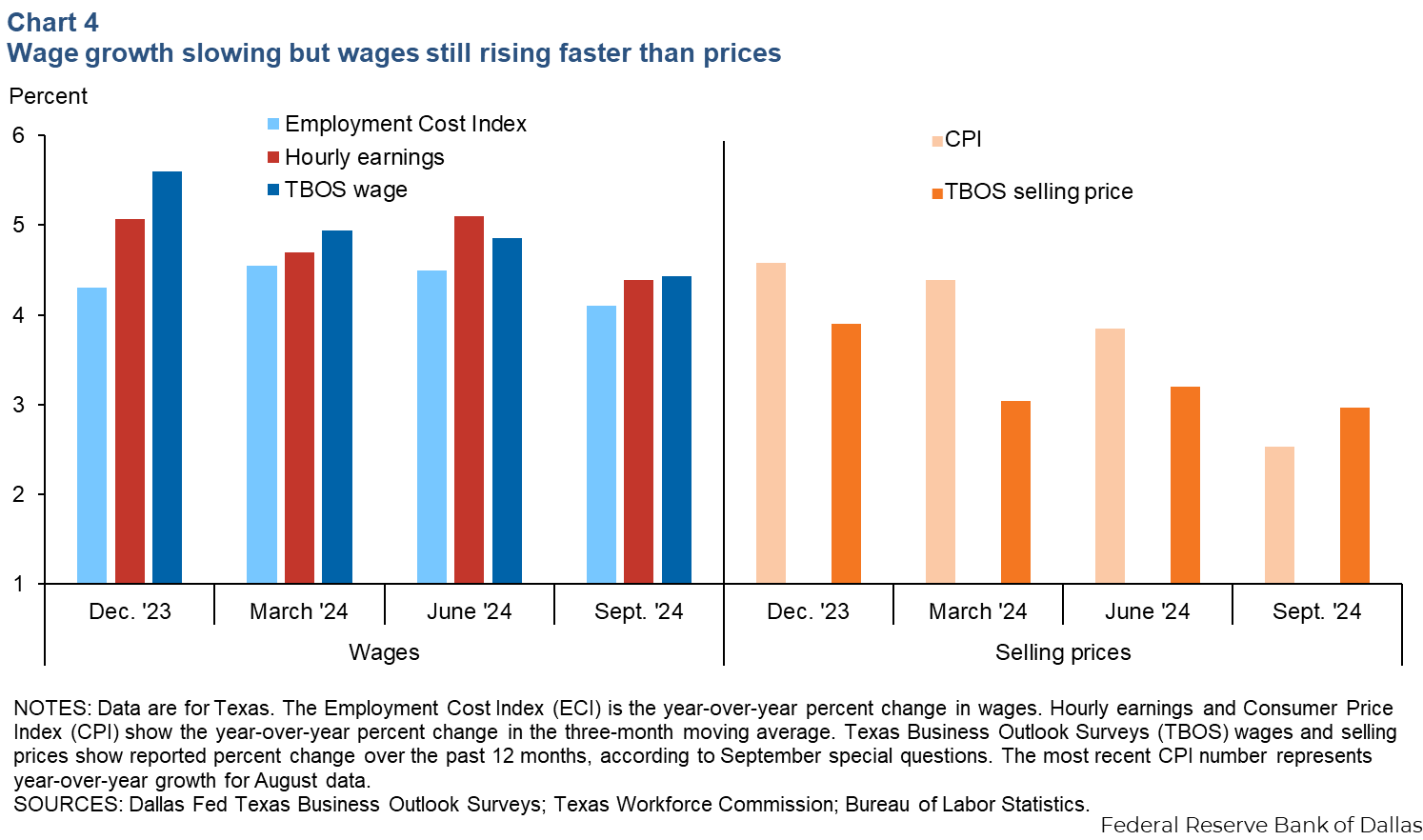

Inflation and wage growth slow

Texas businesses reported in special questions in September that year-to-date growth in their selling prices has slowed. TBOS selling price growth over the past 12 months eased to 3.0 percent in the September survey from 3.2 percent in May 2024. The slower pace was broadly in line with shifts in the Texas consumer price index (CPI). Texas CPI year-over-year growth slowed from about 3.9 percent in June to 2.5 percent in August, the most recent month for which data are available.

TBOS September special questions responses indicated a decrease in wage growth over the past 12 months, to 4.4 percent in September from 4.9 percent in June. The change mirrored other measures of wage growth. Private hourly earnings growth slowed to 4.4 percent in September from an annualized 5.1 percent in June. Lastly, the third-quarter Employment Cost Index for Texas dropped to 4.1 percent from 4.5 percent (Chart 4). These measures point to a loosening but still healthy Texas labor market.

With wage growth outpacing inflation and stabilizing credit conditions, Texas consumers and businesses are still spending. State real (inflation-adjusted) total sales tax revenue rose 2.9 percent in September, though the year-to-date increase was a modest 0.4 percent. This mostly reflects spending on goods rather than services.

Outlook supports strengthening Texas economy

While a spate of bad weather during the first half of summer diminished growth expectations, recent reports and revisions to data paint a picture of a healthy regional economy with broad-based momentum. Strong job additions, improving output measures and better expectations for growth in regional and national surveys suggest that Texas is getting back to trend or may exceed trend growth.

The 2024 Dallas Fed Texas employment forecast in October rose to 2.5 percent for the December-to-December period, implying a growth rate of 3.0 percent for the remainder of the year, well above the trend rate of about 2.0 percent.

About the authors