Batteries, solar help keep the lights on in Texas but more needed

Many Texas residents remain skeptical about the reliability of the electric grid. Memories endure of the deadly Texas freeze and days of massive outages in February 2021 followed months later by frequent electricity conservation pleas during summer 2023.

Notably, the power supply situation has since improved, with capacity added over the past two years, primarily from utility-scale solar and battery storage. Battery capacity has nearly tripled from year-end 2019 levels to 19 gigawatt hours of energy capacity, more than three times the year-end 2023 level. Such improvements have reduced the intensity of wholesale electricity price spikes.

Demand-side measures have also helped, particularly incentives for industrial and crypto-mining power users to reduce consumption during tight grid conditions, which have successfully shaved peak loads.

Although the improvements are welcome, the proliferation of electricity-hungry data centers dedicated to artificial intelligence applications challenge the abilities of regulators and power providers to meet rapidly growing demand. More baseload resources to handle ongoing power requirements beyond demand spikes will likely be required to meet most load growth projections.Winter demand growth, steeper peaks challenge the grid

Batteries are well suited to support the daily electricity load curve on hot summer days. Abundant solar power output at midday can recharge batteries when wholesale power prices are low. During evenings when power prices rise, reflecting added demand and the disappearance of solar from the grid, batteries can discharge to the grid as their owners benefit from the price arbitrage.

The situation is different in the winter. Peak demand often spans a more prolonged period in the morning, when renewable generation isn’t ample and there is no guarantee of low prices in the preceding hours. Add a bitter cold snap, and the economics for batteries become more difficult, raising questions about their capability to meet demand.

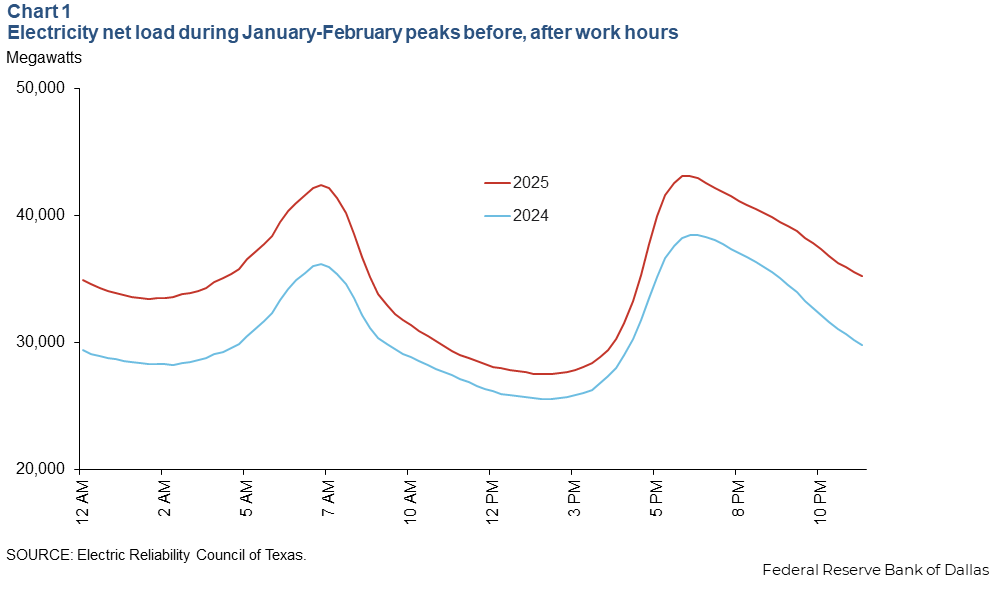

Winter 2024–25 provided an opportunity to measure how the new, expanded fleet of battery storage assets performed in the real-time wholesale market. Specifically, we looked at the average net load profile by hour of day for January and February over the past two years. Net load is the amount of electricity generation on the grid minus intermittent resources, such as wind and solar.

Electricity demand in the Electric Reliability Council of Texas (ERCOT) service area, covering much of the state including its most-populous areas, has expanded as population, commercial activity and electrification continue to grow. A steepening net load ramp (the added power available at peak hours due to increased renewable sources, particularly solar) has led to an increase in the net load across all hours of the day.

Notably, there was large growth in the morning ramp, from 6 a.m. to 8 a.m., in January and February when households are waking up and turning on home heating and appliances, but before solar generation can begin to serve load (Chart 1).

Batteries provide critical peak power during the winter months

The morning of Feb. 20, 2025, was particularly cold. The overnight low fell to 18 degrees in Dallas, and ERCOT reported an all-time net winter load record of 70.99 gigawatts.

Batteries provided a max output of 4.5 gigawatts of energy during that peak. Even though real-time prices averaged over $100 per megawatt hour during the early morning hours when batteries were charging, high day-ahead market prices exceeding $800 per megawatt hour had signaled to battery operators that there would be arbitrage opportunities (Chart 2). In part due to the battery capacity, real-time prices settled considerably lower than the day-ahead price, but still well above the prices battery owners paid to recharge.

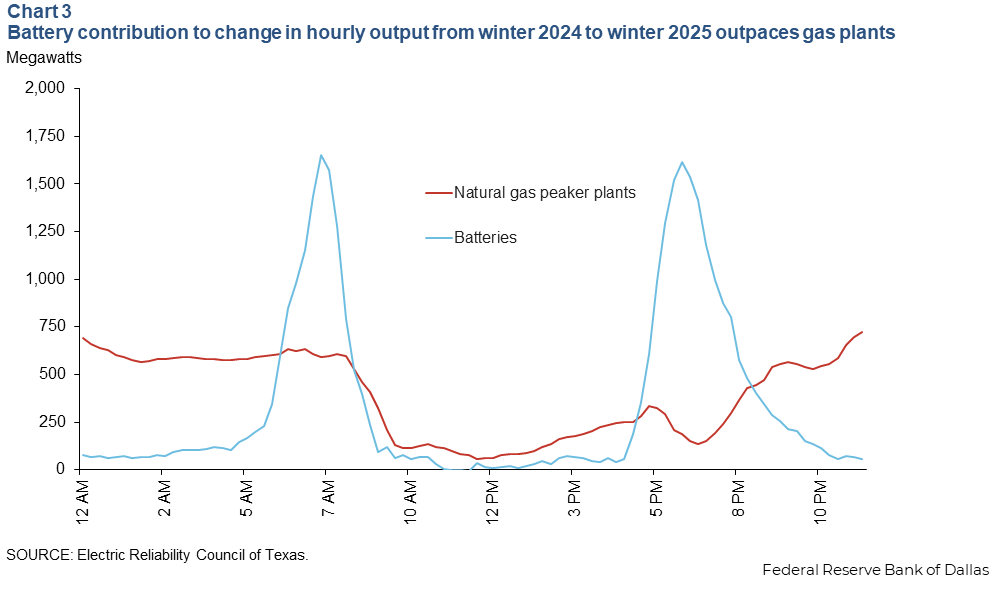

To get another perspective, we compare the output change from winter 2024 to 2025 for use of batteries versus natural gas peaker plants, which are designed to run for short stretches of time during periods of high load or high prices.

The added battery capacity accounted for the bulk of quick-response capacity growth during peak hours, with little observed growth in peaker plant output, which historically filled this role (Chart 3). However, peaker plant output expanded during overnight hours, potentially in part due to the increased battery charging overnight.

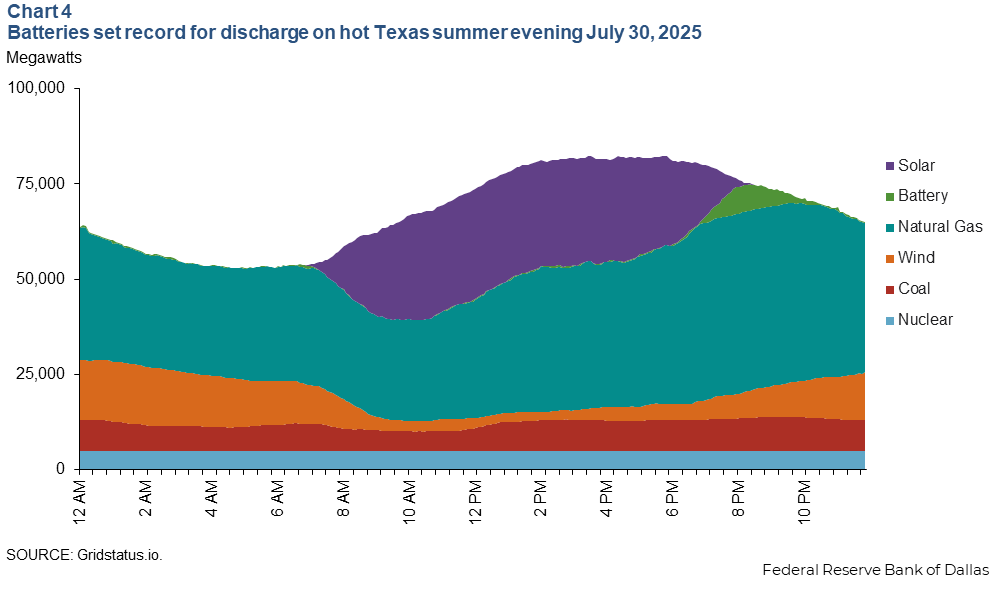

We can compare this to the more familiar load shape during the hottest days in Texas. On July 30, 2025, load again peaked at around 80 gigawatts, this time in the late afternoon and early evening hours. Batteries, boosted by capacity additions in the first half of the year, set an ERCOT record (at the time) of 7.1 gigawatts of energy at 8 p.m., when net load peaked after solar disappeared for the day. Batteries took advantage of prices around $20 per megawatt hour in the late morning hours to charge, selling at peak time prices of around $400.

Importantly, ERCOT navigated these record-high net load events with average wholesale prices exceeding $500 per megawatt hour only once during summer 2025 and without issuing a conservation warning.

During summer 2022, prices reached ERCOT’s price cap of $5,000 per megawatt hour three times and exceeded $1,000 on 182 occasions. (Regulators replaced the prior $9,000 cap following the February 2021 freeze that resulted in prolonged, record wholesale prices.) Thus, with the recent absence of such extreme pricing, it appears battery owners have adapted their strategies to accommodate a steep morning peak, adding to the reliability of the grid alongside thermal plants.

Meanwhile, as solar generation increases, and the changing net load profile leads to both large morning and evening ramp periods, more battery capacity will be needed given the usual daily one-charge-discharge battery cycle. Increasing to two cycles per day can cut the lifespan of a battery by half, requiring expensive cell replacements.

Longer duration batteries (four to eight hours) are a potential solution for elongating peak periods, but given their need to recharge, batteries’ role remains unclear should another multiday cold episode like the 2021 Texas deep freeze occur.

Price signals to power providers change

The intraday price environment through 2024 and 2025 has suited the interplay between solar, battery storage and the current stock of natural gas power plants. However, low daytime prices continue to damp market signals for additional baseload capacity from natural gas and nuclear generation. This is coupled with backlogs for gas turbine manufacturing that are unlikely to be alleviated in the near term.

For reference, 35 gigawatts of natural gas assets are under review in ERCOT’s interconnection queue—projects under review for connection to the grid—between 2025 and 2031 compared with 420 gigawatts of solar generation. While the actual amount that will be approved and built will be much less, the comparison indicates where investment is concentrated.

Compared with most other areas of the country, ERCOT does not operate a formal capacity market to incentivize creation and maintenance of added grid generation capacity. (In such auctions, generators bid to assure operators they will provide standby power as needed.) For instance, a recent capacity auction covering the PJM regional transmission organization (covering parts of the Midwest, midsouth and mid-Atlantic) yielded prices more than 20 percent higher than those in the previous year. Expected load growth from data centers contributed to the increase.

Payments from these capacity auctions represent a stream of guaranteed funds for generators during the delivery year that also serves as a signal to plant operators, developers and financiers. These are also translating into rapidly rising utility bills for households in the region.

ERCOT’s energy-only design relies on market price signals alone to attract investment in new generation. With both peak-hour pricing and daytime prices coming off highs in 2022–23, the investment case for additional baseload generation is in question. While average prices were up slightly between summer 2024 and 2025, the rise was driven by increased input prices. Notably, natural gas prices increased 45 percent, while the implied heat rate (an efficiency measure for fuel consumed to generate 1 megwatt hour) improved year over year.

Investors are therefore being asked to look past soft prices in the short run at a time when rising input costs and supply constraints on critical components required to build plants further deteriorate the attraction of such investment.

Uncertainty about forecasts of demand growth from data centers and other large industrial loads further complicates the situation. Researchers at Duke University suggest some demand flexibility among data centers (curtailing their demand for 0.5 percent of hours annually) would allow ERCOT to accommodate 10 gigawatts of data center demand without any additional generation or supply disruptions.

Industry contacts have expressed skepticism about this claim. While certain facilities can demonstrate such a level of demand response or potentially fall back on co-located generating capacity during critical hours, widespread adoption of such load flexibility appears speculative for now.

Even if new generation is not required in this scenario, or if some users develop their own generating capacity, prices for households would inevitably rise. The large demand increase during off-peak hours would require existing high-cost generation units to operate for longer and more frequent periods. This would be in addition to higher transmission and distribution costs that rate-paying customers would pay, the charges for which have also accelerated in recent years.