Supply-chain woes, labor shortages and COVID-19 slow resilient Texas economy

Regional economic growth has slowed, though it remains robust by historical standards. While demand has improved from year-ago levels, supply-chain disruptions and labor shortages have limited output growth and pushed up wages and prices.

Meanwhile, the COVID-19 resurgence is again exacting a toll on high-contact industries—notably, leisure and hospitality and transportation.

Texas employment still growing

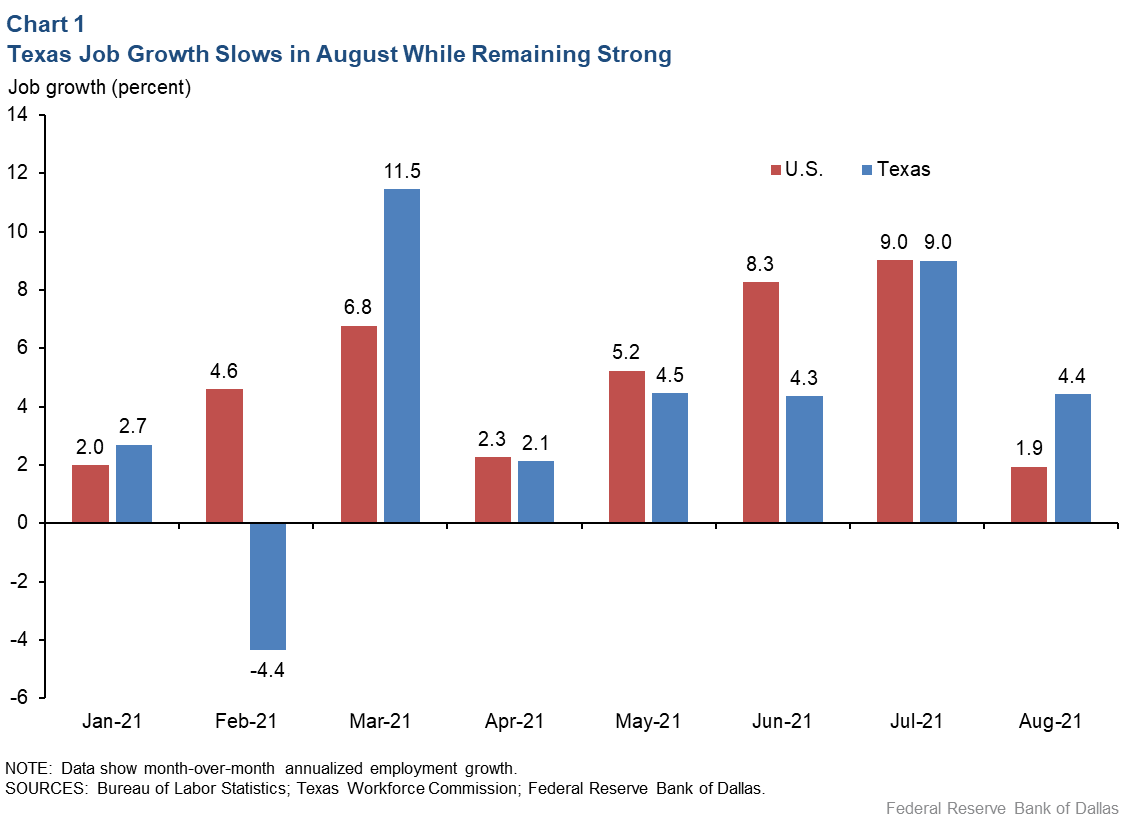

Texas employment expanded at an annualized 4.4 percent rate in August following a 9.0 percent spike in July (Chart 1). Although the pace of new jobs created in Texas exceeded the national rate during the month, state employment growth still trails the U.S. year to date.

Since December 2020, Texas employment has increased an annualized 4.2 percent compared with the U.S. at 5.0 percent. The February deep freeze and power outages in Texas depressed hiring and contributed to the growth gap.

Recent activity is strong relative to Texas’ trend job growth of slightly above 2 percent annually. In August, expansion was most rapid in two of the largest service sectors, professional and business services and education and health. Employment in the oil and gas sector also rose, buoyed by higher oil and gas prices.

Those gains were in contrast to losses within leisure and hospitality—principally restaurants and hotels—which are particularly sensitive to COVID-19 outbreaks.

Generally, demand has held up better than during previous COVID-19 waves. A respondent to the Federal Reserve Bank of Dallas Texas Business Outlook Surveys (TBOS) noted that, “Despite COVID-19 variants, business activity remains strong and is improving. We have no clients that are reflecting a downturn in activity, but [they] see more staffing issues and product shortages.”

Similarly, TBOS results indicated Texas business attempts to hire remained strong in August, with 69 percent of respondents saying they sought to add workers—the same as in July. Additionally, firms reported high rates of absenteeism attributable to the spread of the COVID-19 Delta variant and quarantining.

Supply-chain, staffing shortage disruptions

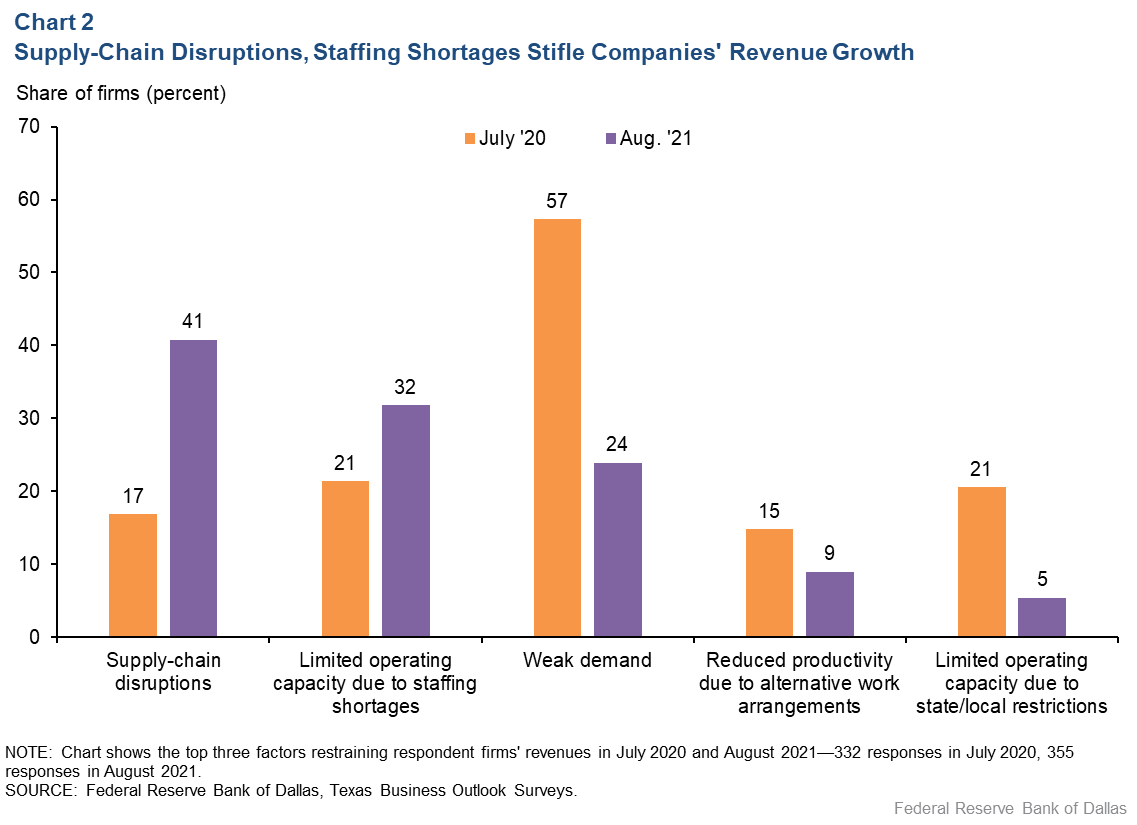

Lingering supply-chain disruptions and staffing shortages are constraining business activity. Forty-one percent of respondents to the August TBOS cited supply-chain disruptions as one of the top three factors restraining revenue growth, compared with just 17 percent in July 2020 (Chart 2).

Unfilled orders and delivery times continued to rise at about the same pace as in the previous month, even as new orders slowed slightly. However, respondents expect these factors to moderate over the next six months.

Staffing shortages that limit operating capacity were cited by about one-third of respondents in August, well above the roughly one-fifth responding similarly in July 2020. While labor shortages were widespread, they were particularly notable among low-skilled positions, with 98 percent of respondents finding it somewhat difficult or very difficult to fill such jobs. Among employers reporting a lack of applicants, 76 percent said labor availability either worsened or stayed the same in August relative to the prior month.

Amid these constraints, demand has remained strong. Compared with July 2020, when 57 percent of firms listed weak demand as one of their biggest constraints, fewer than one-quarter of firms in August cited it as among their top three factors hindering business.

Barriers to hiring

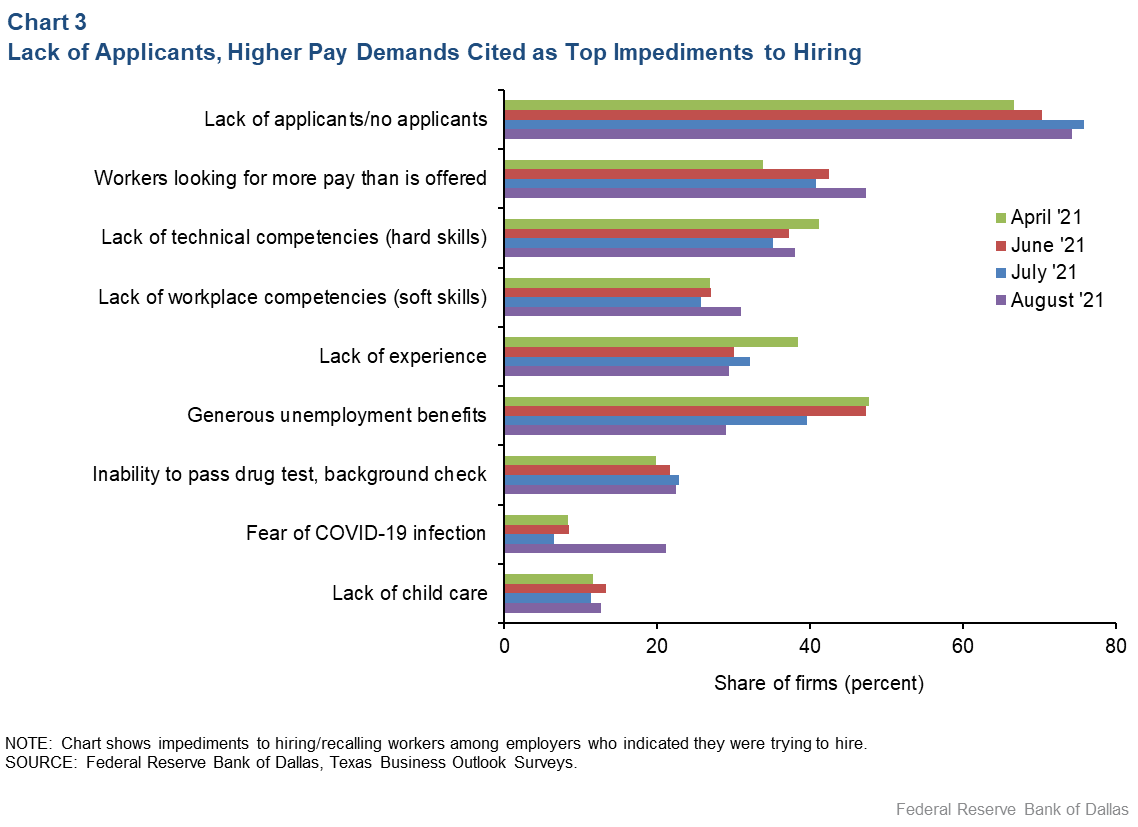

A lack of applicants was the top barrier to hiring in August—mentioned by three-quarters of TBOS respondents as restraining hiring, up from two-thirds of respondents in April (Chart 3).

Moreover, workers became increasingly wary of COVID-19 infection—more than three times as many firms in August relative to July cited applicants’ fear of infection as hindering their hiring.

Workers looking for more pay than what was offered was the second-most frequently mentioned impediment to hiring and recalling workers. Almost half of respondents cited this issue in August, well above one-third of respondents in April.

In response, many businesses have increased wages. Although Texas stopped participating in the federal government’s pandemic-related enhanced unemployment benefits program in June, a lack of applicants persists, creating a tight labor market.

Labor, supply shortfalls boosting business costs and prices

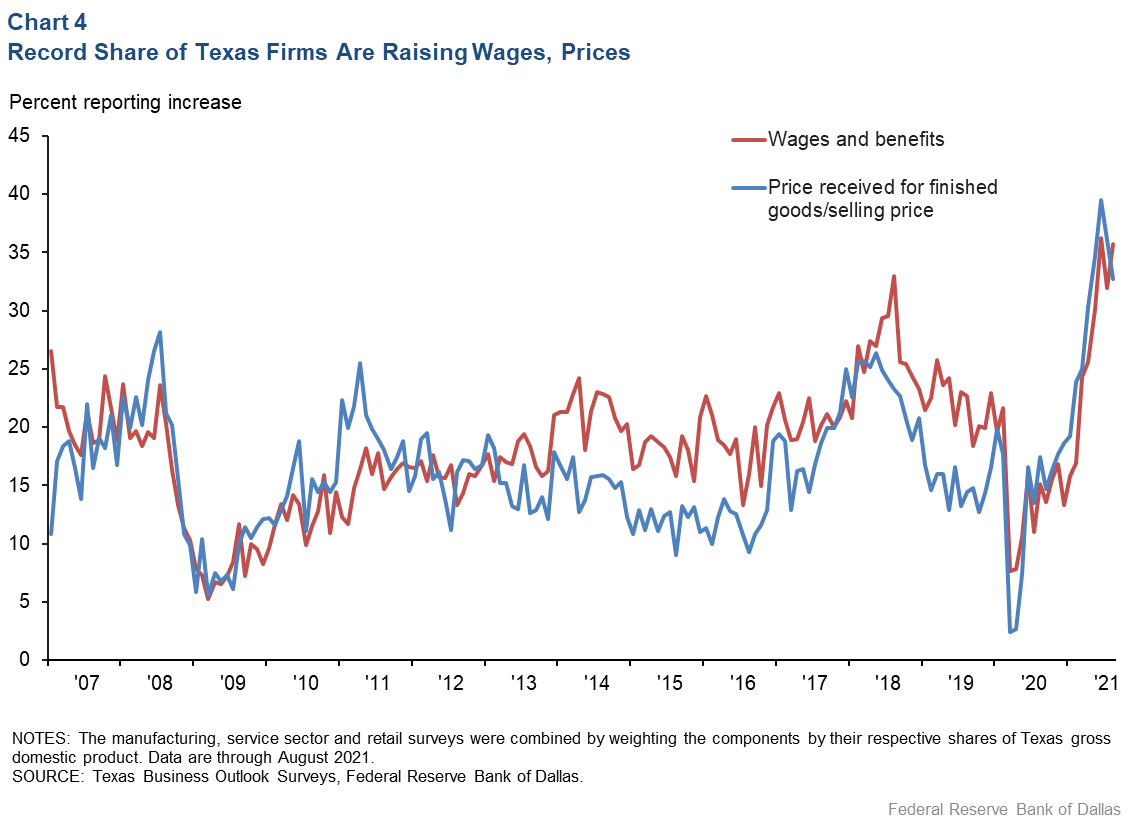

Supply-chain disruptions and hiring difficulties continue pushing wages and prices higher. More than one-third of firms in the TBOS reported raising wages and selling prices in August—a proportion similar to the previous two months and shares that are at or near all-time highs (Chart 4).

Firms steadily boosted their expectations for price and wage increases throughout the year. In July, they anticipated a 5.3 percent increase in selling prices for 2021, up from the December forecast of 3.4 percent. Wages were expected to rise by 5.1 percent, up from a projected 4.3 percent increase in December.

TBOS respondents said they believe price and wage growth will slow in 2022, though the rate of increase will remain above average.

Uncertainty increases despite anticipated 2021 growth

While the recent COVID–19 resurgence has slowed growth somewhat, dimming Texas businesses’ near-term optimism and raising uncertainty, a healthy level of activity is expected through the end of the year. The Dallas Fed’s September forecast for 2021 Texas employment growth anticipates that the number of jobs will increase by 4.6 percent in 2021 (with an 80 percent confidence band of 4.0 to 5.3 percent).

Based on that forecast, 571,800 jobs will be added in the state this year, and total employment will be 12.9 million in December. This will still leave the state slightly below its prepandemic employment level, a shortfall that should be erased by first quarter 2022.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.