Improved business outlooks, faster job growth boost Texas outlook

A majority of Texas Business Outlook Surveys (TBOS) participants expect increasing demand over the next six months, signaling an improving business outlook, even as inflation and wage growth in Texas remain elevated. Separately, the pace of payroll employment growth also picked up in February from January levels.

The positive sentiment outlook follows otherwise mixed indicators from Dallas Fed TBOS surveys, including only modest growth in the Texas service sector and contraction in manufacturing.

Service, manufacturing surveys offer mixed signals

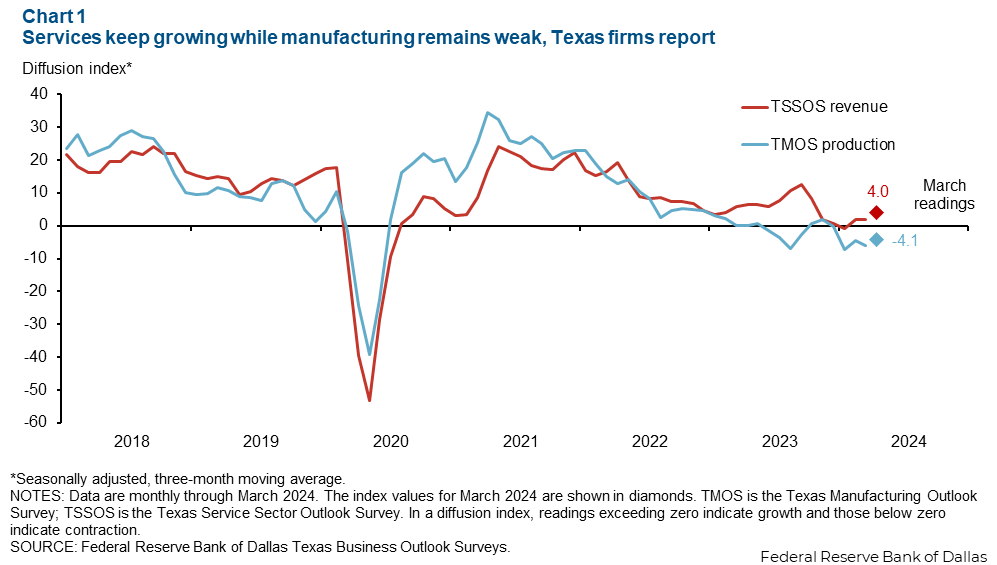

Texas service sector activity expanded at a modest pace in March, as indicated by the Texas Service Sector Outlook Survey revenue index. Meanwhile, Texas factory activity weakened in March, the Texas Manufacturing Outlook Survey showed (Chart 1). The surveys’ diffusion indexes indicate growth when positive and contraction when negative. Three-month moving averages that smooth out volatility are consistent with economic activity converging to long-run average growth.

Texas payroll employment growth in February accelerated notably from January levels. The number of Texas jobs rose 4.3 percent in February (month-over-month, annualized rate), up from a downwardly revised January reading of 1.9 percent (initially 2.0 percent). Employment gains were broad based and led by manufacturing, leisure and hospitality, professional and business services, and financial activities. Employment declined only in the trade, transportation and utilities sector.

The Texas unemployment rate remained at 3.9 percent, while the labor force grew at a 2.1 percent annualized rate.

Wage growth remains elevated; inflation eases slightly

Wage growth remains high, reflecting still-strong demand for labor, elevated inflation and a low unemployment rate. The Texas Employment Cost Index for wages and salaries rose from 3.9 percent growth year over year in third quarter 2023 to 4.3 percent in the fourth quarter. It had trended lower for more than a year.

TBOS wage indexes plateaued during the first three months of 2024 after having receded from highs in mid-2022. Survey respondents in March expected wages to increase 3.6 percent over the next 12 months.

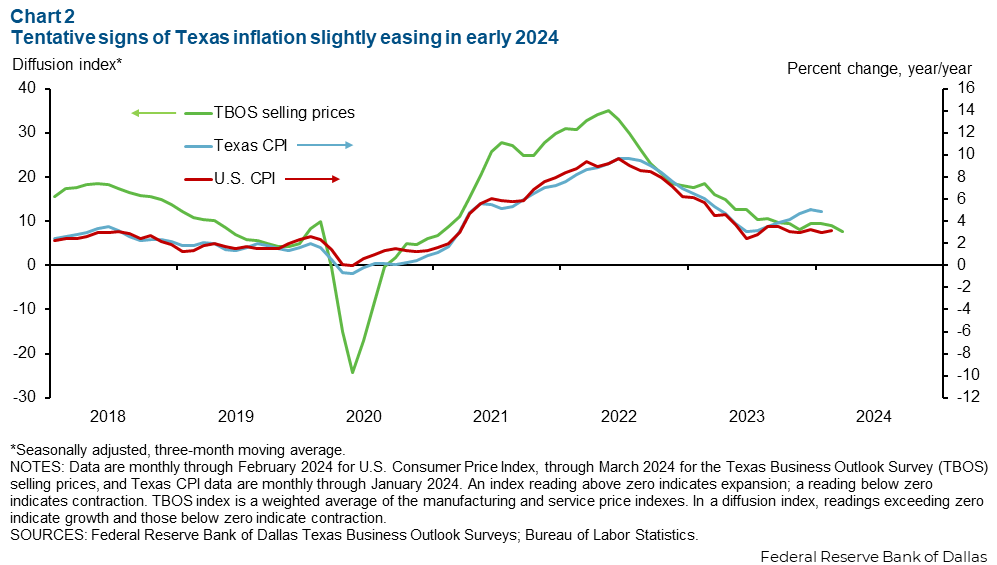

Inflation in Texas, however, appeared to slightly ease at the start of 2024. The 12-month change in the Texas consumer price index (CPI) was 4.8 percent in January, down from 5.0 percent in December. This reflects a break from second half 2023, when the Texas CPI accelerated even as the comparable U.S. measure slowed (Chart 2).

The TBOS selling price index, a weighted average of manufacturing and service sector price indexes, indicated slight moderation of price pressures in January and February. However, the index doesn’t show the level of inflation, only the direction of change.

Demand expectations improve

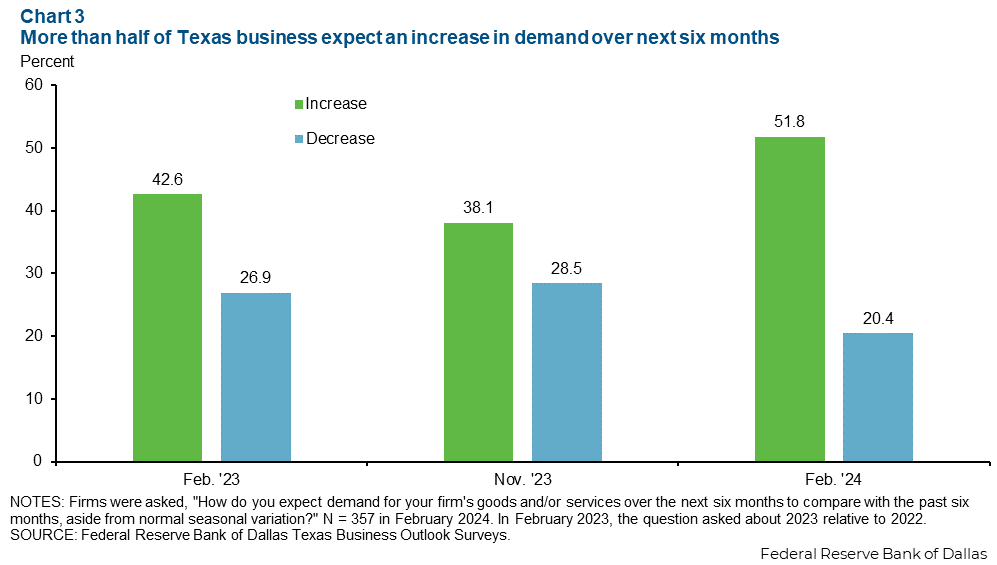

Texas firms’ demand expectations are more bullish so far this year than they were at year-end 2023. More than half of companies surveyed expect demand to increase over the next six months, up from 38 percent in November 2023 (Chart 3).

Among manufacturing firms, those in chemicals, food and fabricated metals were most optimistic, while computer and electronics and transportation equipment companies’ expectations receded from November levels.

In the service sector, expectations increased most among health care, financial activities and transportation services firms, while lagging in retail and leisure and hospitality.

Additionally, the Bureau of Labor Statistics Job Openings and Labor Turnover Survey (JOLTS), a proxy for demand-driven activity, showed job vacancies still elevated in Texas at 781,000 in January, though the total reflected the second consecutive monthly decline. The January JOLTS job openings rate of 5.3 percent significantly exceeded its prepandemic average of 4.0 percent.

Texas firms rely on domestic, international migrants for labor needs

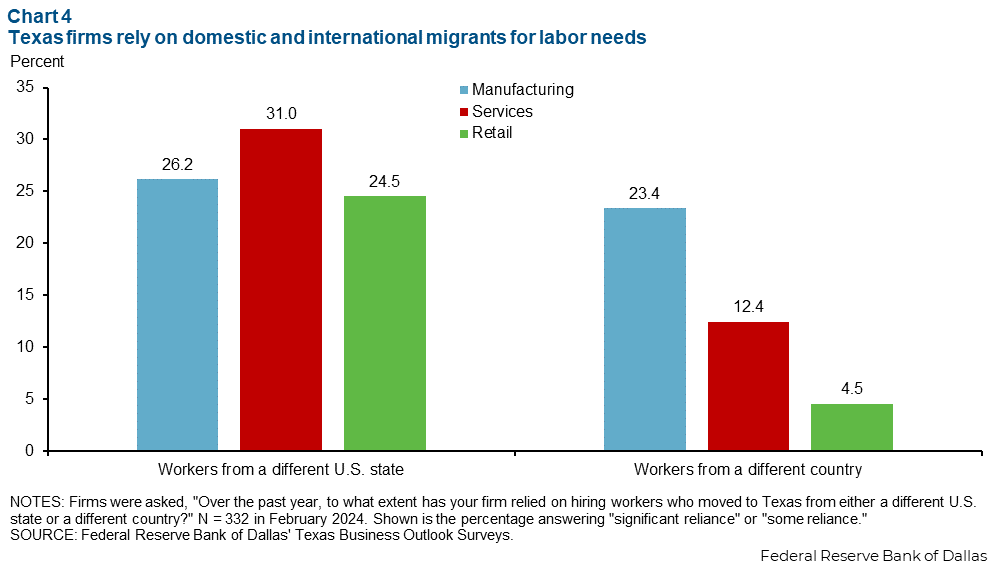

Labor shortages have receded among Texas firms. Labor force growth—including from domestic and international migration—has played a significant role. About 30 percent of Texas firms have relied on hiring workers who moved to Texas from a different U.S. state, while 15 percent did so with workers who relocated from another country over the past year, as indicated in the February TBOS special questions.

Large firms (more than 500 employees) tended to rely more on migrants than small firms . About 42 percent of large firms depended on domestic migrants compared with 28 percent of small firms; 26 percent of large firms relied on international migrants compared with 14 percent of small firms. Over the past year, service sector firms have drawn more on domestic migration, while manufacturing companies have turned to workers from outside the U.S. (Chart 4).

Outlook points to above-trend growth in 2024

The Texas economy was forecast to slow this year to its trend job growth of about 2 percent. However, the most recent data have surprised to the upside, and the forecast lifted to 2.5 percent in March.

Overall, Texas economic growth remains healthy and is expected to outpace the nation, as it typically does. The risks to the outlook are mixed. High inflation at the national level may keep interest rates high, curbing growth. Conversely, a more positive outlook among our survey contacts may portend greater-than-expected expansion.

About the authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.