Surging population growth from immigration may have little effect on inflation

U.S. population growth increased sharply recently following a wave of immigration, according to Congressional Budget Office (CBO) projections. What does this surprise immigration surge mean for the macroeconomy?

On the surface, it seems reasonable to view a surprise increase in population growth as a positive shock to labor supply, which reduces inflation. This intuition, however, ignores important demand-side effects. More people increases demand for goods and services, and more workers increases firm investment demand.

We show these demand-side effects can offset the labor-supply effect, causing population growth to have a muted impact on inflation.

Recent immigration wave leads to job growth

CBO forecasts show the foreign-born population surged by 2.6 million in 2022, with the increase expected to total 3.3 million annually in 2023 and 2024. Cross-referencing these figures with data from the Current Population Survey (CPS) provides slightly lower estimates of 1.9 million in 2022 and 2.5 million in 2023, suggesting a possible undercount in the household-based survey or an overcount in the CBO projections. Averaging the CBO and CPS figures provides a baseline estimate for the surprise increase in population growth.

CPS data also indicate that about 60 percent of the recent wave of immigrants have secured jobs, aligning closely with their overall labor force participation rate. This quick transition into the workforce suggests a minimal lag between population and employment growth.

Model shows implications of higher population growth

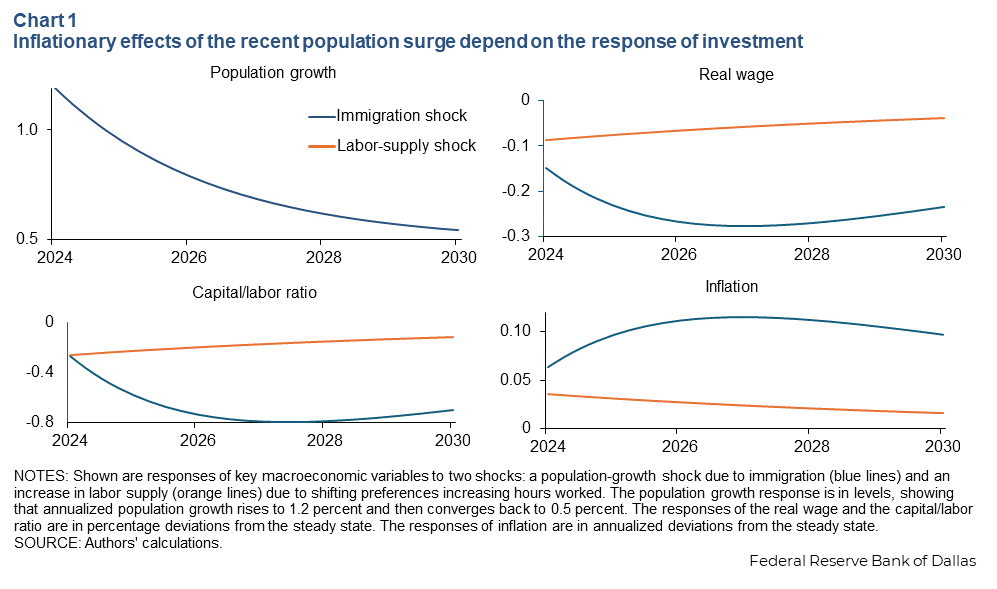

A standard macroeconomic model with capital and prices that are slow to adjust helps us explore the economic effects of the population surge. The model predicts that following a surprise increase in population growth (scaled to the recent immigration wave), a small inflation increase occurs (Chart 1).

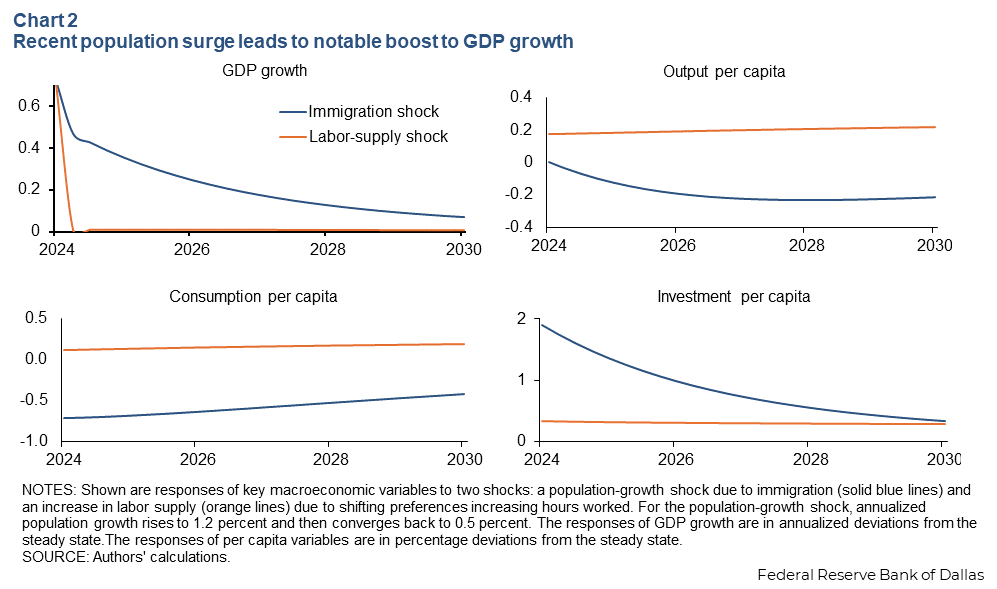

Additionally, the population increase also leads to a noteworthy boost to real (inflation-adjusted) GDP growth (Chart 2).

The mechanics of the higher growth rate are straightforward: If immigration increases the population by 1 percent, and these newcomers integrate into the labor force at rates comparable to native-born citizens, both employment and output expand immediately. In the absence of capital as a factor of production—machines, plants and equipment—employment, output and consumption would each expand by 1 percent, balancing demand and supply, maintaining price stability and keeping GDP per capita unchanged.

Accounting for capital as an input in the production process complicates the transmission mechanism. When labor inputs increase by 1 percent, reaching the same per capita output necessitates a simultaneous 1 percent increase in capital, which only builds over time. This delay creates temporary shortages of capital relative to labor, boosting real returns to capital but depressing real wages.

To stimulate investment, households might temporarily reduce consumption and choose to work more hours, but overall demand for goods increases more than supply, putting upward pressure on prices.

The inflationary effect of population growth could be moderated or accentuated by various factors. For example, households generally resist reducing consumption below a perceived essential level, and new immigrants may be more likely to consume all of their income, exacerbating inflationary pressures. Conversely, if new immigrants are less skilled and more likely to accept manual labor positions, the need for capital accumulation diminishes, softening the inflationary impacts.

Estimates based on data from Norway and a larger-scale model of the Spanish economy generally support our model's predictions, indicating nuanced impacts of immigration on macroeconomic variables and on inflation in particular. These findings underscore the complex interplay between immigration, labor markets and macroeconomic outcomes—highlighting the need for refined models that capture the varied characteristics of recent immigrants.

Effects of native population working more differ from higher population growth

Comparing the effects of a population-growth shock due to immigration (blue lines in the charts) to those of a more traditional labor-supply shock consistent with an increase in labor force participation among the native population (orange lines) offers further insights.

A positive labor-supply shock, typically understood as a decrease in the value of leisure leading to a voluntary increase in hours worked, mirrors the responses observed in population-growth shocks in many respects, yet the impacts are quantitatively more muted.

Individuals opt to work additional hours, necessitating an accumulation of more capital to match the bolstered supply of labor. This increase in labor availability allows for higher overall consumption due to the expanded wage bill. The primary distinction lies in the impact on real GDP per capita, which is consistently positive under a labor-supply shock but turns negative over time in response to an immigration shock.

Interestingly, both types of shocks generate a small increase in inflation, challenging the conventional wisdom that associates supply-side expansions with disinflationary outcomes.

An economic boost without a catch

The predictions of a standard model show that the boost to GDP and employment from the recent increase in population growth is considerable. Based on our model estimates, over the past year the immigration wave contributed to the higher GDP growth by adding nearly 2 million newly employed workers. Remarkably, this significant economic enhancement likely occurred with very little effect on inflation.

About the authors