Texas posts job gains in August, bolstering outlook despite signs of slowing

The Texas economic expansion continued in August despite some signs of slowing. Employment growth strengthened, rebounding from weakness in the prior two months. For the first eight months of the year, the state’s job growth outpaced that of the nation.

Payrolls in professional and business services and information are flat this year, and the staffing services sector, an indicator of economic turning points, has been losing ground. Texas manufacturing output has barely grown since May, and growth continues below trend in the service sector, according to the Dallas Fed’s Texas Business Outlook Surveys (TBOS).

While some data suggest waning momentum, a plurality of Texas businesses expect demand to hold steady or increase over the next six months, signaling a positive business outlook.

Employment growth exhibits volatility

Texas job growth rebounded in August, rising an annualized 7.3 percent (83,200 jobs). Part of the gain reflected the recovery from Hurricane Beryl, which knocked out electricity to much of the Houston area in early July, and other storm-related losses. Houston added 28,000 jobs in August after shedding 17,000 jobs in June and July.

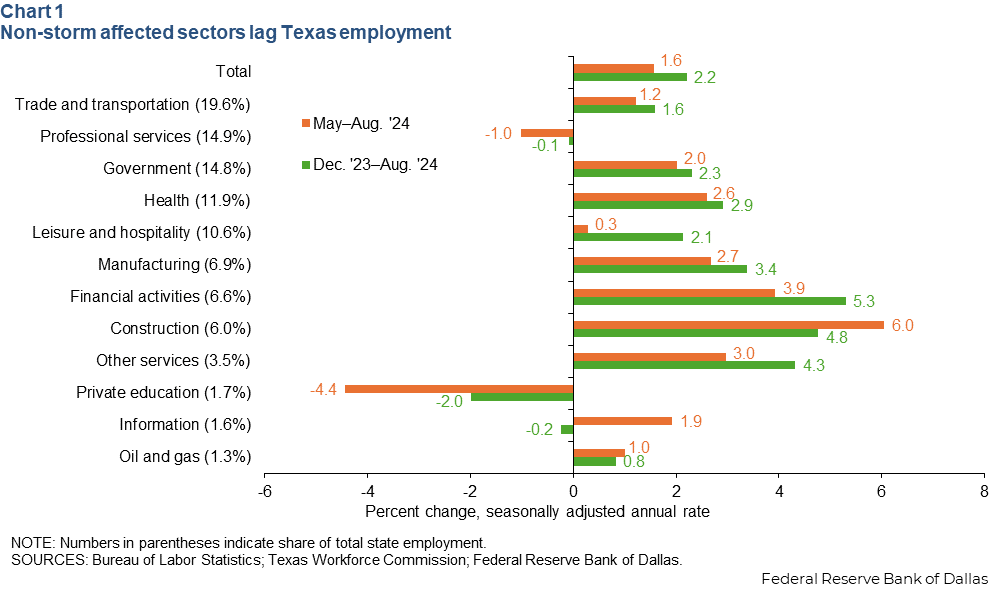

Texas payroll gains of 2.2 percent year to date were near the trend annual rate of 2 percent (Chart 1) . However, some key sectors have slowed, and their performance wasn’t likely tied to the storms.

For the three months ended in August, job growth was a modest 1.6 percent, with employment contracting in the key professional and business services sector (-1.0 percent) and private educational services (-4.4 percent).

Job creation has been stagnant in the information and professional and business services sectors this year. In the state’s high-tech hubs of Austin and Dallas, those sectors’ payrolls have contracted.

Slowing staffing services activity sends warning signals

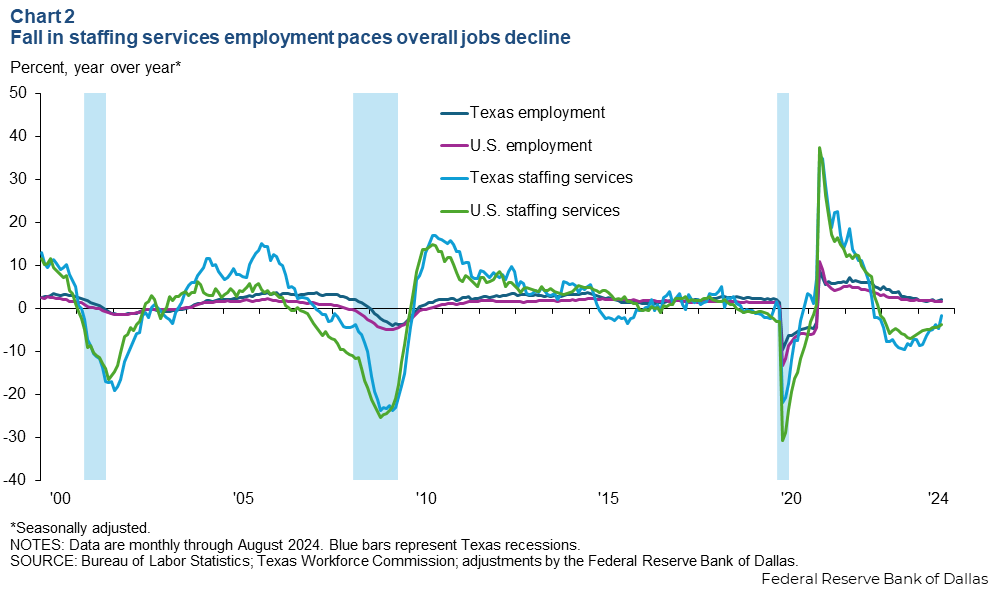

Texas staffing services employment dropped 11 percent over the 24 months ended in August (Chart 2). Nationally, the sector also decreased notably from peak levels.

The decline partly reflects a readjustment from pandemic highs and a shift in preference for permanent hires amid tight labor conditions. While some of the reduction is a natural rebalancing of the labor market, the sustained softness could signal broader labor market weakness.

Staffing firm employment is often considered a leading indicator due to its flexibility to quickly adapt to cyclical change. During economic downturns, firms release temporary workers before laying off regular employees. Conversely, during recoveries, cautious firms turn to temporary workers first, as they are easier to hire and dismiss than full-time staff.

Regional Fed surveys point to growth, labor market vulnerability

The August TBOS indicates an ongoing modest pace of expansion in the state buoyed by the service sector, where revenue growth was positive but slightly below trend. Manufacturing output was little changed. Four other Federal Reserve Banks conduct regional surveys, and most of the August results similarly suggested growing service sector revenue and manufacturing weakness.

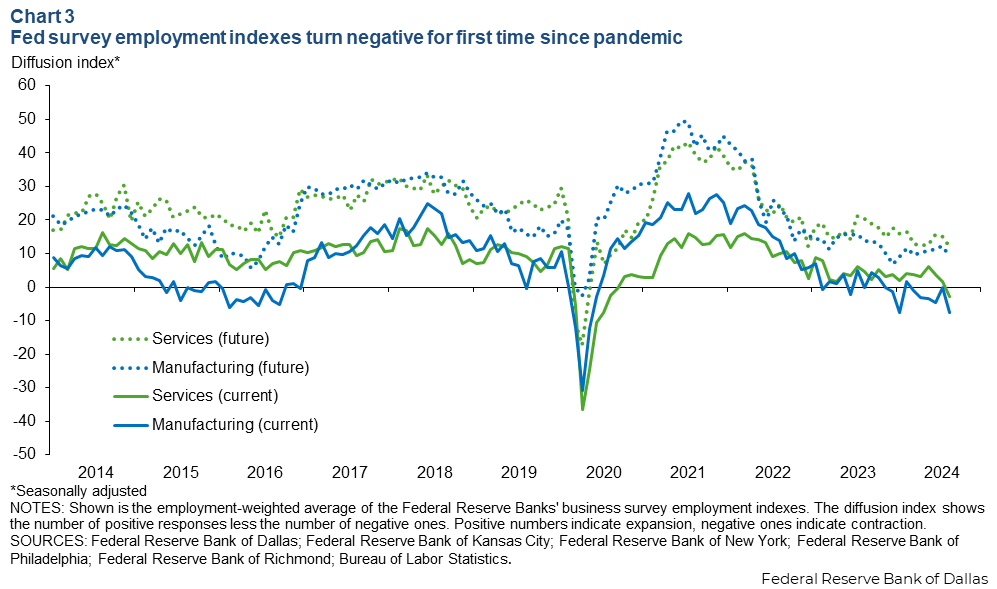

Additionally, an aggregation of all five Federal Reserve regional business surveys points to a widespread labor market slowdown. The service sector aggregated employment index was negative in August for the first time since the onset of the pandemic in 2020 (Chart 3). The employment index covering manufacturing was negative for six straight months through August.

While current employment indexes indicate slowing, future employment indexes for both manufacturing and services remain positive, signaling anticipation of increased factory and service sector hiring in early 2025.

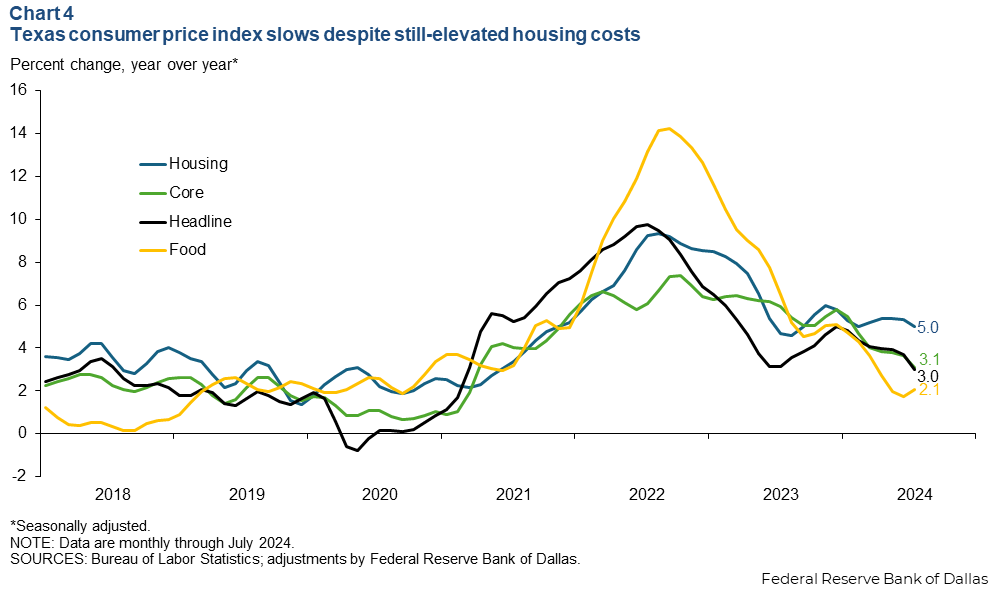

Texas inflation ticked down in July

The 12-month change in the Texas consumer price index (CPI) continues to inch lower (Chart 4). Texas headline CPI dipped from 3.7 percent in June to 3.0 percent in July. A drop in energy and health care prices contributed to the decline. Housing inflation remained elevated at 5.0 percent year over year.

Outlook remains optimistic, supporting a soft landing

Texas firms remained bullish in their expectations for demand, albeit less so than earlier in the year. In August, TBOS firms were queried on their demand outlooks, with 47 percent of those surveyed expecting demand to increase over the next six months, down from 52 percent in February but up from 38 percent in November 2023.

Firms’ assessments of their current employment situations pointed to a normalizing labor market. The share of TBOS firms saying they are understaffed continued to decline in August to 46 percent, down from 51 percent in December 2023 and 63 percent in October 2022. The share of firms reporting ideal staffing levels increased from 30 percent in December 2023 to 36 percent in August.

Only 15 percent of firms said they were overstaffed, but the share reporting laying off workers remained low and unchanged at 3 percent, suggesting firms expect to need workers in the near future.

The Dallas Fed’s Texas Employment Forecast for 2024 suggests the pace of job growth in the remainder of the year will be steady around 2.2 percent and slightly above the long-term trend.

About the authors