Mexico’s economy surprises to the upside, but outlook is weak

The Mexican economy grew 1.8 percent during the first half of 2025, surprising analysts who had anticipated a recession. However, the outlook is weak, with the consensus forecast for 2025 real (inflation-adjusted) GDP growth at 0.7 percent (fourth quarter over fourth quarter), implying an economic slowdown during the second half of 2025.

Recent export growth, which may reflect front-running of U.S. tariffs, accounted for much of the first-half gain. Meanwhile, slowing real wage growth and declining remittances from abroad have led to weakening consumption. Relatively high inflation and elevated interest rates along with government spending cuts have suppressed investment.

Economic growth accelerated in first half of 2025

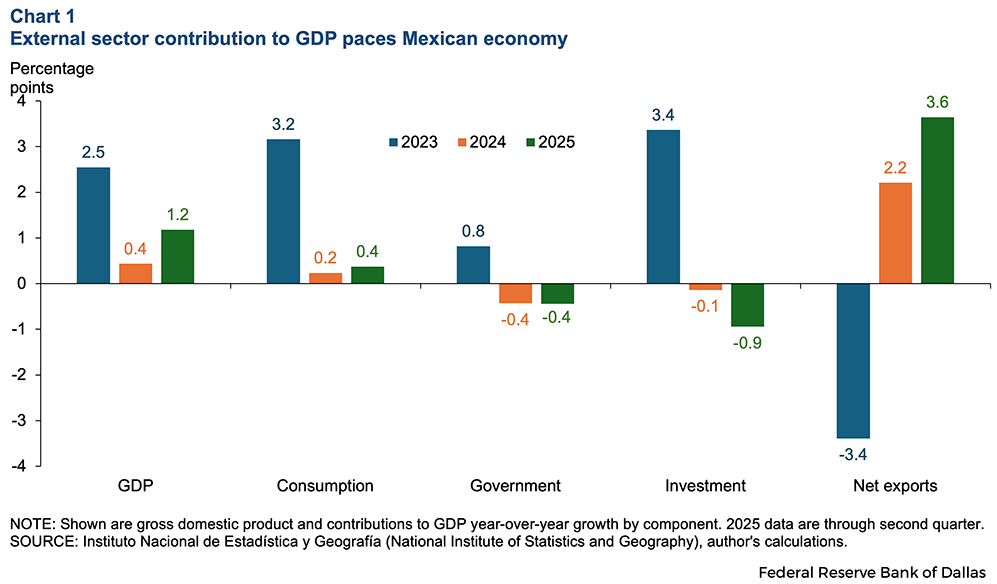

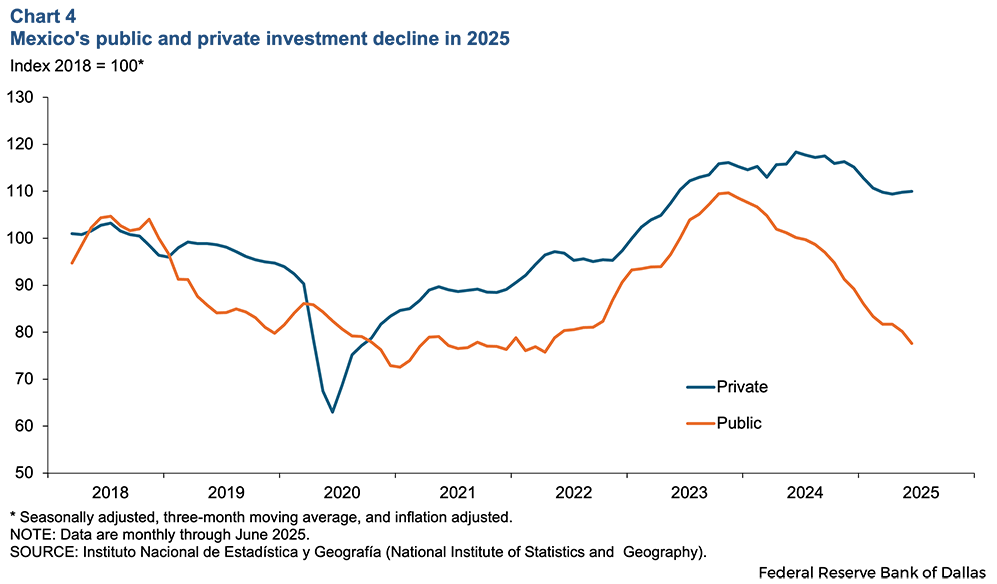

The first-half 1.8 percent annual growth rate followed a meager 0.4 percent gain in 2024. The recent result reflected external sector performance, notably net exports contributing 3.6 percentage points to year-over-year growth in gross domestic product (GDP) (Chart 1). Meanwhile, investment made a negative contribution; in fact, public and private investment has been falling for the better part of the last 12 months. Uncertainty about tariffs and renegotiation of the United States–Mexico–Canada Agreement (USMCA) appeared to be factors.

More recently, the U.S. announced in early August a 90-day extension to the current arrangement under which goods from Mexico are taxed at 25 percent unless they are compliant with the USMCA (allowing them to enter duty free). An estimated 76 percent of imports from Mexico entered under USMCA provisions in July, up from 50 percent in the prior year. Broad-based tariffs that included an end to the USMCA exemption for Mexico imports had been scheduled for Aug. 1 but were postponed for three months.

In addition to trade policy uncertainty and high interest rates—the policy rate is 7.50 percent—Mexico business leaders report that a host of structural domestic issues are impeding investment. They include a lack of access to reliable electricity sources, regulatory uncertainty and high crime and corruption.

Government spending contributed negatively to GDP in the first half of 2025, and consumption growth was weak. Factors suppressing consumption included a slowdown in formal-sector (established companies and government) job creation, weak wage growth, persistent inflation and falling remittances from abroad. The conclusion of major public infrastructure projects in the south, notably, the Tren Maya railroad in the Yucatan, are part of diminishing public sector stimulus.

Mexico’s formal-sector employment was little changed in the first half of 2025, with weakness in construction and manufacturing. Broader employment measures have supported informal-sector jobs, which generally pay lower wages and lack benefits.

Wages continued to rise but at a slower pace than last year. Average real wage growth in the formal sector has averaged 3.4 percent through the first half of 2025 compared with 4.7 percent in 2024. Minimum wages have risen at an average annual rate of 7.5 percent, faster than average wage growth in the formal sector, suggesting intensifying wage compression.

Declining remittances from Mexicans living in the U.S. may also be contributing to economic sluggishness, especially in poorer states and rural areas. Remittances totaled $66.3 billion in 2024, equivalent to 3.5 percent of Mexico’s GDP. They fell 7.5 percent on a year-over-year basis in July.

A slowdown in U.S. construction, which traditionally has employed a large share of Mexican immigrants, may have factored into the remittance decline. U.S. construction spending fell 2.8 percent year-over-year in July, while construction employment growth has slowed since January.

The U.S. immigration crackdown is another possible contributor to falling remittances, as immigrant communities deal with trepidation and likely increases in precautionary savings.

Services sector resilient while energy drags on growth

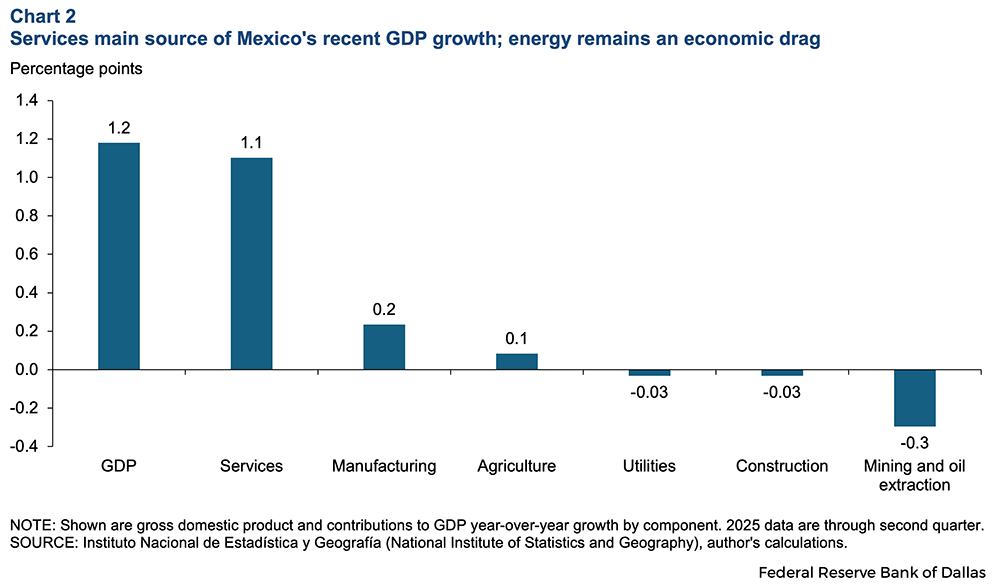

The services sector was the largest contributor to GDP growth in Mexico, followed by manufacturing and agriculture (Chart 2). Retail; professional, scientific and technical services; real estate rental and leasing; and management of companies and enterprises paced services sector performance.

Mexican manufacturing is growing slowly in 2025. Production was little changed year-over-year in June compared with 10-year inflation-adjusted average growth of 1.7 percent. Firms likely reduced output and drew down inventories to meet still sturdy demand, possibly in anticipation of trade policy changes.

Mexico’s energy sector has been a drag on growth. Crude oil production has declined since early 2023, running around 1.6 million barrels per day, a historic low. Mexico’s government-run oil company, Pemex, is saddled with more than $100 billion in debt and continues struggling financially. It was recently ordered to pay more than $20 billion in past-due bills. Several U.S.-based oil field services companies have paused operations or significantly decreased activity due to lack of payment.

US–Mexico trade grows

Mexico’s total trade during the first half of the year ($635.7 billion) increased 3.0 percent, slightly lower than in 2024, when full-year trade rose 3.9 percent ($1.2 trillion). The gain in 2025 is likely related to attempts to front-run U.S. tariffs. The effective tariff rate for Mexican exports to the U.S. has increased to 10.6 percent from 1.6 percent in 2024. Mexico sends about 80 percent of its exports to the U.S., while about 40 percent of Mexico’s imports come from the U.S.

Tariffs on U.S.-Mexico commerce are particularly problematic given extensive intra-industry trade ties. For example, the No. 1 U.S. export category to Mexico, computer and electronic products (20 percent share), is the No. 2 U.S. import category from Mexico (24 percent share). The No. 2 U.S. export category to Mexico, transportation equipment (13 percent share) is the No. 1 U.S. import category from Mexico (31 percent share) (Table 1).

Table 1A: Top 10 U.S. exports to Mexico January-June 2025

| Total (in billions) | $168.2 | |

| 1 | Computer and electronic products (19.5%) | $32.8 |

| 2 | Transportation equipment (12.9%) | $21.7 |

| 3 | Chemicals (8.8%) | $14.9 |

| 4 | Petroleum and coal products (8.7%) | $14.7 |

| 5 | Machinery except electrical (7.2%) | $12.1 |

| 6 | Electrical equipment and components (6.9%) | $11.6 |

| 7 | Food and kindred products (4.9%) | $8.3 |

| 8 | Fabricated metal products (4.4%) | $7.3 |

| 9 | Primary metal manufacturing (4.3%) | $7.2 |

| 10 | Plastics and rubber products (4%) | $6.7 |

Table 1B: Top 10 U.S. imports from Mexico January-June 2025

| Total (in billions) | $264.4 | |

| 1 | Transportation equipment (30.6%) | $81.0 |

| 2 | Computer and electronic products (23.9%) | $63.1 |

| 3 | Electrical equipment and components (9.0%) | $23.9 |

| 4 | Machinery except electrical (6.6%) | $17.3 |

| 5 | Agricultural products (4.2%) | $11.0 |

| 6 | Other manufactured commodities (3.1%) | $8.3 |

| 7 | Food and kindred products (2.8%) | $7.4 |

| 8 | Fabricated metal products (2.6%) | $6.8 |

| 9 | Beverages and tobacco products (2.3%) | $6.1 |

| 10 | Primary metal manufacturing (2.2%) | $5.9 |

NOTE: Data are from January–June 2025. Numbers in parentheses represent year-to-date shares.

SOURCE: USA Trade, Census Bureau.

Intra-industry trade, or “production sharing,” involves the manufacture of goods in each country at different stages of the production process, utilizing each nation’s comparative advantage. For the U.S., that favors capital-intensive activity, while for Mexico, it’s labor-intensive activity. The goal is manufacturing efficiency, allowing the region to consume at the lowest possible price domestically while remaining competitive outside North America.

Stubbornly high core inflation to continue

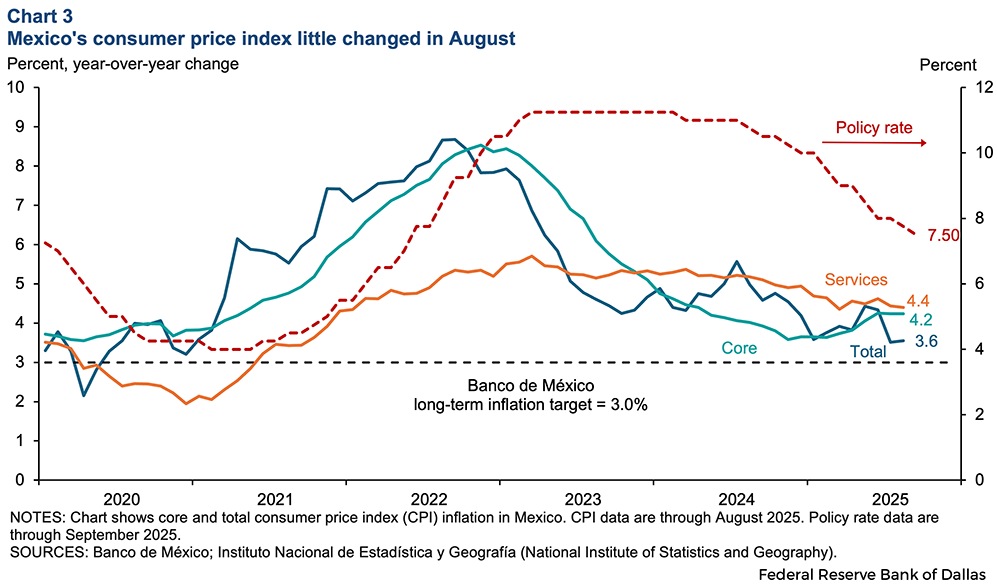

Mexico’s 12-month consumer price inflation ticked up to 3.6 percent in August after declining to 3.5 percent in July (Chart 3). Core CPI inflation, which excludes food and energy, remained at 4.2 percent, the likely result of high services inflation, which hasn’t improved much in over a year.

Despite little progress on core inflation, Mexico’s central bank lowered its benchmark interest rate 25 basis points to 7.50 percent in September, the 10th consecutive cut since the policy rate peaked at 11 percent in August 2024. The central bank does not expect inflation to reach its 3.0 percent target until late 2026.

Nonetheless, the Mexican peso has edged higher against the U.S. dollar since the start of 2025. The Mexican currency averaged 18.7 pesos per dollar in August, stronger than December’s average of 20.3 pesos per dollar. The peso has been a top candidate for carry trade due to Mexico’s higher interest rates relative to the U.S. and other developed economies.

Institutional funds and traders use the carry trade to borrow dollars at a comparatively low interest rate, reflecting U.S. borrowing costs, and buy pesos earning the higher Mexican rate. Investors profit from the interest rate differential, boosting demand for the target currency, the peso.

Mexico faces emerging challenges

The future of USMCA and the government’s commitment to fiscal discipline are leading challenges confronting the Mexican economy.

The possibility of additional U.S. tariffs and ongoing USMCA negotiations could alter Mexico’s role in North American trade. Mexico has represented a good manufacturing platform for the U.S. market, offering geographic proximity and competitive cost.

Meanwhile, there are questions about whether the government can sustain its spending on antipoverty programs and its commitment to aggressive minimum wage increases. Since 2018, unprecedented growth in real wages combined with the expansion of social programs have elevated consumption. As a result, Mexico experienced a historic reduction in its poverty rate between 2018 and 2024, with 13.4 million people—10 percent of the total population—lifted out of poverty.

Real wage increases accounted for about 70 percent of the poverty reduction, while remittances and social transfers in equal parts made up the remaining 30 percent, according to the World Bank.

However, public spending, including investment, is falling as Mexico prioritizes fiscal discipline (Chart 4). The government aims to reduce the budget deficit to 3.9 percent of GDP in 2025, a significant decrease from the 5.7 percent in 2024. Additionally, private investment fell during first quarter 2025 and has remained little changed.

Mexico's credit ratings, affirmed by rating agencies in late 2024 and early 2025 as stable with a low investment grade of BBB, reflect efforts to craft a prudent macroeconomic policy framework and strong external finances.

Mexico could emerge a net winner under the current global tariff scenario, if USMCA talks largely retain the existing terms exempting many exports from tariffs. Still, uncertainties remain. They include Mexico’s ability to stabilize public finances amid pressure to support the national oil company, Pemex, while backing the nation’s social programs. Uncertainty also remains about the rule of law amid the ongoing restructuring of Mexico’s judiciary, approved by voters in June 2025, which among other things provides for popular election of judges.