Texas economy cools as concerns about tariffs, uncertainty persist

Tariffs, reduced immigration and heightened policy uncertainty continue to impact the Texas economic outlook. Texas Business Outlook Surveys (TBOS) respondents are signaling increasing price pressures largely due to tariff pass-through. The One Big Beautiful Bill Act, a broad package of federal spending and tax policies signed in July, is expected to encourage business investment.

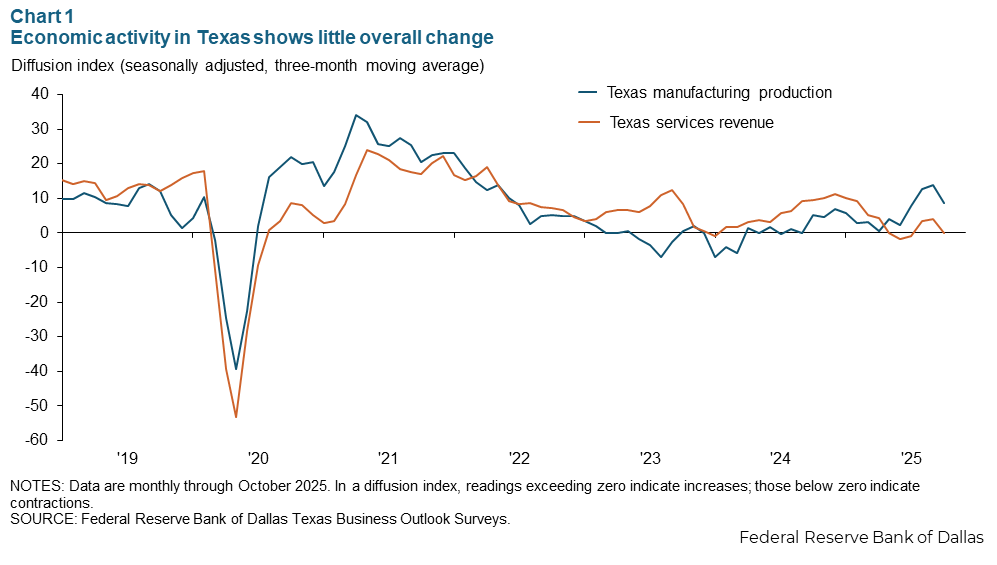

Most recently, growth in the Texas economy appears to be subsiding following an upturn during the summer, according to TBOS.

Economic activity in Texas decelerates

TBOS headline output indexes, which increased in July and August, flattened in September and weakened in October (Chart 1). The manufacturing production index declined but remained positive, indicative of moderate growth, while the near zero services revenue index as reflected in the three-month moving average suggests stalled growth in October.

Hiring muted, wage growth unchanged

The TBOS employment indexes suggest limited hiring in September and October. Data on Texas payroll employment from the Bureau of Labor Statistics are only available through August due to the federal government shutdown. The data suggested state job growth of 0.7 percent—the annualized three-month moving average through August, well below Texas’ long-run average of about 2 percent.

Historically, the TBOS employment indexes have closely followed state jobs data and can help fill the data gap resulting from the federal government shutdown. While the manufacturing employment index suggests modest employment growth in October, the services employment index turned negative, indicating slight job losses on net.

Other data are also consistent with a low-hiring, low-firing environment. Initial claims for unemployment insurance benefits are at normal levels, and layoff announcements at Texas firms remain well below typical levels through October.

TBOS firms reported that wages increased 3.8 percent over the 12 months ended in September, largely unchanged from June. Expectations for wage growth over the upcoming 12 months increased from 3.1 percent in June to 3.4 percent in September. Both services and manufacturing firms indicated modest increases in expected wage growth. The absence of softening wage growth expectations suggests labor market slack is not increasing in Texas.

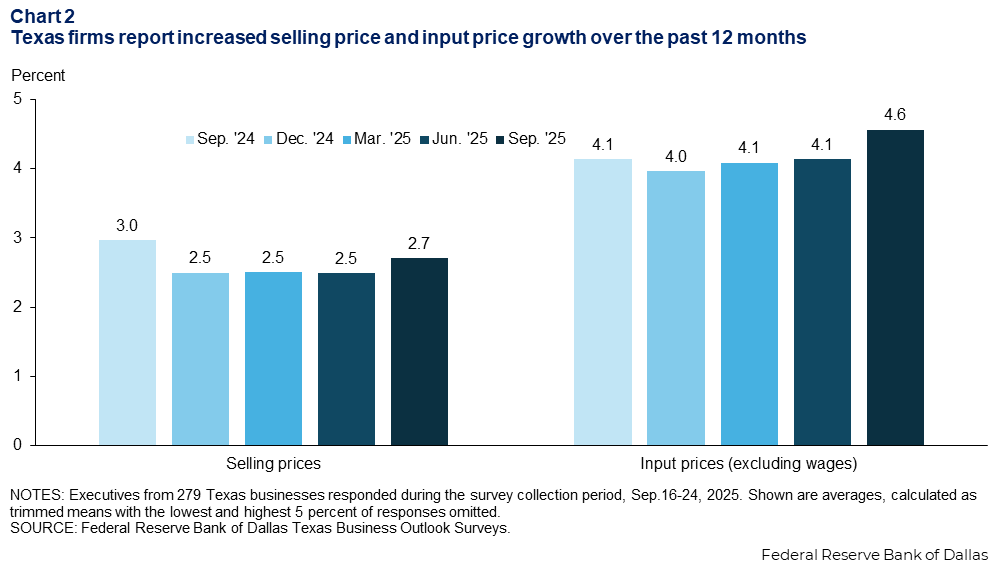

Price pressures increase in the region

TBOS firms reported their selling prices in September rose 2.7 percent over the prior 12 months, up from the 2.5 percent reported for the 12 months ended in June (Chart 2). Much of the uptick can be attributed to firms passing along some input price increases.

Input price growth had hovered around 4.1 percent since September 2024, jumping to 4.6 percent this past September. Tariffs appeared to play a key role; nearly half of firms reported in August that their input costs rose because of higher tariffs, and more than a quarter said they increased selling prices as a result. Tariffs are increasingly working through the economy.

“Input prices continue to increase as duties and tariffs take effect and remain in place,” a TBOS respondent in textiles said. We are “unsure of demand and will also need to increase our prices due to rising costs.”

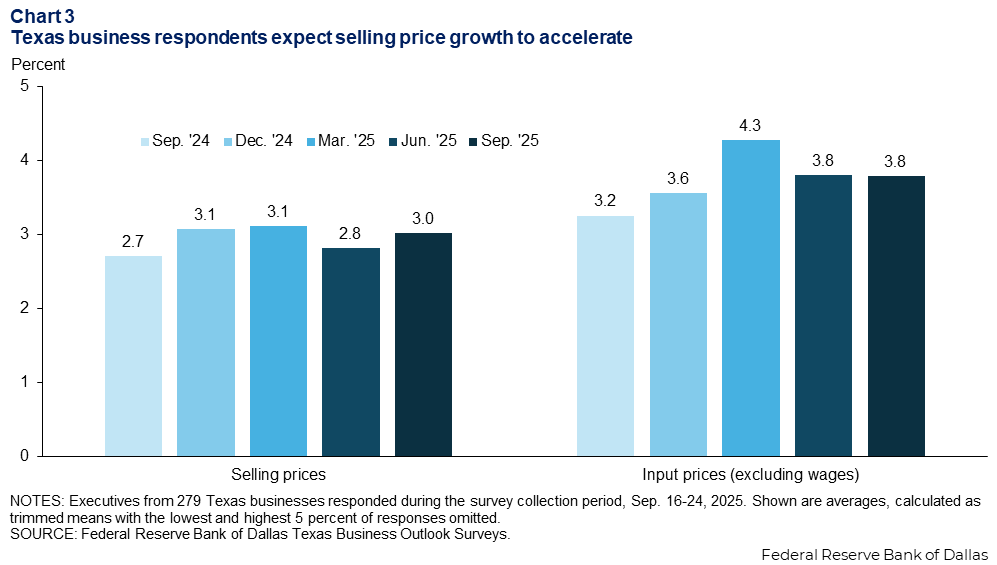

Heightened cost pressures boosted selling price expectations among Texas businesses (Chart 3). Anticipated selling price growth over the upcoming 12 months edged up from 2.8 in June to 3.0 percent in September, signaling that while firms anticipate continued pass- through of tariff costs, a marked jump in pricing is not anticipated.

Notably, expected input price growth held at 3.8 percent despite the recent jump in input prices. This indicates that while tariffs are moving through production costs now, firms do not expect cost pressures to further accelerate.

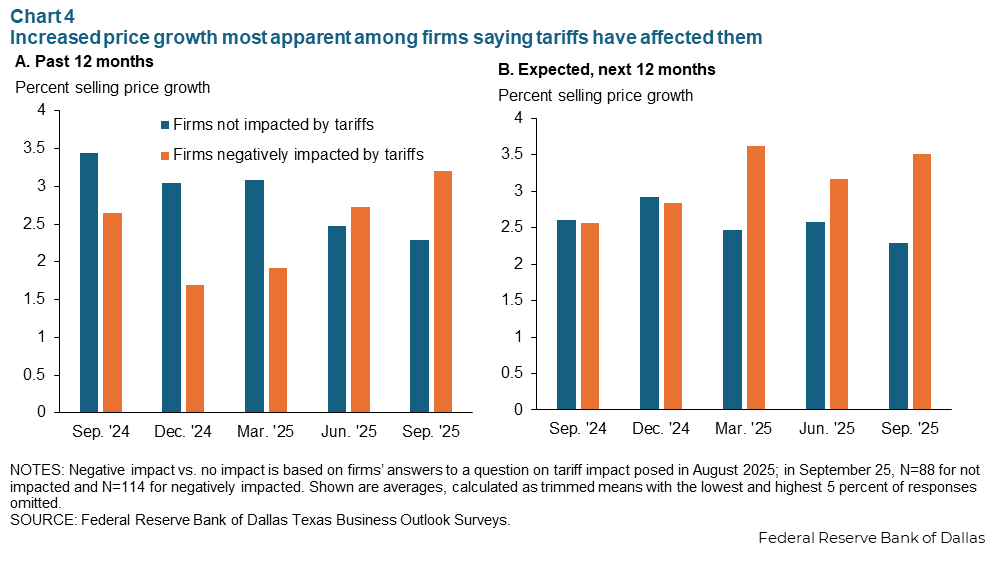

Accelerating price growth concentrated among tariff-affected firms

The uptick in price growth may largely reflect one-time tariff-related increases. Chart 4 examines reported selling price growth separately for TBOS firms that indicated in August that they were or were not negatively affected by tariffs.

The rate of selling price growth for TBOS firms affected by tariffs increased from 2.6 percent for the 12 months ended in September 2024 to 3.2 percent in September 2025. Over the same period, the rate of selling price growth for firms reportedly unaffected by tariffs fell from 3.4 percent to 2.3 percent. While there may be other factors contributing to the variance in pricing decisions across the two groups, increased input costs from higher tariffs likely played a key role.

Expectations of selling price growth among firms unaffected by tariffs have been somewhat stable over the past year, hovering between 2.3 and 2.9 percent, while expectations among tariff-impacted firms shot up from 2.6 percent in September 2024 to a high of 3.6 percent in March before easing to 3.5 percent in September.

However, tariff-impacted firms expect price growth in the next 12 months to only slightly rise from the 3.2 percent increase experienced over past 12 months. The outlook suggests that firms on average do not anticipate much further escalation of tariff pass-through.

Although manufacturing firms are disproportionately affected by tariffs, notably some 40 percent of services firms—particularly retailers—said tariffs hurt them, with 38.0 percent citing increased input costs and 19.1 percent citing higher selling prices.

Policy uncertainty poses risk to the outlook

Tariffs and policy uncertainty pose risks to the outlook, as does falling immigration and the chilling effect of immigration enforcement. Declining oil prices are an additional concern. Texas is the No. 1 oil-producing state, and oil prices have fallen below the $65 per barrel price many firms say is required to profitably drill new wells.

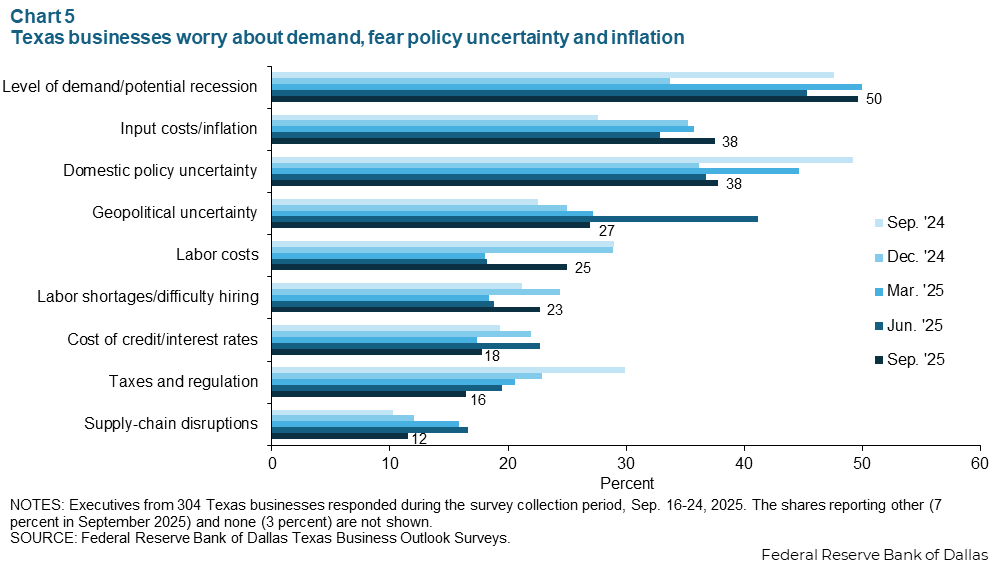

Overall, demand remains the top outlook concern among Texas businesses (Chart 5). The shares of firms citing inflation and domestic policy uncertainty rose in September, while geopolitical uncertainty retreated to the No. 4 spot.

The One Big Beautiful Bill Act could provide a boost, as one-third of businesses said in the September TBOS they expect its tax provisions to positively affect their firms. Most frequently, companies said they anticipated or were already undertaking increased capital expenditures consistent with the act’s capital investment incentives. Others plan to shift or already have shifted planned capital expenditures forward.

The six-week federal government shutdown, which began Oct. 1 and ended Nov. 12, has created a short-term drag on economic growth. As of August, 223,000 federal civilian employees worked in Texas, representing 1.6 percent of the state’s workforce. The Bipartisan Policy Center as of Oct. 14 estimated that 670,000 federal civilian employees nationwide were furloughed and 730,000 worked without pay. An estimated 96,000 people were furloughed in Texas.

Additionally, the shutdown paused Small Business Administration loans, delaying $307 million in average monthly funding Texas firms typically receive. Another $675 million for infrastructure improvements and other projects in the state were also deferred. The impact of suspension of the Supplemental Nutrition Assistance Program (SNAP), which provides food assistance to 3.5 million Texans, is also a headwind.

Modest growth anticipated through end of 2025

The Dallas Fed in September forecasted that employment will increase 1.3 percent this year, slightly below the 1.5 percent growth rate in 2024. Taking into consideration recent TBOS and other labor market data, it is likely that Texas employment growth will remain well below its 2 percent long-run annual trend rate.

Texas businesses continue to face an ambiguous economic climate. As one TBOS contact noted: “Overall uncertainty about the strength of the economy is our largest concern.”

About the authors