At the heart of Texas: Cities’ industry clusters drive growth

Fort Worth–Arlington: Transportation-related sectors predominate in local economy

- Print version

- Additional tables: Fort Worth location quotients, employment shares, average annual earnings, demographics

At a glance

Population (2017): |

2.5 million |

Population growth (2010–17): |

12.9 percent (Texas: 12.1 percent) |

Median household income (2017): |

$65,439 (Texas: $59,206) |

National MSA rank (2017): |

No. 4* (Dallas and Fort Worth combined) |

Kauffman Startup Activity Index rank (2017): |

No. 11* (Dallas and Fort Worth combined) |

| *The Fort Worth–Arlington metropolitan division is part of the Dallas–Fort Worth metropolitan statistical area (MSA) and encompasses Hood, Johnson, Parker, Somervell, Tarrant and Wise counties. The population of the Dallas–Fort Worth MSA is 7.4 million. The Kauffman Startup Activity Index, a measure of business creation in the 40 largest U.S. metropolitan areas, is further explained in the appendix. | |

- Fort Worth began as an outpost marking Texas’ western frontier. Rail connections and a central location for cattle drives helped establish the city’s identity as “Cowtown,” a moniker that endures.

- In the years surrounding World War II, Fort Worth emerged as a hub for the aviation and defense industries, key elements of the local economy today.

- Fort Worth’s blue-collar workforce provides a ready labor supply for the manufacturing sector, but a less-educated pool of workers may be a factor shifting some types of employment toward its regional neighbor, Dallas.

- Depressed natural gas prices have limited exploration of the area's Barnett Shale, but high oil prices are aiding growth in the metro’s energy sector.

History: Cowtown takes off with aviation

Fort Worth, established as an Army fort near the Clear Fork of the Trinity River in 1849, is named after Mexican–American War hero U.S. Army Gen. William Jenkins Worth. He had proposed a series of 10 forts from Eagle Pass to North Texas to mark the western Texas frontier. Shortly after Fort Worth’s inception, settlers began moving in and, by 1860, had established the city as a county seat. However, its initial growth spurt didn’t occur until after the Civil War.[1]

Once a wayside for cowboys on cattle drives to Kansas, Fort Worth attracted the interest of cattle buyers and meatpackers and acquired the nickname “Cowtown.” The Texas Pacific Railway completed a route linking Fort Worth with San Diego in 1876—the first in a series of railroad ties—and the city caught the attention of Armour and Co. and Swift and Co. Local citizens assembled a $100,000 incentive to entice the companies. Both began slaughterhouse operations in 1903, helping draw a burgeoning livestock trade to north Fort Worth.

Following the discovery of oil in Texas in 1901, refinery and pipeline firms came to Fort Worth. Oil and gas companies increased their foothold during the oil boom of the 1980s and the more recent discovery of large natural gas deposits in the nearby Barnett Shale.

With World War II, the aviation industry established a major presence in the form of Consolidated Aircraft Corp. (later acquired by General Dynamics Corp. and now part of Lockheed Martin Aeronautics Co.). Carswell Air Force Base (now the Naval Air Station Joint Reserve Base), part of the Strategic Air Command, was located next door. The siting of Dallas/Fort Worth International Airport (DFW) in 1973 on the Tarrant–Dallas county line and subsequent relocation of American Airlines nearby have continued to link the city to the aviation industry.Industry clusters: Transportation manufacturing, defense vital

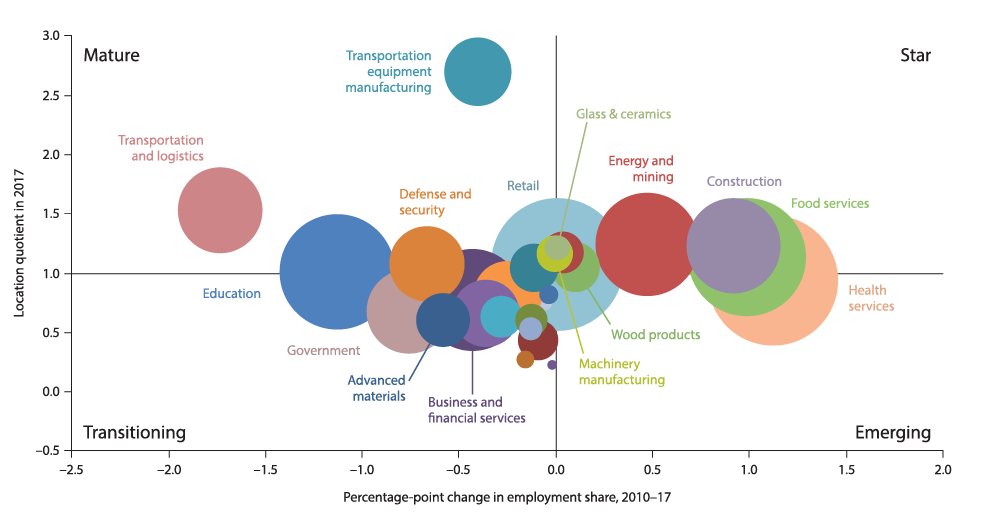

Location quotients (LQs), which compare the relative concentration of various industry clusters locally and nationally, are a convenient way of assessing key drivers in an economy. An LQ exceeding 1 indicates that a specific industry cluster carries more relative weight locally than nationally. Industry cluster growth is measured by the percentage-point change in its share of local employment between 2010 and 2017 (Chart 5.1).[2]

NOTE: Bubble size represents cluster share of metropolitan statistical area employment.

SOURCES: Texas Workforce Commission; Bureau of Labor Statistics.

Clusters in the top half of Chart 5.1, such as transportation equipment manufacturing, have a larger share of employment relative to the nation and, thus, an LQ greater than 1. These clusters are generally vital to the area’s economy and can be expanding rapidly (“star”) or growing slowly (“mature”). Those in the bottom half, such as advanced materials and government, are less dominant locally than nationally and, hence, have an LQ less than 1. “Emerging” clusters, such as health services, are fast growing; those growing slowly or contracting are “transitioning.”

The large LQs of transportation equipment manufacturing, transportation and logistics, and defense and security reflect their outsized role in the region. Along with DFW Airport, Fort Worth Alliance Airport and the Joint Reserve Base are major hubs. They have helped spur additional activity, much of it tied to e-commerce. United Parcel Service (UPS) has been constructing a $200 million package operations facility in Arlington, expected to employ 1,400 full-time-equivalent positions. FedEx already operates a growing regional sorting hub at Alliance.

General Motors has operated an automobile assembly plant in Arlington since 1954 and continues to invest in its growth. The plant specializes in larger sport utility vehicles. A $1.4 billion upgrade and expansion began at the facility in 2015, and in 2018, the company was completing a nearby manufacturing and warehousing complex to augment existing production.[3]

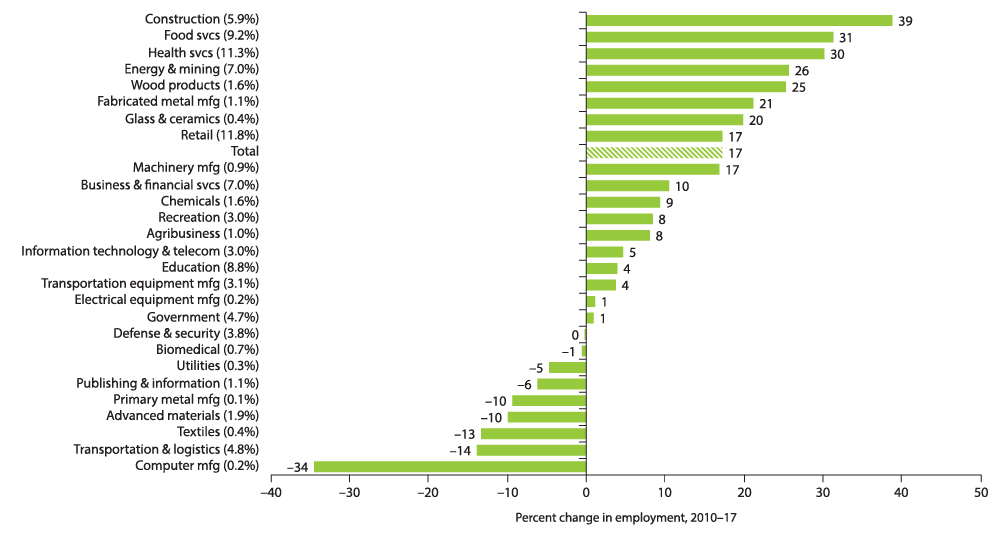

Fort Worth’s largest industry clusters drive essential activity and development—these include retail, health services, food services and education. Retail, which experienced employment growth of 17 percent during the 2010–17 study period, is the largest cluster (Chart 5.2). Jobs in food services, the third-largest cluster, expanded 31 percent during the period. The smaller recreation cluster, which grew 8 percent, includes Arlington’s Six Flags Over Texas amusement park. The park’s parent company, Six Flags Entertainment Corp., is based in nearby Grand Prairie.

NOTES: Percent change in employment is shown in whole numbers. Each cluster’s share of total jobs is shown in parentheses (rounded to one decimal place).

SOURCES: Texas Workforce Commission; authors’ calculations.

The energy and mining cluster holds a large overall employment share and experienced the fourth-fastest employment growth of all clusters, up 26 percent from 2010 to 2017. Fort Worth was a commercial center for the oil industry early in the last century and enjoyed easy access to the Permian Basin to the west. Today, it is the center of the Barnett Shale formation, a prolific source of natural gas. Persistent price weakness—natural gas was selling for about one-third of its July 2008 high in November 2018—has prompted some retrenchment.

The Fort Worth metropolitan division also supports a sizable defense and security cluster that includes Lockheed Martin Corp. and Bell Helicopter. Arlington is the site of two premier sports facilities—AT&T Stadium, where the Dallas Cowboys football team has played since moving from Irving in 2009, and Globe Life Park (formerly the Ballpark in Arlington), home field of the Texas Rangers baseball team. A $1.1 billion, 41,000-seat baseball stadium, Globe Life Field, is under construction and scheduled to open in 2020.

Fort Worth’s construction industry cluster was the fastest-growing over the study period. In 2016, the value of all construction activity in the greater Dallas–Fort Worth metropolitan area ranked second among the nation’s metros, according to Dodge Data and Analytics.[4] Major projects recently undertaken in Fort Worth include Facebook’s more than $1 billion data center and a $450 million multipurpose arena near the Will Rogers Memorial Center that will become home of the annual Fort Worth Stock Show & Rodeo.[5] Residential construction activity in Fort Worth has picked up as well, and growth in single-family permits exceeded the Dallas metropolitan division in 2017 for the first time since 2013.[6]

On average, clusters with a greater employment concentration locally than nationally paid $50,000 annually, compared with those with a relatively smaller presence, at $64,500 (Table 5.1). However, within more concentrated clusters, average pay varies widely. Transportation equipment manufacturing—with nearly three times the national employment share (LQ of 2.7)—pays well, at $95,200, as does defense and security (LQ of 1.1), at $89,000. By comparison, the larger food services and retail clusters (both straddling the star and emerging categories) were among the lowest paying, at about $18,300 and $31,700 a year, respectively.

| Cluster | Fort Worth | U.S. | |||||

| 2010 | 2012 | 2014 | 2016 | 2017 | 2017 | ||

| Transportation equipment manufacturing | 94,220 | 96,044 | 92,359 | 99,533 | 95,231 | 73,569 | |

| Transportation and logistics | 58,733 | 58,450 | 49,894 | 45,509 | 46,467 | 53,761 | |

| Energy and mining | 83,368 | 75,853 | 78,625 | 71,766 | 72,643 | 80,900 | |

| Construction | 50,460 | 51,753 | 54,579 | 57,863 | 60,418 | 60,742 | |

| Glass and ceramics | 51,932 | 55,022 | 59,728 | 59,747 | 62,752 | 55,398 | |

| Fabricated metal manufacturing | 52,526 | 53,323 | 55,472 | 54,188 | 55,033 | 55,830 | |

| Machinery manufacturing | 66,040 | 69,553 | 67,927 | 66,944 | 68,726 | 70,059 | |

| Food services | 17,533 | 17,437 | 17,565 | 18,164 | 18,254 | 18,963 | |

| Defense and security | 87,777 | 87,885 | 88,876 | 91,022 | 89,034 | 91,226 | |

| Retail | 32,001 | 31,397 | 31,680 | 32,110 | 31,700 | 31,216 | |

| Wood products | 47,531 | 48,261 | 49,498 | 52,251 | 53,924 | 52,914 | |

| Chemicals | 98,629 | 93,074 | 87,437 | 75,376 | 72,983 | 72,887 | |

| Education | 43,232 | 42,308 | 43,278 | 44,695 | 44,066 | 49,322 | |

| Clusters with location quotient > 1 | 52,605 | 53,336 | 52,751 | 50,106 | 50,044 | – | |

| Clusters with location quotient < 1 | 64,161 | 59,931 | 60,142 | 64,908 | 64,544 | ||

| Average earnings (total) | 51,298 | 50,841 | 51,875 | 52,276 | 52,714 | 55,375 | |

| NOTES: Clusters are listed in order of location quotient (LQ); clusters shown are those with LQs greater than 1. Earnings are in 2017 dollars. SOURCES: Texas Workforce Commission; Bureau of Labor Statistics; authors’ calculations. |

|||||||

Demographics: In-migration key to growth

Fort Worth and its larger neighbor, Dallas, make up the Dallas–Fort Worth metroplex—the fourth-largest MSA in the country, with 7.4 million people in 2017.[7] New residents from elsewhere in the U.S. accounted for 40 percent of the metroplex’s population growth in 2017, and the region took the top spot nationally for total net migration from 2010 to 2017. The largest share of people moving from outside the state to Dallas–Fort Worth in 2016 came from California, followed by Oklahoma.

A total of 59.3 percent of the Fort Worth area’s foreign-born population came from Latin America, less than the 68.6 percent share for Texas overall in 2016.

In 2017, Fort Worth’s median household income—the midpoint at which half of incomes are above and below—was $65,439, exceeding the U.S. median of $63,336 but trailing Dallas.

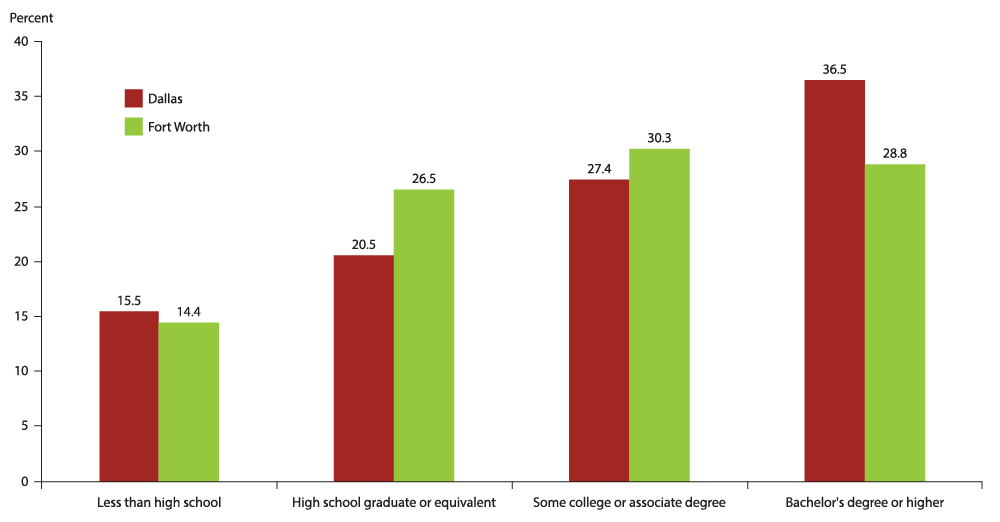

Consistent with the area’s manufacturing emphasis, 28.8 percent of workers age 25 and older hold a bachelor’s or higher degree, less than Dallas at 36.5 percent and the U.S. at 31.2 percent but on par with Texas at 28.9 percent (Chart 5.3). The share of adults with only a high school diploma in Fort Worth exceeds the share in Dallas.

NOTE: Share of population age 25 and over.

SOURCE: Census Bureau, 2016 American Community Survey 1-year estimates.

Employment: Energy affects postrecession recovery

While Fort Worth and Dallas together make up a diversified economy that closely resembles the U.S. as a whole, the influence of the mining and energy cluster—whose LQ of 1.2 makes it more prominent locally than nationally—likely helped Fort Worth get a quicker start than its sibling metro following the Great Recession. While it took Dallas 51 months to regain all the jobs it lost during the recession, Fort Worth was able to rebound in 43 months.

The situation was reversed in 2015, when the steep decline of oil and gas prices restrained the Fort Worth area’s expansion.

Through much of 2012 and 2013, the Fort Worth area’s unemployment rate was lower than Dallas’. A wider spread—this time favoring Dallas—emerged during 2015 as the energy slump deepened. Employment growth in Fort Worth slowed to 0.9 percent in 2015, and in 2016, job gains occurred at a 1.5 percent rate. This compares with 3.7 percent for Dallas over the same period. Higher oil prices and a pickup in manufacturing activity boosted Fort Worth employment growth to 2.3 percent in 2017, similar to Dallas’ 2.6 percent increase.

Fort Worth's unemployment rate was 0.7 percentage points below the U.S. average during most of 2017 and was little changed through much of 2018.

Outlook: Transportation and eefense lead

Although sometimes viewed as a single economic unit with Dallas, the Fort Worth region has a unique and complementary industry profile, with a greater concentration in energy, transportation and defense. In the near term, those industries’ performances will help set the course for Fort Worth. Logistics is an expanding sector that should provide a net positive. A lower cost of housing relative to Dallas will continue to attract residents to Fort Worth, which in 2017 outpaced its eastern neighbor in both single-family and multifamily construction.

Federal budget decisions will likely help set the long-term outlook for the historically powerful defense and security cluster and the almost 4 percent of the workforce it represents. Stagnant prices for natural gas will damp prospects and limit natural gas exploration along the Barnett Shale. Record-high oil production in the state will continue to boost growth in the energy and mining cluster, which makes up 7 percent of the region’s employment and is classified as a star among Fort Worth’s clusters.

—Michael Weiss and Alexander T. Abraham

| Fort Worth—Arlington Growth Outlook | |

| Drivers | Challenges |

|

|

Notes

- The history of Fort Worth is taken from the Texas State Historical Association’s Handbook of Texas, tshaonline.org/handbook/online/articles/hdf01.

- The percentage shares of individual clusters do not add to 100 because some industries are counted in multiple clusters, and some industries are not counted at all based on cluster definitions. (See the appendix for more information.).

- “GM Adds 850 More Jobs in Arlington, Expands to Six Flags Mall Site,” by Tracy M. Cook, Dallas Morning News, June 16, 2017, www.dallasnews.com/business/jobs/2017/06/16/general-motors-bring-850-jobs-arlington.

- “Dallas–Fort Worth Construction Is Slowing from Recent Highs,” by Steve Brown, Dallas Morning News, Aug. 1, 2017, www.dallasnews.com/business/real-estate/2017/08/01/dallas-fort-worth-construction-slowing-recent-highs.

- “Facebook’s Fort Worth Data Center Opening This Week Is Getting Bigger,” by Steve Brown, Dallas Morning News, May 3, 2017, www.dallasnews.com/business/real-estate/2017/05/03/facebooks-fort-worth-data-center-opening-week-getting-bigger ; “New $450 Million Dickies Arena Moves Forward in Fort Worth,” by Larry Collins, KXAS-TV, April 18, 2017, www.nbcdfw.com/news/local/New-450-million-Fort-Worth-Arena--419681933.html .

- In 2017, single-family permits in the Dallas–Plano–Irving metropolitan division were up 13 percent from the previous year compared with a 29 percent increase in Fort Worth–Arlington.

- The 2017 population estimates are from the Census Bureau. The three largest metropolitan statistical areas are New York–Newark–Jersey City, Los Angeles–Long Beach–Anaheim and Chicago–Naperville–Elgin.