McAllen–Edinburg–Mission: Retail, medical hub draws on cross-border trade

At a glance

Population (2023): |

898,471 |

Population growth (2016–23): |

5.7 percent (Texas: 9.5 percent) |

Median household income (2023): |

$52,281 (Texas: $76,292) |

National MSA rank (2023): |

No. 65* |

| *The McAllen–Edinburg–Mission metropolitan statistical area (MSA) encompasses only Hidalgo County. | |

- Health services, education and retail trade are the largest clusters in McAllen. Government and transportation and logistics are also important sectors, largely attributable to border crossings with Mexico.

- McAllen’s employment was affected by the pandemic but has since more than bounced back, with average employment growth from 2022 through 2024 exceeding growth from 2016 through 2019.

- Formation of the University of Texas Rio Grande Valley has brought greater access to education and a focus on addressing local workforce gaps.

- While poverty remains high and education relatively low, both metrics are improving, bettering the area’s ability to attract higher-paying industries.

History: From a private ranch to a bridge to Mexico

McAllen began as a private ranch in the late 19th century. The city was not officially incorporated until 1911, several years after the St. Louis, Brownsville and Mexico Railway established a depot on ranchdonated land.[1]

At the request of President Woodrow Wilson, 20,000 soldiers from New York were deployed to McAllen in 1916 to help quell border disturbances. The area subsequently boomed, with the population growing from 1,200 to 6,000 by 1920.

McAllen’s economy was primarily agriculture based, with some oil exploration, in the early 20th century. In 1941, the city built a suspension bridge across the Rio Grande to Reynosa, Mexico. The McAllen–Hidalgo–Reynosa International Bridge increased tourism and trade, helping establish McAllen as an important port of entry.

The discovery of oil in the Reynosa area in 1947 prompted a large in-migration from the Mexican interior, boosting tourism and providing McAllen with an inexpensive labor supply. The McAllen Foreign Trade Zone—the first inland foreign trade zone in the United States—was established in 1973. International trade and tourism remain important to the region’s economy.

Industry clusters: Led by health, a diverse set of industries drive economy

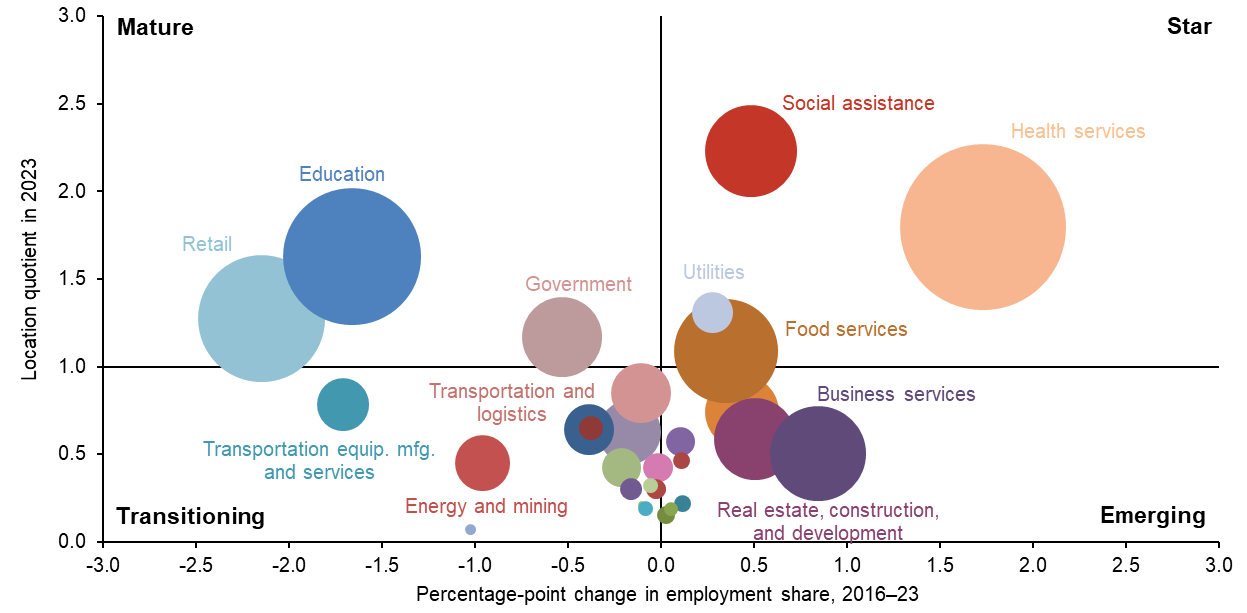

McAllen’s cluster composition is shown in Chart 7.1. Clusters are organized by location quotient (LQ), which represents the share of local employment in each cluster relative to the nation, and the change in employment share from 2016 through 2023.[2] “Star” quadrant clusters, such as health services and social assistance, have a larger share of employment relative to the nation (an LQ exceeding 1) and are comparatively fast growing. “Emerging” industries, such as business services, are smaller relative to the nation (LQ less than 1) and fast growing. Clusters in the “mature” quadrant are more concentrated but slower growing, and “transitioning” clusters are smaller relative to the nation and slower growing or declining.

NOTE: Bubble size represents the cluster share of metropolitan statistical area employment.

SOURCES: Texas Workforce Commission; Bureau of Labor Statistics.

Health care is a key sector in the McAllen economy. While the cluster has grown in importance in most metro areas, it is more concentrated in McAllen (and has the highest LQ) relative to other metros in this report. About 21 percent of McAllen’s workers are in the health cluster. Hospitals and medical centers, including McAllen Medical Center and Edinburg Regional Medical Center, are among the metro’s top employers.[3] The opening of the University of Texas Rio Grande Valley School of Medicine, which welcomed its first class in 2016, and the establishment in 2022 of the Graduate Medical Education program to train physicians at the South Texas Health System, points to further growth in the sector.[4]

Retail is typically big in the larger border communities, and this mature cluster employs 12.1 percent of McAllen’s workers. The metro area serves as the retail trade center of South Texas and northern Mexico. Retail tourism draws customers from as far as Monterrey, Mexico’s third-largest metro area, located 150 miles southwest of McAllen. Mexican shoppers account for an estimated 30 to 40 percent of the area’s retail sales.[5]

Overall, retail trade made up just over 11 percent of McAllen’s total output in 2023.[6] In terms of gross sales, however, retail trade accounted for 54 percent in McAllen in 2023, compared with about 23 percent statewide.[7]

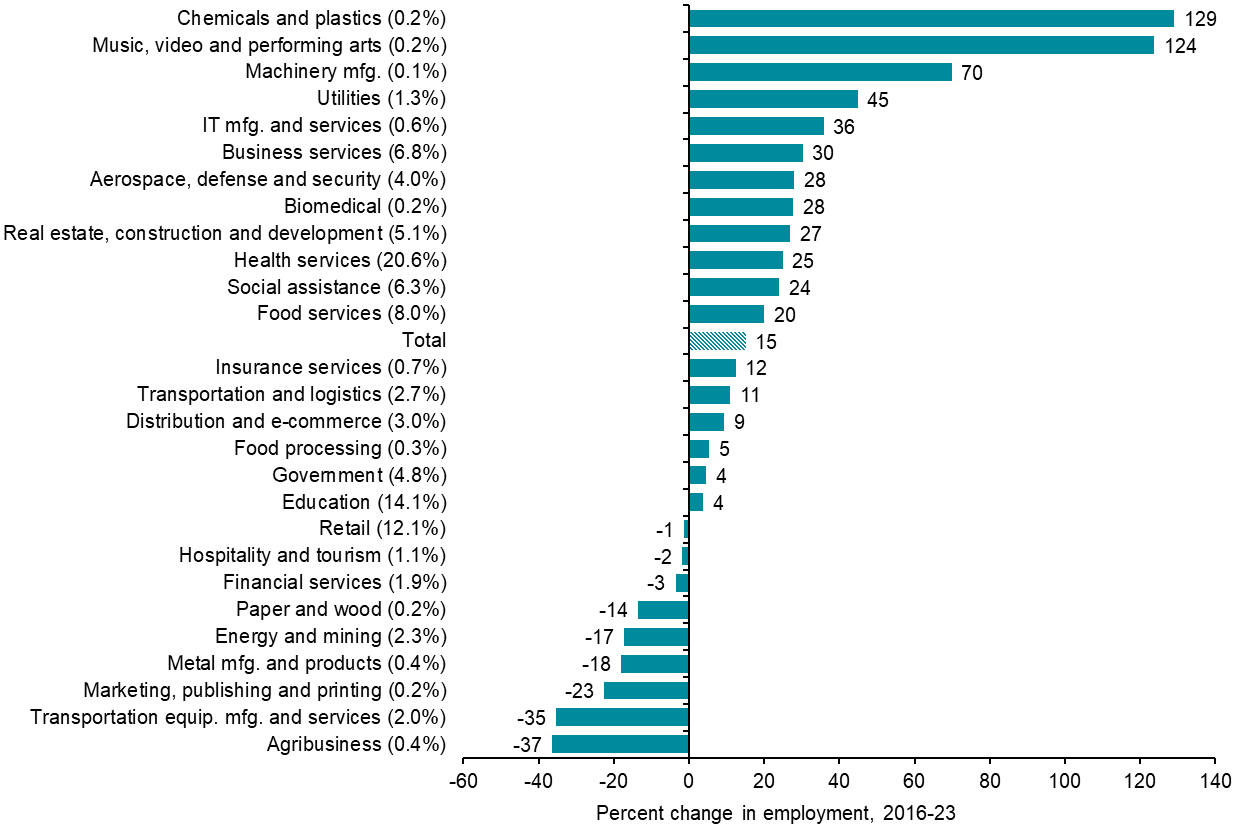

Government employees figure prominently in border economies, and McAllen is no exception. Excluding public education, defense and health services e mployees, government employees make up 4.8 percent of all workers in McAllen. The cluster’s workforce grew 4 percent from 2016 through 2023 (Chart 7.2).

NOTES: Percent change in employment is shown in whole numbers. Each cluster’s share of total jobs is shown in parentheses (rounded to one decimal place). Clusters with employment shares less than 0.1 percent are not displayed.

SOURCES: Texas Workforce Commission; authors’ calculations.

The city of McAllen has more than 2,000 municipal workers, while border crossings and international trade represent a major federal employment commitment involving U.S. Customs and Border Protection and other federal agencies.[8] Presence of both federal and state personnel expanded over the period due to the 2021–24 border migration surge.

Education (both public and private) makes up one of the biggest industry clusters in McAllen, accounting for 14.1 percent of all jobs, likely a result of the large share of youth in the region. Although employment fell in the pandemic, education sector job growth has been steady since then.

With three international border crossings in the metropolitan statistical area, McAllen is the third-busiest border crossing in Texas (behind Laredo and El Paso) in terms of commercial truck traffic and pedestrians.[9] Consequently, transportation and logistics is an important industry. While its concentration (LQ of 0.8) isn’t as significant locally as nationally, the cluster grew 11 percent from 2016 through 2023.

Highly concentrated clusters—those with LQs greater than 1—are slightly lower paying in McAllen than their less-concentrated counterparts (Table 7.1). This is due to the prevalence of retail, social assistance and food services industries, which tend to pay low wages, and the relative scarcity of high-paying manufacturing and skilled services jobs. The aerospace, defense and security, biomedical, and energy and mining clusters—the highest-paying clusters in the region by a significant margin—constitute 6.6 percent of jobs in the area.

| Cluster | McAllen-Edinburg-Mission | U.S. | |||

| 2016 | 2019 | 2021 | 2023 | 2023 | |

| Social assistance | 20,250 | 19,615 | 20,770 | 19,790 | 33,136 |

| Health services | 40,046 | 37,424 | 37,540 | 36,072 | 69,397 |

| Education | 51,601 | 53,640 | 56,133 | 51,603 | 66,490 |

| Utilities | 55,444 | 53,659 | 54,501 | 54,398 | 106,251 |

| Retail | 32,272 | 32,698 | 35,490 | 33,770 | 39,817 |

| Government | 46,758 | 49,087 | 50,149 | 49,664 | 67,435 |

| Food services | 18,384 | 18,883 | 19,460 | 19,023 | 25,821 |

| Clusters with location quotient > 1 | 35,444 | 37,858 | 39,149 | 37,760 | |

| Clusters with location quotient <= 1 | 47,264 | 46,271 | 47,649 | 48,824 | |

| Average earnings (total) | 40,635 | 40,678 | 41,637 | 40,350 | 70,033 |

| NOTES: Clusters are listed in order of location quotient (LQ); clusters shown are those with LQs greater than 1 in 2023. Earnings are in 2023 dollars. SOURCES: Texas Workforce Commission; Bureau of Labor Statistics; authors' calculations. |

|||||

Real (inflation-adjusted) wages overall remain significantly lower than U.S. industry averages. Wages in the star and mature clusters (LQs greater than 1) rose 6.5 percent from 2016 through 2023. Pay in less-concentrated clusters grew 3.3 percent over the same period. Government and retail experienced the most wage growth among the concentrated sectors, while health services wages hit a steep decline. It bears noting that wages in McAllen partly reflect the area’s low cost of living and that wage growth over the entire period obscures the boost in wage growth in more recent years.

A low-pay environment in the burgeoning health industry is unusual; doctors, nurses and other health workers are generally well-educated and command high wages. However, 63.5 percent of workers in McAllen’s health cluster and 14.8 percent of the area’s total workforce are employed in home health care services.[10] This segment of the cluster grew 42 percent from 2016 through 2023, much more than the overall health services cluster, which expanded 25 percent. Many home health workers are unlicensed, nonmedical caregivers, and the average salary for these jobs is significantly lower than for the sector as a whole.

Demographics: Poorer, younger and less educated than the state

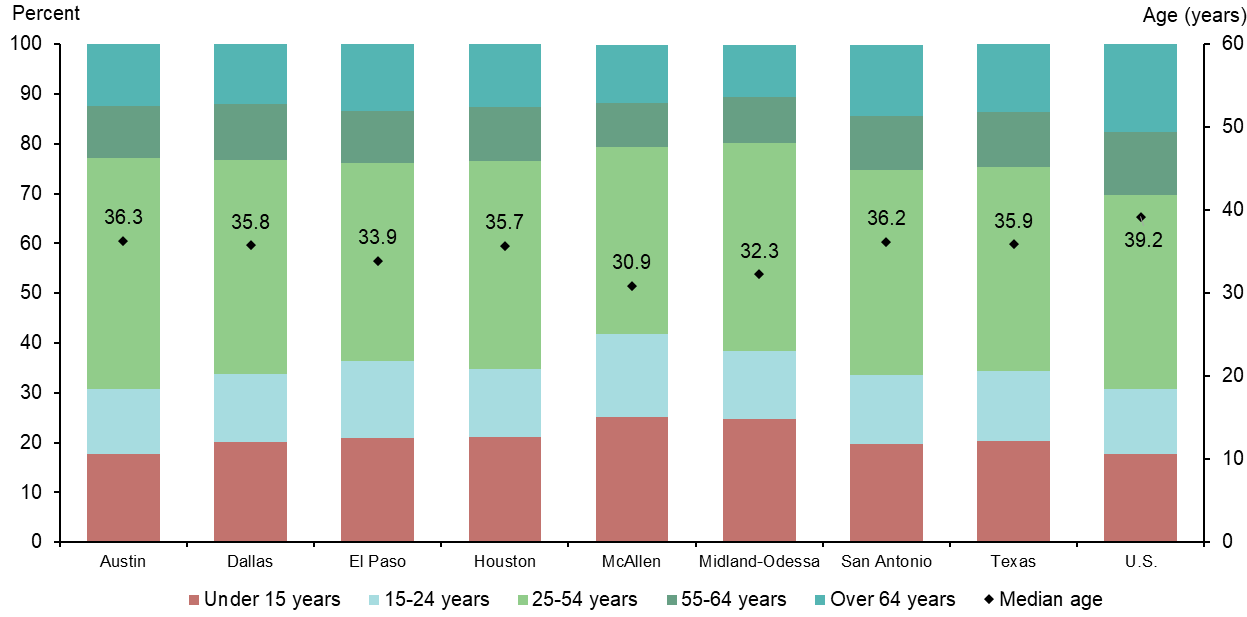

McAllen’s population is much younger than that of the other metros (Chart 7.3). The median age of 30.9 is five years lower than the statewide figure. The city has the largest share of under-15-year-olds of all metros in this report at 25.1 percent. Households in McAllen also tend to be larger—the metro averages a household size of 3.2 individuals compared with 2.7 for Texas.

NOTE: Right hand side axis shows relative median ages for Texas, U.S. and the metro areas listed.

SOURCE: Census Bureau, 2023 American Community Survey 1-year estimates.

The population is predominantly Hispanic at 91.9 percent, and 87.9 percent of the population self-identifies as being of Mexican descent. McAllen has the largest foreign-born population of any metro in the report, nearly 26 percent. Among the foreign-born population, 92.4 percent are from Mexico, illustrating the region’s deep cross-border ties.

McAllen is also home to a large group of seasonal residents who, at an average age of 74, contrast starkly with the younger inhabitants of the metro and the Rio Grande Valley. These “Winter Texans” come primarily from midwestern U.S. states and Canada to find a more temperate climate and low cost of living. The approximately 57,000 winter Texan households spent $761 million locally in 2022–23.[11]McAllen trails the state in terms of educational outcomes. Nearly 30 percent of the population age 25 and over has no high school diploma—more than twice the Texas average. Only 20.7 percent of the population holds a bachelor’s degree or higher, compared with 34.2 percent in Texas. However, educational attainment has improved in McAllen, with the share of the population with a high school diploma rising 5.5 percentage points from 2016 through 2023, and those with a bachelor’s degree or higher increasing 2.4 percentage points.

Due to low education levels and the prevalence of low-paying industries, it’s not surprising that McAllen has a high poverty rate—27.2 percent of the population lived below the poverty line in 2023, compared with 13.7 percent in Texas. The 2023 median household income of $52,281 was two-thirds of the Texas figure, $76,292. This is an improvement from 2016, when 31.4 percent of the population lived below the poverty line, and the median household income was less than two-thirds of the state’s median.

Employment: Solid growth after recovery from pandemic

McAllen weathered the pandemic better than most metros. From February through April 2020, McAllen experienced a 10.2 percent drop in employment. McAllen regained all lost jobs 17 months after the beginning of the pandemic, in July 2021, two months before Texas recovered and several months before the nation. Total nonfarm employment grew 10.6 percent between February 2020 (onset of the pandemic) and December 2024.

Over a longer horizon, from December 2016 to December 2024, McAllen’s total employment grew 19.1 percent, exceeding Texas’ 17.7 percent growth. Professional and business services experienced the fastest growth, expanding 55.4 percent over the period.

Outlook: Dependence on ties to Mexico, skilled job growth and slowing the brain drain

Many highly educated McAllen residents, especially young, college-educated workers, seek employment elsewhere because of the higher pay offered in bigger cities. This situation may change in the future; McAllen’s economy is diversifying, and opportunity is increasingly more broad-based.

The merger of the University of Texas—Pan American in Edinburg and the University of Texas at Brownsville created the University of Texas Rio Grande Valley, based in Edinburg and Brownsville, the largest public university by enrollment in the Texas border region. The university welcomed the first students to a new medical school in 2016, which along with the recently established graduate medical education program at the South Texas Health System, create the promise of greater accessibility to medical training and services.[12] Nevertheless, the emerging industries that employ highly educated workers are not yet dominant enough to retain large numbers of the young, educated workforce.[13]

SpaceX investment in the region promises to bring new job opportunities, including skilled and high paying jobs. SpaceX’s newly incorporated town, Starbase in nearby Cameron County, is projected to add more than $6.5 billion in economic value to the Rio Grande Valley, according to company estimates. SpaceX says it anticipates bringing in 3,400 employees and contractors and indirectly create an additional 21,400 jobs.[14]

Border commerce continues as an economic driver. From 2021 to 2023, a strong peso helped border retail sales, with total retail trade rising 15.7 percent. However, the peso weakened slightly in 2024 and sales softened.

Higher origin content thresholds and streamlined regulatory processes outlined in the United States-Mexico-Canada Agreement (USMCA), the 2020 successor to the North American Free Trade Agreement, support trade and warehousing activity. However, renegotiation of the USMCA is pending. The effects of new and higher tariffs may further impact local activity. Meanwhile, possible nearshoring, involving relocation of trade often from Asia to North America, could increase trade volumes in McAllen and boost the trade-related services industry.[15]

While border cities such as McAllen remain strategic trade gateways, near-term growth is clouded by weakness in the Mexican economy and U.S. trade policy uncertainty, as well as federal government budget cuts. Resilience will depend on trade flows under an updated USMCA, peso stability and investment diversification beyond retail and logistics.

| McAllen–Edinburg–Mission growth outlook | |

| Drivers | Challenges |

|

|

Notes

- The history of McAllen is taken from the Texas State Historical Association’s Handbook of Texas.

- The percentage shares of individual clusters are normalized to add up to 100 and differ from individual industry share totals. Some industries are included in multiple clusters, while some others are omitted because they fall outside revised cluster definitions, (See the appendix for more information.)

- Information about McAllen’s top employers is from the McAllen Economic Development Corp.

- See “South Texas Health System Expanding Medical Training in the Rio Grande Valley Through its Recently Accredited Graduate Medical Education Program.”

- See “Dollar-Sensitive Mexican Shoppers Boost Texas Border Retail Activity,” by Roberto Coronado and Keith R. Phillips, Southwest Economy, Fourth Quarter, 2012.

- Metropolitan statistical area (MSA) 2023 gross domestic product data by industry are from the Bureau of Economic Analysis.

- See Texas Comptroller gross sales and tax data.

- Data are from city of McAllen.

- Border crossing information is from the Bureau of Transportation Statistics. Data for McAllen are listed under Hidalgo, Texas, which is part of the McAllen–Edinburg–Mission MSA.

- See definition of home health care workers in NAICS 6216. See also Occupational Employment Reports.

- See “2022-23 Winter Texan Report,” Business and Tourism Research Center, University of Texas Rio Grande Valley.

- See “Our Story,” University of Texas Rio Grande Valley School of Medicine.

- See McAllen Key Industries from the McAllen Chamber of Commerce.

- See Starbase Local Impact Report, June 2024.

- “The Impact of Maquiladoras on U.S. Border Cities,” by Jesus Cañas, Roberto Coronado, Robert W. Gilmer and Eduardo Saucedo, Growth and Change, vol. 44, no. 3, September 2013, pp. 415–42.