San Antonio–New Braunfels: Home of the Alamo, the ‘Cradle of Texas Liberty’

At a glance

Population (2023): |

2.7 million |

Population growth (2016–23): |

11.3 percent (Texas: 9.5 percent) |

Median household income (2023): |

$74,297 (Texas: $76,292) |

National MSA rank (2023): |

No. 24* |

| *The San Antonio-New Braunfels metropolitan statistical area (MSA) encompasses Atascosa, Bandera, Bexar, Comal, Guadalupe, Kendall, Medina and Wilson counties. | |

- San Antonio has a rich heritage and history. It was the largest city in Texas from 1860 to 1930, when it fell behind Houston and Dallas. It has remained Texas’ third-largest metro area.

- While housing costs are lower in San Antonio relative to other large Texas metros, its median household income is only slightly lower than the state figure.

- The area’s diversified economy—particularly its business and financial services firms, tourism industry, military installations and medical research complex—will continue to provide economic stability.

- While a less-educated workforce has helped the area attract blue collar industries such as manufacturing, difficulties attracting skilled workers make growth in high-wage industries more challenging.

History: A military service and health research center emerges

Spanish expeditions explored the area of present-day San Antonio in 1691 and 1709. A town grew out of the San Antonio de Béxar Presidio and San Fernando de Béxar. The presidio was built to defend the San Antonio mission, and San Fernando was the first chartered civil settlement in Texas. In 1773, San Antonio de Béxar became the capital of Tejas, Spanish Texas. It was the site of several battles during the Texas Revolution from October 1835 to April 1836, most notably the 13-day siege of the Alamo. Bexar County was established by the Republic of Texas following the departure of Mexican troops, and San Antonio became its seat in 1837.[1]

In 1860, San Antonio surpassed Galveston to become the largest city in Texas and, following the Civil War, it thrived as a center for the cattle industry. The 1877 arrival of San Antonio’s first railroad, the Galveston, Harrisburg and San Antonio Railway, fueled the city’s economic growth and spurred additional railroad connections to other parts of the country by 1900. However, San Antonio’s population fell behind that of Houston and Dallas by 1930, and San Antonio has since remained the third-largest urban area in Texas.

The First United States Volunteer Cavalry, later known as the Rough Riders, was organized in San Antonio during the Spanish–American War. In World Wars I and II, San Antonio served as an important military center for the Army and Air Force. Today, three large military installations—Fort Sam Houston and Lackland and Randolph Air Force bases—provide employment for many of the area’s residents.

A 418-bed military hospital began operations in 1938 and expanded during World War II. In 1946, with Fort Sam Houston chosen as site of the U.S. Army Medical Field Service School, the hospital was renamed Brooke Army Medical Center. It marked the beginning of the area’s ties to medical research.

Industry clusters: Health care, finance and retail at the forefront

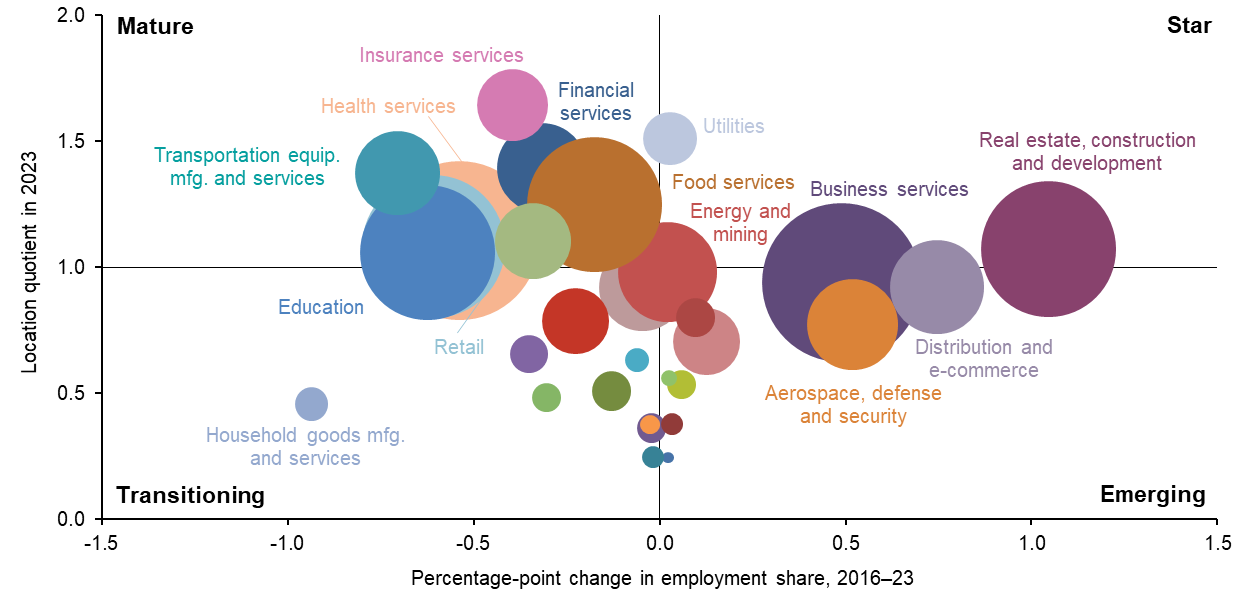

Location quotients (LQs), which compare the relative concentration of various industry clusters locally and nationally, can be used to assess key drivers in an area’s economy. An LQ exceeding 1 indicates a specific industry cluster is more dominant locally than nationally. Industry cluster growth is measured by the percentage-point change in its share of local employment between 2016 and 2023 (Chart 9.1).[2]

NOTE: Bubble size represents cluster share of metropolitan statistical area employment.

SOURCES: Texas Workforce Commission; Bureau of Labor Statistics.

Clusters in the top half of the chart have a larger share of employment relative to the nation and, thus, an LQ exceeding 1. These clusters are generally vital to the area’s economy and can be expanding relatively rapidly (“star”) or slowly (“mature”). Those in the bottom half are less dominant locally than nationally and, hence, have LQs below 1. “Emerging” clusters are fast growing; those growing slowly or declining are “transitioning.”

The higher LQs of insurance services, utilities, financial services, transportation equipment manufacturing and services, and food services reflect their outsized roles in the San Antonio area. The metro’s largest private employer is the supermarket chain H-E-B, with 20,000 employees in the region. The third- and fifth-largest industry clusters by employment share, retail and food services, are tied to the region’s vibrant tourism industry. San Antonio is a top U.S. convention city. Local attractions draw millions of visitors annually, and the hospitality industry generates billions of dollars in economic impact each year.[3]

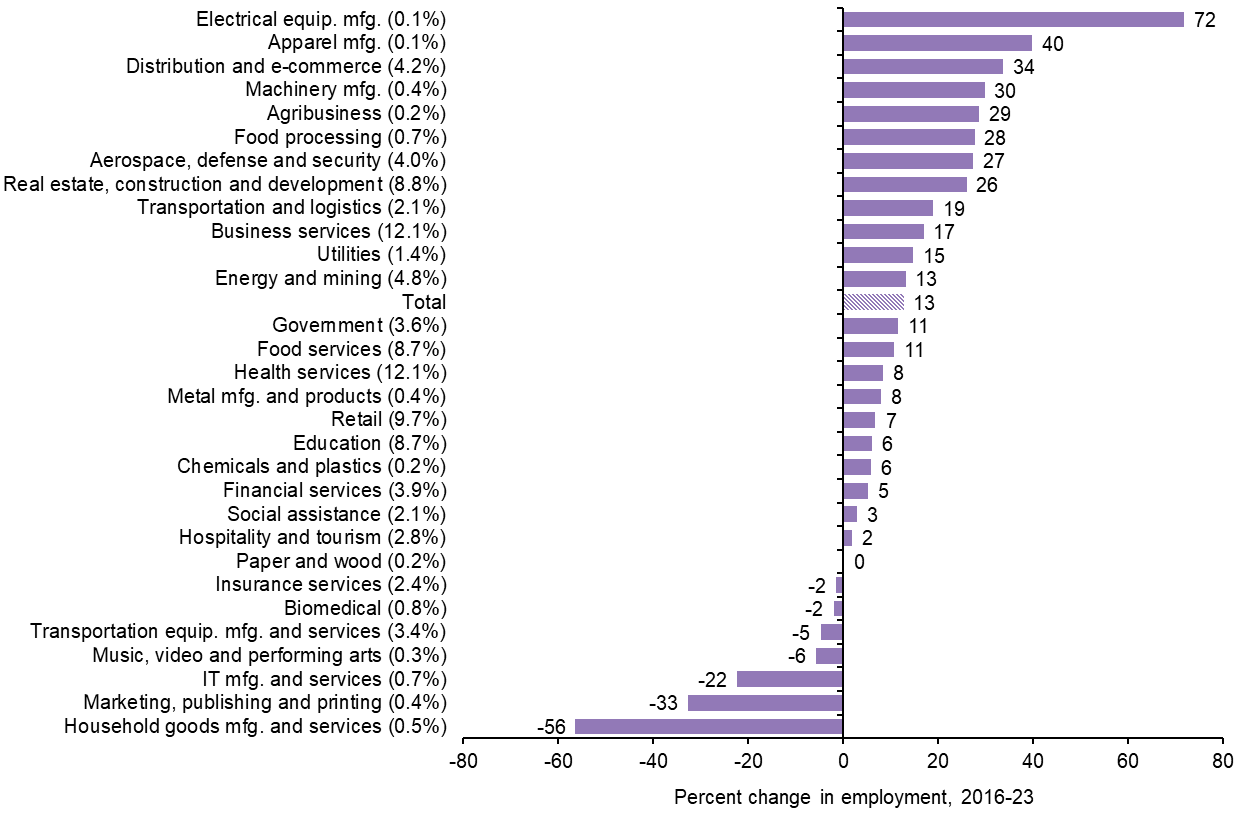

Employment expanded 11 percent in food services and 7 percent in retail from 2016 through 2023—the two clusters make up 18 percent of all metro jobs (Chart 9.2). Though San Antonio boasts major attractions such as the River Walk, the Alamo, SeaWorld and Six Flags Fiesta Texas, the tourism and hospitality cluster grew just 2 percent from 2016 through 2023, likely tempered by the impact of the pandemic.

NOTES: Percent change in employment is shown in whole numbers. Each cluster’s share of total jobs is shown in parentheses (rounded to one decimal place). Clusters with employment shares less than 0.1 percent are not displayed.

SOURCES: Texas Workforce Commission; authors’ calculations.

The government cluster reflects the presence of three military installations, which together employ 67,000 people and contributed $55 billion in output in 2023.[4] The military bases support employment in the defense and security and health clusters. San Antonio ranks among the top U.S. metro areas in terms of the largest concentrations of federal government and military workers.[5]

The health services and biomedical sectors also have strong footholds, with a combination of private and government operations. Employment in health-related institutions (private and government) accounts for 12 percent of San Antonio’s workforce, a larger proportion than in other major Texas metros (including Houston). Large private health care service providers are Methodist Healthcare and Baptist Health System. Medical research facilities in San Antonio include the Brooke Army Medical Center’s San Antonio Military Medical Center (the nation’s largest military hospital), Wilford Hall Ambulatory Surgical Center at Lackland Air Force Base, the University of Texas Health Science Center at San Antonio and the Texas Biomedical Research Institute.

Education is also a significant regional contributor, with more than 30 higher-education facilities and many ties to health care and biosciences through the South Texas Medical Center. Along with public and private K-12 education jobs, education accounts for almost 9 percent of employment in San Antonio.

San Antonio stands out for its robust insurance and financial services clusters. The metro area boasts a higher concentration of employment in these clusters than the nation, thanks in part to hometown heavyweights. USAA, a Fortune 500 financial services giant, anchors the industry with roughly 19,000 employees. SWBC adds another 3,000 jobs to the local economy. The financial landscape is further enriched by the presence of institutions such as locally based Cullen/Frost Bankers, JPMorgan Chase, Randolph-Brooks Federal Credit Union and Security Service Federal Credit Union.

Electronic equipment manufacturing was the fastest-growing cluster from 2016 to 2023, as employment increased 72 percent. Apparel manufacturing employment followed, growing 40 percent during the period. Both clusters are among the smallest in San Antonio, each accounting for 0.1 percent of total employment.

Transportation equipment manufacturing employment edged lower from 2016 through 2023, though the cluster remains vital to the San Antonio economy. It is anchored by the Toyota USA plant that began operations in 2006. The plant produces he Toyota Tundra, a full-size pickup, and the Toyota Sequoia SUV. Toyota employs 3,800 workers at its facility, and an additional 5,600 people are employed by the more than 20 on-site suppliers that support Toyota’s operations.[6] Companies such as Toyota that utilize Mexico-based manufacturing partners have faced increased tariffs for steel and aluminum and await the renegotiation of the United States-Mexico-Canada Agreement (USMCA) trade pact.

However, other companies continue to see opportunity in the area. Heavy machinery maker JCB (J.C. Bamford Excavators Ltd.) is building a 720,000-square-foot factory that will produce lift and access equipment. The plant will be operational in 2026 and is expected to employ 1,500 workers within five years.[7]

Aerospace, defense and security, the metro’s ninth-largest cluster—accounting for 4 percent of the local workforce—expanded 27 percent from 2016 through 2023 and shows no signs of slowing. In 2023, the U.S. Department of Defense awarded a $313 million contract to Boeing Co. to perform additional support services for the U.S. Navy’s F/A-18 E/F Super Hornet fighter jets. Approximately 95 percent of the work will be done at the Boeing Global Services facility at Port San Antonio.[8]

Business services, the metro’s second-largest cluster, accounts for 12 percent of the local workforce, roughly equivalent to its national presence. It expanded 17 percent locally from 2016 through 2023.

On average in 2023, clusters with a greater employment concentration in San Antonio than in the U.S. paid workers about $64,041, roughly the same as those clusters with a relatively smaller presence (Table 9.1). San Antonio’s dominant clusters are in industries that typically command less pay. These include food services at $24,492 annually and hospitality and tourism at $38,142. Still, some locally concentrated clusters are among the highest paying—insurance services at $106,748 annually and financial services at $88,382. A relatively low cost of living in San Antonio boosts the purchasing power of local wages, a difference not accounted for in the table.

| Cluster | San Antonio-New Braunfels | U.S. | |||

| 2016 | 2019 | 2021 | 2023 | 2023 | |

| Insurance services | 102,087 | 107,447 | 107,281 | 106,748 | 101,445 |

| Utilities | 85,436 | 84,117 | 79,794 | 79,417 | 106,251 |

| Financial services | 74,359 | 81,341 | 88,016 | 88,382 | 120,489 |

| Transportation equipment manufacturing and services | 58,580 | 62,726 | 66,756 | 72,372 | 66,929 |

| Food services | 22,304 | 22,823 | 24,281 | 24,492 | 25,821 |

| Health services | 61,738 | 62,723 | 64,524 | 62,958 | 69,397 |

| Hospitality and tourism | 37,628 | 39,096 | 38,883 | 38,142 | 43,035 |

| Retail | 38,565 | 39,479 | 43,323 | 41,186 | 39,817 |

| Real estate, construction and development | 67,834 | 70,413 | 69,956 | 70,824 | 75,369 |

| Education | 56,152 | 55,963 | 56,714 | 55,886 | 66,490 |

| Clusters with location quotient > 1 | 60,468 | 64,763 | 63,953 | 64,041 | - |

| Clusters with location quotient <= 1 | 62,968 | 62,867 | 64,724 | 64,193 | - |

| Average earnings (total) | 57,766 | 59,620 | 61,057 | 60,160 | 70,033 |

| NOTES: Clusters are listed in order of location quotient (LQ); clusters shown are those with LQs greater than 1 in 2023. Earnings are in 2023 dollars. SOURCES: Texas Workforce Commission; Bureau of Labor Statistics; authors' calculations. |

|||||

Demographics: Mostly hispanic; strong military background

The population is predominantly Hispanic, 54.7 percent, the highest share among the five major Texas metros and well above the Texas share of 39.8 percent.[9] Despite the higher proportion of Hispanics, the metro area has the lowest foreign-born population among the major Texas metros in this report at 12.5 percent. This compares with the foreign-born share of 17.9 percent in Texas overall and 14.3 percent in the U.S.

About a third, 33.1 percent, of the population age 25 and older holds bachelor’s degrees or higher, similar to the Texas average of 34.2 percent but markedly lower than neighboring Austin at 52.1 percent.

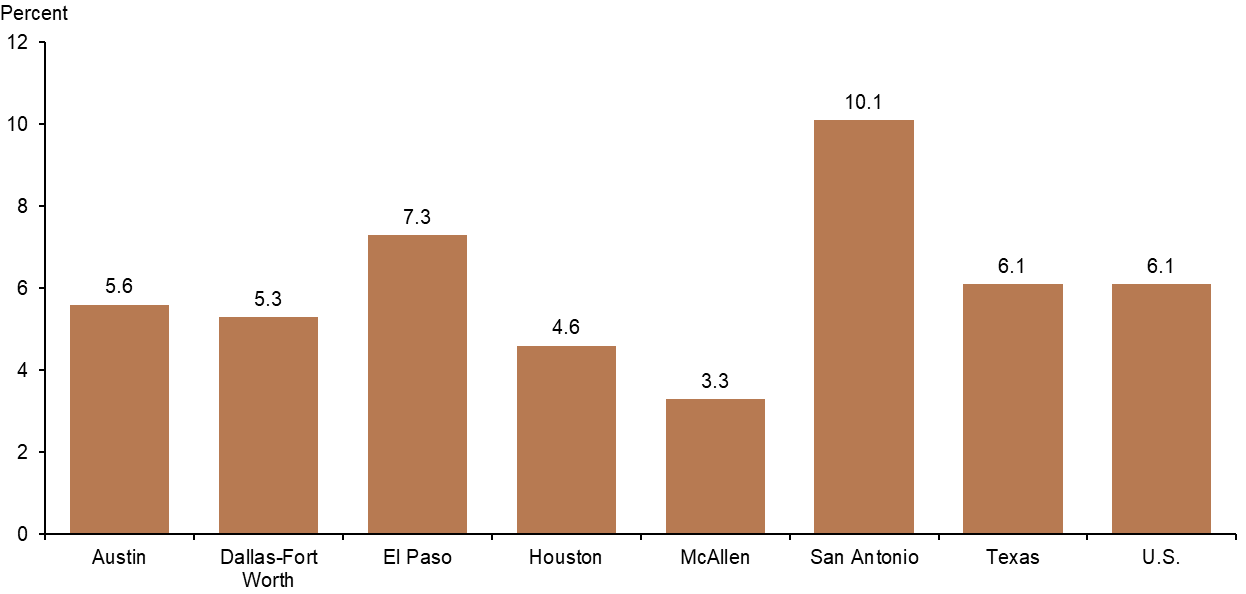

San Antonio’s median age is 36.2, in line with the Texas median of 35.9. Nevertheless, the area has a relatively large older population compared with other major Texas metros; the share of seniors is 14.3 percent. The area’s age distribution reflects the significant military presence and a tendency for many armed forces personnel to retire in the area after completing their service. As a result, one in 10 San Antonio adults is a veteran, the highest share of all the metros in this report (Chart 9.3). This compares with 6.1 percent in Texas and in the U.S.

NOTE: Shown are shares of veteran populations in Texas major metros, Texas and the U.S.

SOURCE: Census Bureau, 2023 American Community Survey one-year estimates.

Employment: Postpandemic recovery solid

The San Antonio economy proved resilient during and after the pandemic. Employment fell 12.6 percent from February to April 2020. Labor market recovery from the pandemic was largely in line with other major Texas metros, with employment in December 2024 9.0 percent above February 2020 levels. Employment expansion was broad based, with above-average growth notable across a diverse cross-section of sectors such as manufacturing, e-commerce, aerospace, energy and business services. The San Antonio unemployment rate was low at 3.8 percent in December 2024, below the state (4.2 percent) and U.S. (4.1 percent).

Outlook: Industry diversity lifts economy

San Antonio’s industry profile is as distinctive as its history, with a concentration in health care, retail, education, insurance, financial services, food services, and hospitality and tourism. In the near term, those industries’ performance will set the course for the area’s economy.

San Antonio’s real GDP expanded 4.6 percent in 2023. Among private industries, real estate, rental and leasing rose 13.1 percent.[10]

San Antonio’s dependence on government and military jobs—government accounted for 15 percent of the area’s 2023 real output—would normally provide some stability. Government employment levels increased 11 percent from 2016 to 2023. However, recent federal government layoffs and budget constraints may limit growth going forward.

The metro’s proximity to several state-of-the art military medical facilities, as well as large private research and health institutes, should continue to propel health sector growth and enable San Antonio to meet the needs of South Texas.

Additionally, in 2023, the University of Texas at San Antonio (UTSA) introduced a new doctoral program in developmental and regenerative sciences, comprising more than 30 different labs in academic, clinical, military and biotechnical settings.[11]

Likewise, a $90 million investment in UTSA’s School of Data Science and National Security Collaboration Center aims to expand the city’s tech presence combining data science, engineering and cybersecurity.[12] The University of Texas Health Sciences Center at San Antonio’s Center for Brain Health, offering comprehensive dementia care, is to open a 103,000-square foot facility in December 2025.[13]

| San Antonio–New Braunfels growth outlook | |

| Drivers | Challenges |

|

|

Notes

- The history of San Antonio is adapted from the Texas State Historical Association’s Handbook of Texas and from the Brooke Army Medical Center website.

- The percentage shares of individual clusters are normalized to add up to 100 and differ from individual industry share totals. Some industries are included in multiple clusters, while some others are omitted because they fall outside revised cluster definitions. (See the appendix for more information.)

- Data are from the San Antonio Hotel and Lodging Association.

- Data were obtained from the Texas Comptroller of Public Accounts (accessed Oct. 16, 2025).

- See “Relying on a Federal Paycheck During the Shutdown,” The Washington Post, March 7, 2013 (updated Oct. 1, 2013).

- Information about Toyota and its suppliers is from the Toyota Newsroom website (accessed Oct. 16, 2025).

- See “Equipment maker JCB breaks ground on its Southside manufacturing plant,” San Antonio Report, June 4, 2024.

- Information about Boeing’s modification contract is from the San Antonio Business Journal, “$313 million contract boost means more work at Boeing SA facility,” April 27, 2023.

- Texas’ major metros are Austin, Dallas, Fort Worth, Houston and San Antonio.

- Output data are from the Bureau of Economic Analysis, October 2025, BEA Interactive Data Application.

- See “UTSA’s new doctoral program to give graduates a competitive edge in the emerging regenerative medicine sector,” UT San Antonio Today, Dec. 14, 2022.

- See “UTSA holds virtual groundbreaking for School of Data Science and National Security Collaboration Center,” UT San Antonio, Jan. 25, 2021.

- Information from the UT Health San Antonio Center for Brain Health website (accessed Oct. 16, 2025).