Dallas–Plano–Irving: Texas’ business and financial services hub

At a glance

Population (2023): |

5.5 million |

Population growth (2016–23): |

13.9 percent (Texas: 9.5 percent) |

Median household income (2023): |

$89,301 (Texas: $76,292) |

National MSA rank (2023): |

No. 4* (Dallas–Fort Worth) |

| *The Dallas–Plano–Irving metropolitan division is part of the Dallas–Fort Worth metropolitan statistical area (MSA) and encompasses Collin, Dallas, Denton, Ellis, Hunt, Kaufman and Rockwall counties. The population of the Dallas–Fort Worth MSA was 8.1 million in 2023. | |

- Dallas’ prominence arose from its importance as a center for the oil and cotton industries and its location along numerous railroad lines.

- Today, Dallas serves as the business and financial services center for the state and has evolved into a major high-tech, aerospace and defense, and transportation hub.

- Dallas is the state’s top migrant destination, attracting residents from other states and abroad.

- The metro’s finance, insurance, transportation and e-commerce clusters are expected to continue expanding following an earlier national consolidation that increased their local concentration.

History: Business center rises from rail crossroads

Dallas quickly became a service center for the surrounding countryside after its founding in 1841. By the 1870s, Dallas had attracted two major rail lines, making it one of the first rail crossroads in Texas and establishing the city as a strategic location for the transport of regional products to manufacturers to the north and east.[1]

Dallas became the world’s leading inland cotton market at the beginning of the 20th century. It also rapidly evolved into a center of petroleum financing; Dallas bankers were among the first in the nation to lend money to oil companies using oil reserves as collateral.

The growth of companies such as home-grown Texas Instruments Inc. helped make Dallas the nation’s third-largest technology center during the 1950s and 1960s. The opening of Dallas–Fort Worth International Airport in 1974 provided a major selling point and broad transportation access, bringing corporate headquarters to Dallas and further increasing the area’s prominence as the state’s business and financial center.

Industry clusters: Business, finance and high tech loom large

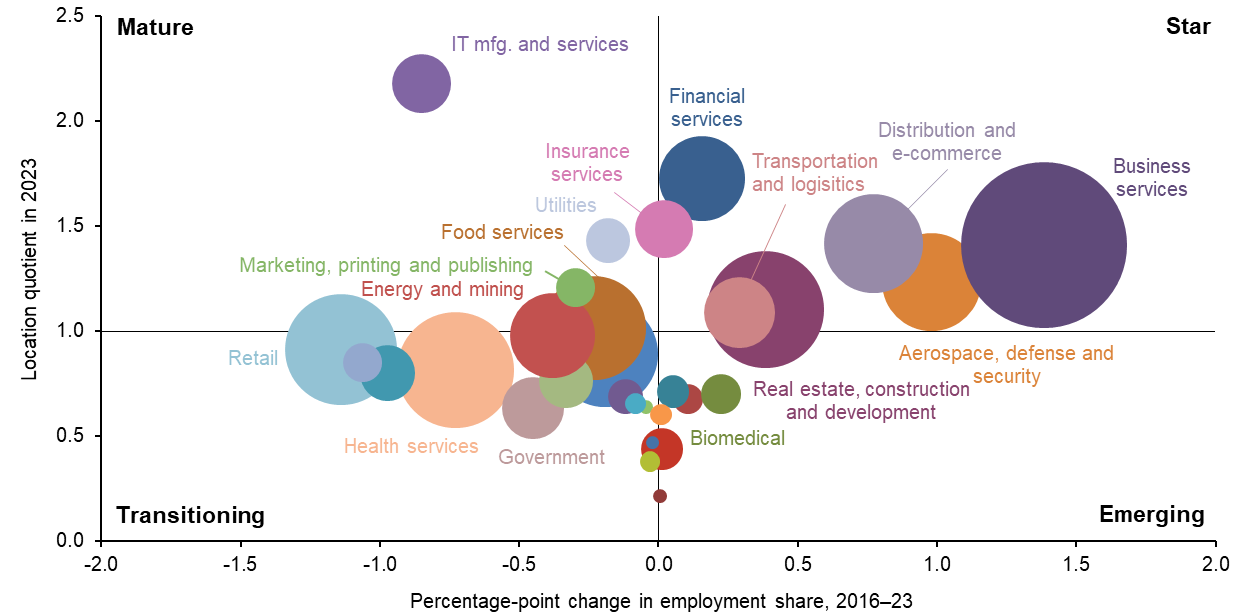

Industry cluster concentration is measured by location quotient (LQ), which compares a cluster’s local employment share to its share nationally (Chart 3.1). Growth within an industry cluster is measured by the percentage-point change in its share of local employment from 2016 through 2023.[2]

NOTE: Bubble size represents cluster share of metropolitan statistical area employment.

SOURCES: Texas Workforce Commission; Bureau of Labor Statistics.

Clusters in the top half of Chart 3.1, such as business services, financial services and IT manufacturing and services, have a larger share of employment relative to the nation and, thus, an LQ greater than 1. These clusters are generally vital to the area’s economy and can be expanding relatively rapidly (“star”) or slowly (“mature”).

Those in the bottom half, such as health services, retail, and government, are less dominant locally than nationally and, hence, have an LQ below 1. “Emerging” clusters are fast growing, while those expanding slowly or declining are “transitioning.”

Not surprisingly, Dallas’ most important star clusters are business services; financial services; insurance; real estate; aerospace, defense and security; IT manufacturing and services; and distribution and e-commerce.

Business services is the largest cluster, employing 17.3 percent of the workforce in 2023. The cluster’s employment share was the fastest growing from 2016 through 2023, its share increasing 1.4 percentage points. Major employers include a mix of telecom, IT, law, accounting, staffing and consulting firms.[3]

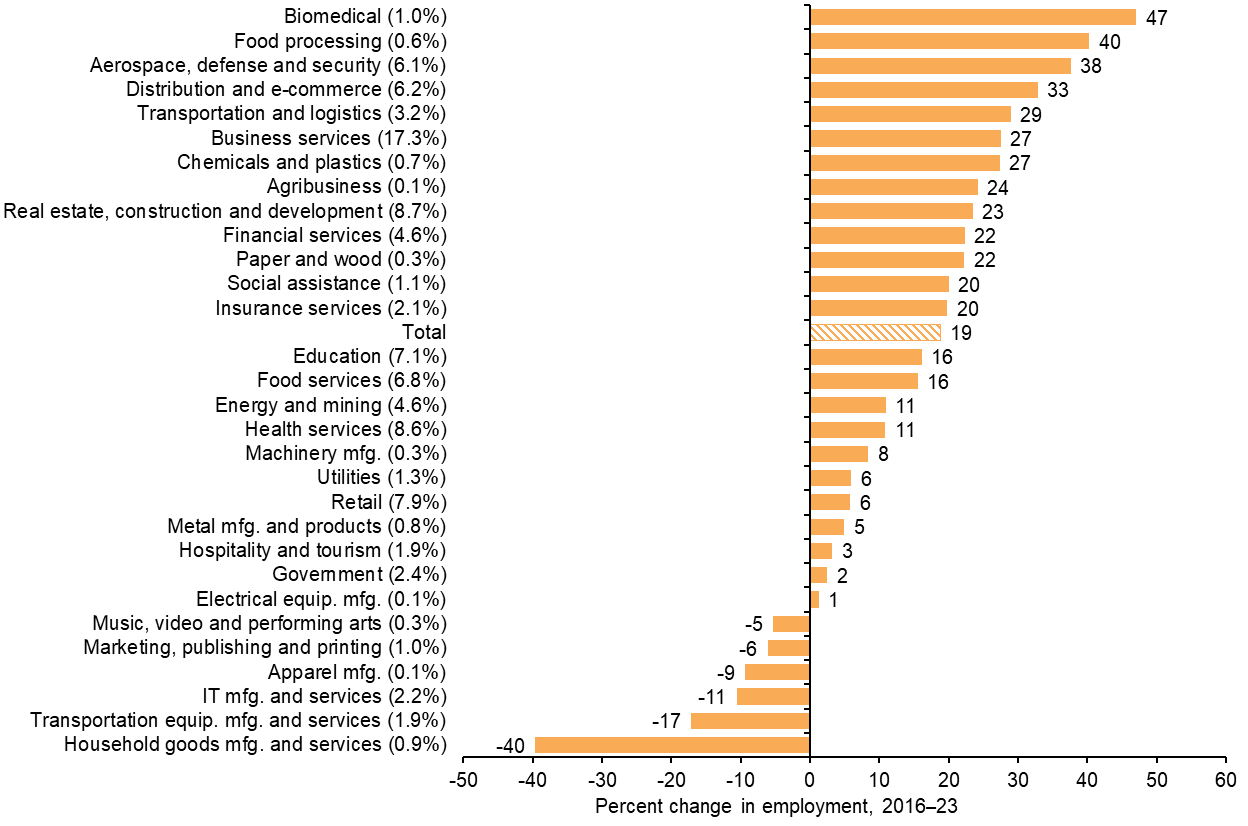

Some of Dallas’ largest employers are banking companies, such as JPMorgan Chase and Bank of America. Dallas’ financial services cluster grew 22 percent from 2016 through 2023 (Chart 3.2). The New York Stock Exchange and NASDAQ operate regional offices as of 2025, and the Texas Stock Exchange is expected to begin full operations in early 2026.[4] The explosive growth of the financial sector in Dallas has earned it the moniker “Y’all Street.”

NOTES: Percent change in employment is shown in whole numbers. Each cluster’s normalized share of total jobs is shown in parentheses (rounded to one decimal place). Clusters with employment shares less than 0.1 percent are not displayed.

SOURCES: Texas Workforce Commission; authors’ calculations.

Goldman Sachs is building an 800,000-square-foot, $709 million campus in Dallas, which when completed in 2028 will house 5,000 employees.[5] Charles Schwab relocated in 2021 from California to a 500,000-square-foot campus in Westlake in Denton County, with 7,000 workers at year-end 2024 and plans for 10,000 total in the area.[6] Nearby, also in Westlake, Fidelity Investments has 5,000 workers at its 300-acre campus.[7]

Wells Fargo opened its two-tower, 850,000-square-foot facility in Irving in October 2025. The 22-acre campus will become the operating base for 4,500 employees.[8] It joins other companies with expanded local presence, including Capital One, whose Plano campus covers 1.5 million square feet.

Liberty Mutual Insurance and State Farm Insurance have consolidated operations into the Dallas area, bringing thousands of jobs and making insurance one of the metro’s fastest-growing industries. These relocations contributed to above-average growth in the insurance services cluster.

Similarly, distribution and e-commerce’s share grew 0.8 percentage points from 2016 through 2023, fueled by pandemic-motivated e-commerce activity. Dallas’ central location, with ample air, rail and highway connections, has supported its emergence as a fulfillment and distribution hub, with Amazon, Walmart, Target and Home Depot opening or expanding distribution centers.

The Dallas area remains a major technology center, with Texas Instruments (TI) and AT&T at the forefront. TI is constructing four 300-milimeter semiconductor wafer fabrication plants in Sherman, a community at the leading edge of growth north of Collin County, along the Red River. The first facility is expected to begin production near the start of 2026. The site represents a $40 billion investment across all four facilities, making it one of the largest semiconductor manufacturing projects in the U.S.[9]

Dallas’ aerospace, defense and security sector is strengthened by the presence of major defense contractors, including Lockheed Martin and Bell Helicopter in the neighboring Fort Worth-Arlington metro division and Raytheon. Raytheon, an aerospace and defense unit of RTX Corp., has North Texas operations in Greenville, McKinney, Richardson and Fort Worth. The cluster accounts for 6.1 percent of total employment and grew 38 percent from 2016 through 2023.

Fort Worth–Arlington serves as a logistics and distribution hub, with activity spilling into Dallas, where the transportation and logistics cluster grew 29 percent from 2016 through 2023.

Together with the major intermodal facilities in Fort Worth–Arlington, the Southern Dallas County Inland Port forms a key logistics and distribution hub linking global supply chains to the North Texas area. The inland port’s proximity to Interstates 45, 20 and 35E and rail connections has drawn a variety of firms that include Amazon, Ace Hardware and Whirlpool.

The inland port spans 7,500 acres across five cities in southern Dallas County, supporting more than 30,000 jobs in warehousing, manufacturing and distribution.[10]

It is adjacent to additional such facilities to the south, in Ellis County. Dallas’ transportation and logistics cluster expanded notably from 2016 through 2023, reinforcing the area’s role as a critical gateway for movement of goods.

Dallas remains a powerhouse in healthcare, with Baylor Scott and White, Parkland Hospital, Texas Health Resources and UT Southwestern Medical Center, each employing more than 10,000 people.[11]

Hand in hand with the region’s expertise in health care is its investment in biotechnology, most notably Pegasus Park, a 23-acre biotech and life sciences development. Pegasus Park was selected in 2023 as a home of the Advanced Research Projects Agency for Health Customer Experience Hub focusing on developing accessible health solutions. The facility, a public-private partnership, is one of three such regional innovation hubs nationwide.[12]

Dallas’ boom in migration and firm relocations is reflected in the growth of construction and development. Employment in the real estate, construction and development cluster rose 23 percent from 2016 through 2023. Beyond the obvious investment in housing and offices, Dallas has also experienced robust growth in industrial and data center construction since 2020.[13] The Dallas and Fort Worth metro divisions together are home to 21 Fortune 500 companies on the 2025 list.[14]

Dallas’ star and mature clusters are relatively high-paying and boast annual average earnings of $96,700, 23 percent higher than the annual average earnings in Dallas ($78,800) and 38 percent greater than the nation ($70,000) (Table 3.1).

| Cluster | Dallas–Plano–Irving | U.S. | |||||

| 2016 | 2019 | 2021 | 2023 | 2023 | |||

| IT manufacturing and services | 150,522 | 157,055 | 152,159 | 145,701 | 131,681 | ||

| Financial services | 113,153 | 121,320 | 125,782 | 125,371 | 120,489 | ||

| Insurance services | 100,593 | 101,015 | 100,610 | 98,066 | 101,445 | ||

| Utilities | 122,499 | 126,069 | 122,542 | 128,453 | 106,251 | ||

| Distribution and e-commerce | 98,337 | 94,413 | 93,119 | 91,727 | 83,656 | ||

| Business services | 93,440 | 96,798 | 97,969 | 99,907 | 91,443 | ||

| Aerospace, defense and security | 104,453 | 108,053 | 107,733 | 107,968 | 108,638 | ||

| Marketing, publishing and printing | 88,617 | 85,909 | 90,580 | 86,010 | 87,049 | ||

| Real estate, construction and development | 82,312 | 85,083 | 85,708 | 86,409 | 75,369 | ||

| Transportation and logistics | 64,979 | 65,303 | 66,635 | 66,877 | 65,167 | ||

| Food services | 24,316 | 25,094 | 26,583 | 27,001 | 25,821 | ||

| Clusters with location quotient > 1 | 96,383 | 98,020 | 97,884 | 96,681 | – | ||

| Clusters with location quotient <= 1 | 68,511 | 69,493 | 70,815 | 69,142 | – | ||

| Average wages | 76,330 | 77,592 | 79,737 | 78,772 | 70,033 | ||

| NOTES: Clusters are listed in order of location quotient (LQ); clusters shown are those with LQs greater than 1 in 2023. Earnings are in 2023 dollars. SOURCES: Texas Workforce Commission; Bureau of Labor Statistics; authors’ calculations. |

|||||||

Demographics: A destination for new arrivals

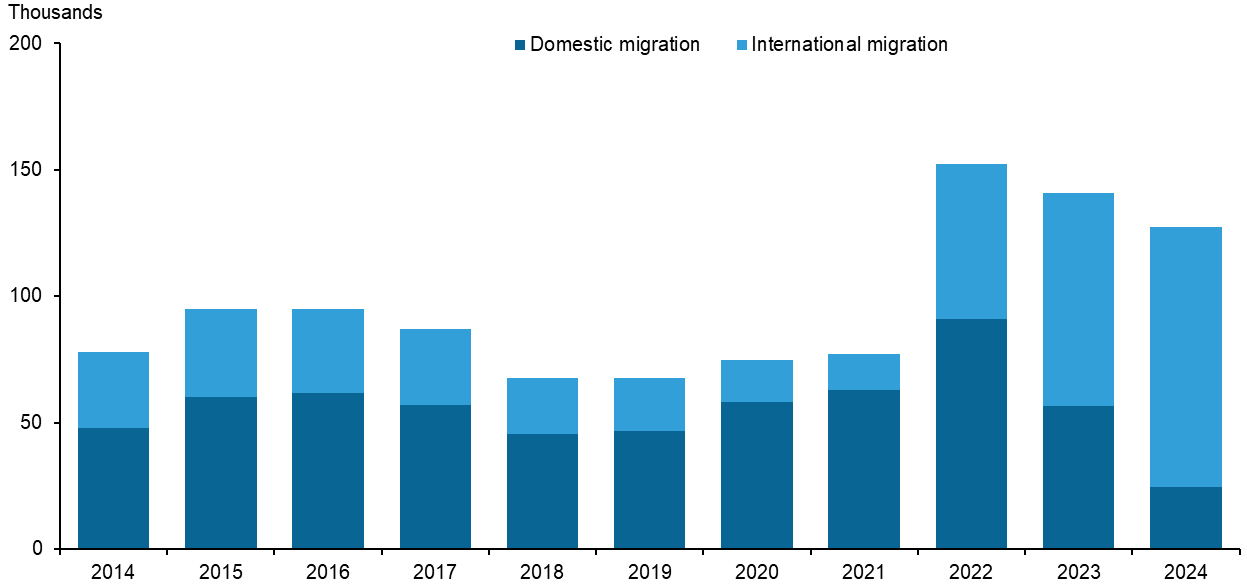

The Dallas–Fort Worth metropolitan area is a top destination for both domestic and international migrants. New arrivals from other parts of the U.S. accounted for more than 60 percent of DFW’s population increase since 2016 (Chart 3.3). Among U.S. metro areas, DFW experienced the highest population gains through total net migration from 2000 through 2024.[15]

NOTE: Shown are net domestic and net international migration into Dallas–Fort Worth metro area annually.

SOURCE: Census Bureau.

Amid record migration, Dallas’ unemployment rate has remained lower than the state’s, ending 2024 at 3.9 percent. Per capita income and median household income are higher than national and Texas figures.

Dallas’ population is 39 percent non-Hispanic white. Hispanics make up just under one-third of the area’s inhabitants. Foreign-born residents constitute 22.1 percent of the metro population, higher than their shares in Austin, Fort Worth and San Antonio.

Dallas ranks second in educational attainment among the Texas metros in this report, with 42.6 percent of its adult residents holding a bachelor’s degree or higher. This is likely because the business and financial services, health care, education, information technology, and defense and security sectors employ a large share of the workforce and typically require a college degree.

Employment: Strong post-pandemic recovery

Dallas’ job growth has been robust over the past decade, notably during the recovery from the pandemic. Employment declined 11.1 percent from February to April 2020, matching the state’s drop. The metro bounced back quickly, regaining all lost jobs by July 2021. In December 2024, total nonfarm employment was 12.7 percent higher than in February 2020 (before the onset of the pandemic).

Dallas’ rapid postpandemic expansion has benefited from the metro’s outsized concentration of professional and business services, IT and financial services jobs. In December 2024, employment in the professional and business services and financial activities sectors exceeded prepandemic highs by 19 percent. Employment growth has been tepid, under 0.5 percent, in 2025.

Outlook: Slower growth but competitive advantages remain

Dallas’ central location and expansive network of highway, rail and air transportation position the region to continue expanding its distribution and e-commerce and transportation and logistics sectors. These together make up 9.4 percent of regional employment and are classified as star clusters. Accessibility is a major selling point for the area.

The region will see continued growth in business services and financial firms. Dallas has reached a critical mass of companies in these sectors, which attracts additional businesses that draw on the existing talent pool and support services. The area’s well-educated workforce further strengthens these industries, helping sustain long-term expansion.

However, rapid population growth has resulted in greater competition for housing, leading to affordability challenges. High rents and home prices have displaced some lower-income individuals, who along with new arrivals are settling further out from the urban core and face ever-longer commutes.

Dallas also continues to attract a diverse set of firms from across the country, from states as large as California and New York and as far away as New Hampshire and Washington state. While other Texas metros are gaining firms as well, Dallas stands out for the number and breadth of industries represented.

| Dallas–Plano–Irving growth outlook | |

| Drivers | Challenges |

|

|

Notes

- The history of Dallas is adapted from the Texas State Historical Association’s Handbook of Texas.

- The percentage shares of individual clusters are normalized to add up to 100 and differ from individual industry share totals. Some industries are included in multiple clusters, while some others are omitted because they fall outside revised cluster definitions. (See the appendix for more information.)

- Data about major employers is from the Dallas Regional Chamber, 2025.

- Information about the Texas Stock Exchange was accessed Nov. 12, 2025.

- “Goldman Sachs campus reaches construction milestone,” Dallas Business Journal, Nov. 5, 2025.

- “Charles Schwab execs see North Texas as central to financial giant’s growth,” Dallas Business Journal, May 23, 2024.

- “Economic Development, the town of Westlake,” accessed Nov. 12, 2025.

- “Wells Fargo Opens $570M Campus in Las Colinas for 4,500 Employees,” Oct. 22, 2025.

- Data about the TI wafer fabrication plants was accessed Nov. 12, 2015.

- Information about the Dallas County Inland Port was accessed Nov. 18, 2025, inlandport.org and southerndallascounty.com/inlandport/.

- See note 3.

- “Pegasus Park: Dallas’ Innovation Hub,” City of Dallas, Economic Development, September 2023.

- “Dallas-Fort Worth witnesses a rapidly expanding data center market with strong demand and extremely tight fundamentals,” Avison Young, Sept. 23, 2024.

- “Largest U.S. Corporations,” Fortune, volume 191, no. 3, 2025, pp. F1–F22.

- Data are from the Census Bureau.