At the heart of Texas: Cities’ industry clusters drive growth

Midland–Odessa: riding the oil booms, seeking fewer busts

- Print version

- Additional tables: Midland–Odessa location quotients, employment shares, average annual earnings, demographics

At a glance

Population (2017): |

327,762 |

Population growth (2010–17): |

17.5 percent (Texas: 12.1 percent) |

Median household income (2017): |

$64,210 (Texas: $59,206) |

National MSA rank (2017): |

Midland, No. 243*; Odessa, No. 262* |

| *The Midland–Odessa combined statistical area is composed of the Midland and Odessa metropolitan statistical areas (MSAs). The MSAs encompass Ector, Martin and Midland counties. | |

- Midland and Odessa began as railroad towns and together evolved into a cattle shipping center and regional financial hub. The Permian Basin oil boom in the mid-1920s shifted the economic focus to energy.

- The shale boom of the last decade boosted household income and spurred economic growth. The dominant energy industry has been supported by manufacturing and transportation. Per capita personal income in Midland is the highest in the state.

- The Permian Basin has bounced back after energy activity and household income decreased sharply with the onset of the oil bust in 2015. The subsequent reemergence of oil production, during what became a period of technological advances, has required fewer blue-collar workers.

History: heart of the Permian Basin

Midland and Odessa are sibling cities about 20 miles apart and jointly promoted as “Two Cities, No Limits.”[1] Like many other Texas communities, Midland and Odessa began as stations along a railroad—halfway points between Dallas and El Paso along the Texas and Pacific Railway. Early on, the area relied primarily on ranching. Midland became a prominent cattle shipping center for Texas as well as a regional financial hub by 1890.

The beginnings of the oil boom in the Permian Basin—which encompasses two counties in New Mexico and 55 counties in West Texas—arrived in the 1920s. Scores of investors and oilfield workers moved to the area, and by 1929, a total of 36 oil companies had established offices in Midland. Demand for oil and petrochemicals rose during World War II, helping transform Odessa into the world’s largest inland petrochemical complex.

From that point forward, the area’s economy was closely tied to the energy industry, rising with the oil booms and contracting with the busts. After years of decline that began with the 1980s oil bust, the Permian Basin and its economic center, Midland–Odessa, were regenerated by the shale oil boom of the late 2000s. Investment grew in the prolific formation even during periods of soft oil and gas prices, as its infrastructure, industry know-how and technological advancement helped make retrieving energy deposits relatively inexpensive.

Industry clusters: energy-driven economy

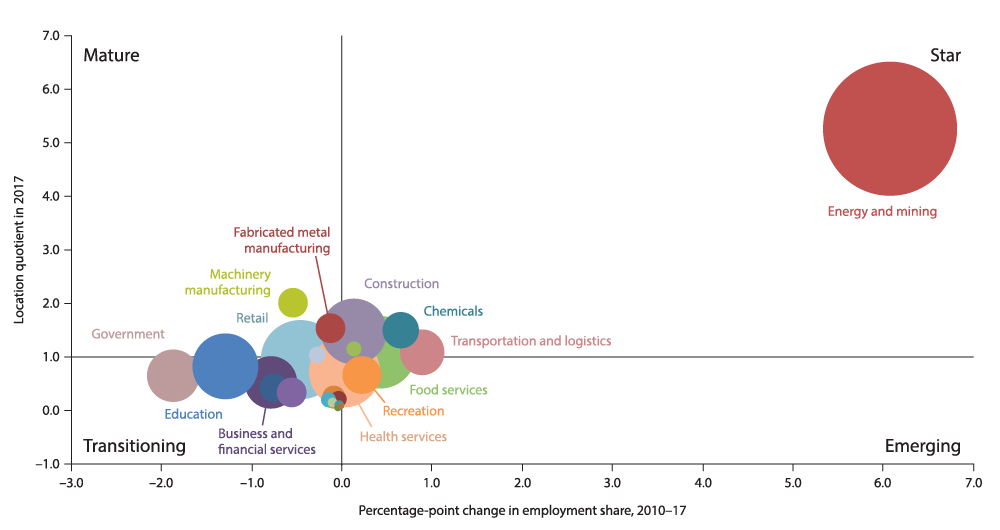

The composition of industry clusters in Midland–Odessa is shown in Chart 8.1. The chart is organized by location quotient (LQ)—a measure of a cluster’s share of local employment relative to its share nationally—and the change in employment share between 2010 and 2017.[2]

NOTE: Bubble size represents cluster share of metropolitan statistical area employment.

SOURCES: Texas Workforce Commission; Bureau of Labor Statistics.

Clusters in the “star” quadrant, such as energy and mining, have a large share of employment relative to the nation (an LQ far exceeding 1, in this case) and are relatively fast growing. “Emerging” industries, such as recreation, are relatively smaller compared with the nation (an LQ less than 1) but are fast growing. “Mature” sectors, such as machinery manufacturing, are more concentrated relative to the U.S. (an LQ exceeding 1) but are slower growing; “transitioning” clusters, such as business and government, are smaller relative to the nation and are slower growing or declining.

Midland–Odessa lies in the heart of the Permian Basin—which accounts for 30 percent of U.S. oil production, up from 16.9 percent in 2010—and its economy is overwhelmingly energy driven. About 30 percent of the workforce is employed by companies in energy and mining, a cluster that has experienced rapid growth. Energy firms dominate the listing of the top private-sector employers in both cities.

Pioneer Natural Resources, with 3,600 employees in Midland, has been the city’s largest employer since 2016, surpassing the Midland Independent School District. Pioneer and the city’s two next-largest exploration and production companies employ more than 5,800 people, accounting for about 7 percent of the city’s total employment in 2017.

Odessa’s second- and third-largest private employers are Halliburton and Keane Group, which together employed about 4,300 workers, or over 5 percent of the total employed.[3]

The region’s other important industries support the outsized energy sector and have recently grown as well. Odessa’s largest private employer, Saulsbury Industries (a heavy industrial construction firm with nearly 4,000 employees nationwide and large midstream oil and gas operations), helped build the growing infrastructure in the Permian Basin. Oil and gas pipeline construction companies employed 2,800 people in Midland–Odessa in 2017, up from just 1,600 in 2014.[4]

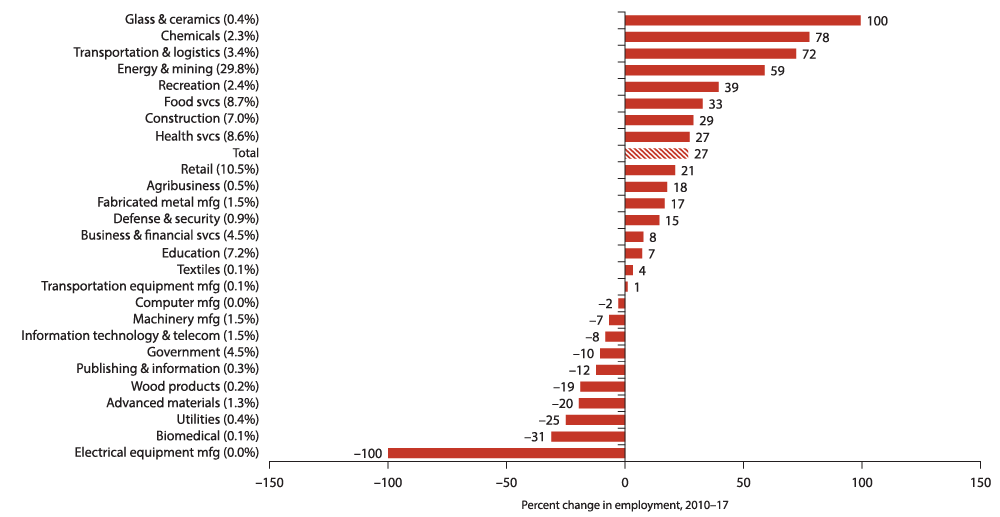

The transportation and logistics cluster employs only 3.4 percent of the workforce but is the third-fastest-growing cluster in Midland–Odessa (Chart 8.2). Manufacturing—notably, fabricated metal manufacturing and machinery manufacturing—while mature and relatively stable, helps support the energy industry.

NOTES: Percent change in employment is shown in whole numbers. Each cluster’s share of total jobs is shown in parentheses (rounded to one decimal place).

SOURCES: Texas Workforce Commission; authors’ calculations.

Job growth has been focused in truck transportation supporting expanding oil and gas production. Chemicals, long associated with the area’s energy sector, also grew rapidly in the 2010–17 period. Additionally, the region remains an important midway point between El Paso and Dallas, serving as a transportation crossroad.

Wages in Midland–Odessa are relatively high for a small metropolitan area, but they boom and bust along with the energy industry. Inflation-adjusted annual average wages grew by about 22 percent between 2010 and 2014—more than quadruple the statewide rate of 4.4 percent (Table 8.1). Midland–Odessa’s increase was driven by energy and mining’s higher wages and growing share of employment. The energy slump depressed overall wages between 2014 and 2016 by 9 percent, led by an 18.8 percent decline among transportation and logistics workers’ pay.

| Cluster | Midland–Odessa | U.S. | |||||

| 2010 | 2012 | 2014 | 2016 | 2017 | 2017 | ||

| Energy and mining | 87,747 | 90,293 | 96,750 | 91,316 | 98,001 | 80,900 | |

| Machinery manufacturing | 70,645 | 73,032 | 82,595 | 77,851 | 78,239 | 70,059 | |

| Fabricated metal manufacturing | 64,216 | 69,453 | 78,192 | 68,784 | 73,787 | 55,830 | |

| Chemicals | 73,394 | 82,854 | 79,460 | 79,094 | 83,471 | 72,887 | |

| Construction | 55,772 | 64,178 | 68,203 | 65,926 | 68,388 | 60,742 | |

| Glass and ceramics | 56,168 | 54,738 | 60,246 | 66,710 | 69,608 | 55,398 | |

| Food services | 17,289 | 18,471 | 19,554 | 19,279 | 19,642 | 18,963 | |

| Transportation and logistics | 60,442 | 66,268 | 70,466 | 57,252 | 65,204 | 53,761 | |

| Utilities | 109,430 | 120,053 | 93,523 | 102,454 | 104,871 | 107,188 | |

| Clusters with location quotient > 1 | 67,991 | 73,436 | 78,616 | 65,139 | 77,844 | ||

| Clusters with location quotient < 1 | 46,200 | 48,484 | 52,406 | 54,252 | 49,458 | ||

| Average earnings (total) | 54,050 | 60,407 | 65,781 | 59,863 | 63,664 | 55,375 | |

| NOTES: Clusters are listed in order of location quotient (LQ); clusters shown are those with LQs greater than 1. Earnings are in 2017 dollars. SOURCES: Texas Workforce Commission; Bureau of Labor Statistics; authors’ calculations. |

|||||||

Demographics: high incomes, low poverty

Real median household income, though quite high in Midland–Odessa, fell 12.6 percent from 2014 to 2016 because of the oil bust (Chart 8.3). Midland–Odessa’s income at $64,210 in 2017 remained above the Texas median of $59,206 as the energy sector rebounded.

NOTES: Bars show real median household income growth during the selected periods. Nominal median 2016 incomes are displayed above bars.

SOURCE: Census Bureau, 2010, 2014 and 2016 American Community Survey 1-year estimates.

The area’s 10.4 percent poverty rate is the lowest among all the metros in this report and 5 percentage points less than the state average in 2016.

Midland–Odessa continues to trail the state in educational attainment. About 80 percent of residents age 25 or older have at least a high school diploma—3 percentage points below the state average in 2016. Midland–Odessa also has the third-lowest share of population with a bachelor’s degree or higher (21 percent) among the Texas metros in this report, ahead of only McAllen and Beaumont–Port Arthur, and trailing the statewide average of 28.9 percent.

Traditionally, many well-paying oilfield jobs do not require a college education, hence the education gap vis-à-vis the rest of the state. More than half (52 percent) of Midland–Odessa’s population is Hispanic—the migration flow reflecting the area’s importance as the heart of the Permian Basin and the employment opportunities it affords.Employment: a tale of boom and bust

During the 2015–16 energy slump, the Permian Basin rig count tumbled from 548 in December 2014 to a low of 137 in May 2016. Net migration in 2016 was negative—the area lost 4,855 residents—even as migration increased in Texas’ largest metros or remained stable in most others. The outmigration likely helped limit increases in the unemployment rate, which peaked at 5.7 percent in April 2016 from a low of 2.8 percent in December 2014.

Technological improvements to oil exploration and extraction accelerated with firming oil prices since the slump ended. Because the Permian Basin’s shale deposits are stacked—some areas have as many as 12 shale layers—it has a considerable cost advantage over other regions that typically contain a single layer. Thus, the Permian has generated new investment and hiring with a drilling breakeven oil price of around $50. The new technology has limited the overall number of workers needed for oilfield work, with new positions typically requiring a higher skill set.

The latest rebound, which has been less labor intensive than prior rebounds, differs from the upturn following the Great Recession. As shale exploration spread in the late 2000s, the Permian Basin’s rig count increased, and total employment returned to prerecession levels by March 2011, growing 41 percent between December 2009 and December 2014, or almost three times the state rate.[5]

A shortage of pipeline capacity from the area to terminals along the Gulf of Mexico has recently restrained the oil industry expansion. Industry officials have suggested that the bottleneck could ease in late 2019.

Outlook: ‘New’ old industry holds promise

Midland–Odessa’s economy and labor market reflect the Permian Basin’s prominence as a leader in the U.S. and global oil markets. Oil companies operating in the region enjoy a cost advantage that comes from technological advances, a shale-rich geography and established workforce and infrastructure. New technology-enabled production will likely continue growing, though employment gains will likely occur at a slower pace than has historically been the case during upturns.

The Permian Basin’s thriving energy sector is helping drive employment among supporting industries, such as construction, manufacturing, transportation and logistics. As production of oil and natural gas increases, infrastructure is expected to grow to meet demand. Several pipeline projects are planned to accommodate the Permian’s growth.

Midland–Odessa’s economy is still exposed to the commodity boom-and-bust cycle. However, recent attempts to diversify the local economy may help the region better weather inevitable busts.

The Permian Basin has the potential to produce alternative energy resources, such as wind power.[6] Midland–Odessa has also shown signs of moving beyond energy. The University of Texas of the Permian Basin established its College of Engineering in August 2017, and the area received a site license to operate a commercial spaceport in September 2014. Midland–Odessa already has a high concentration of manufacturing jobs, and the spaceport and engineering school may help draw more research and development to the region.

—Kristin Davis and Dylan Szeto

| Midland–Odessa Growth Outlook | |

| Drivers | Challenges |

|

|

Notes

- The histories of Midland and Odessa are adapted from the Texas State Historical Association's Handbook of Texas, tshaonline.org/handbook/online/articles/hdm03 and tshaonline.org/handbook/online/articles/hdo01.

- The percentage shares of individual clusters do not add to 100 because some industries are counted in multiple clusters, and some industries are not counted at all based on cluster definitions. (See the appendix for more information.)

- Detail regarding Midland's and Odessa’s top employers was compiled from several local websites: www.midlandtexas.gov/ArchiveCenter/ViewFile/Item/208, odessatex.com/major-employers and www.midlandtxedc.com.

- Data are from the Texas Workforce Commission’s Quarterly Census of Employment and Wages.

- Data are from the Texas Workforce Commission and have been seasonally adjusted by the Federal Reserve Bank of Dallas.

- The city of Midland partnered with Texas Tech University to invest in the National Institute for Renewable Energy, which will research issues for the wind-power industry.