Texas job growth expected to pick up following flat 2025

Texas economic output grew in 2025 but did so with near-zero job growth. The last time that happened was in 2002–03, when the state emerged from the dot-com bust into an extended jobless recovery. Nationally, labor market conditions in 2025 were similarly lackluster—a situation that has been characterized as low-hire, low-fire.

Factors contributing to the hiring slowdown last year included government policy uncertainty, sharply higher tariffs and drastically lower immigration. Additionally, Texas contended with weak oil prices and high-tech layoffs. Despite a stalled labor market, GDP growth was relatively healthy, and construction activity outside of the housing sector boomed. The Dallas Fed Employment Forecast projects modest job growth in 2026.

Little job growth in 2025

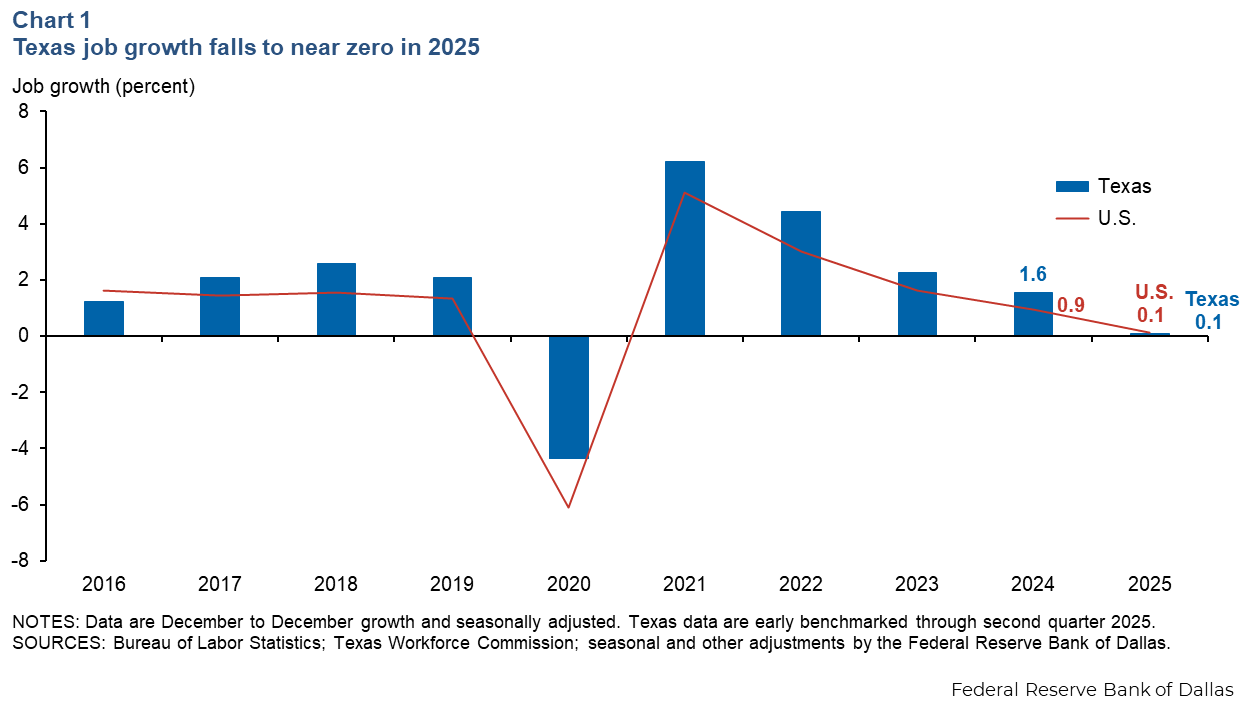

Texas’ job growth evaporated in 2025, with very few jobs added on net—unusual for an economy that typically outpaces the nation’s growth by a wide margin. Nonfarm payrolls grew 0.1 percent in Texas from December 2024 through December 2025, while U.S. employment also rose 0.1 percent (Chart 1).

Notably, the Texas jobs data presented here are benchmarked through second quarter 2025; U.S. jobs data are benchmarked through first quarter 2025.

Still, unemployment remains low in both the state and nation. The unemployment rate in Texas was 4.3 percent in December 2025, little changed from 12 months prior. U.S. unemployment rose during the year on net from 4.1 percent to 4.4 percent in December 2025 but remains at a level that indicates little slack.

Other labor market indicators such as the rate of job separations, mass layoff announcements and unemployment insurance claims are also low and stable in Texas. And hourly wage growth is healthy too, ending the year with a 4.0 percent gain (12-month nominal change).

Stable unemployment in the face of near-zero job growth is consistent with lower labor demand matching lower labor supply, two forces that kept the state’s labor market in balance. Several studies estimate the break-even rate of job growth (the rate of job growth consistent with stable unemployment) fell drastically due to declining immigration. A Federal Reserve Bank of Dallas study estimated the U.S. break-even job growth rate fell from 250,000 jobs per month in 2023 to just 30,000 by mid-2025.

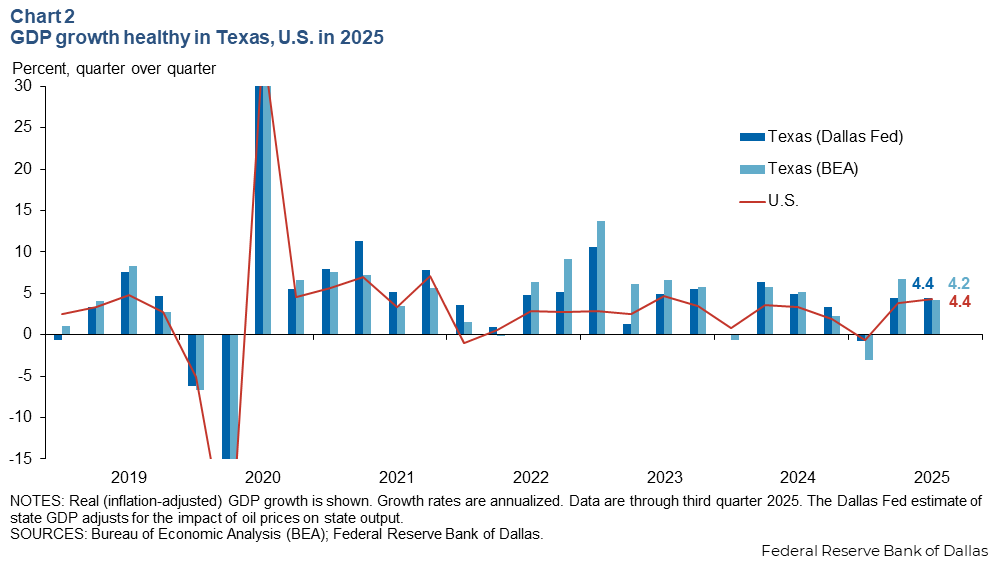

Despite a slowdown in the labor market, real gross domestic product increased at a healthy pace in 2025, indicating productivity gains, a higher rate of output per worker (Chart 2).

Texas real (inflation-adjusted) GDP grew an annualized 2.6 percent from fourth-quarter 2024 to third-quarter 2025, or 2.7 percent adjusting for the impact of low oil prices. U.S. real GDP expanded an annualized 2.5 percent from fourth-quarter 2024 to third-quarter 2025. Growth in 2025 tracked to hold steady with 2024. GDP was supported by continued robust consumption growth and a surge in artificial intelligence (AI) and other tech investment.

Growth confined to a narrow base

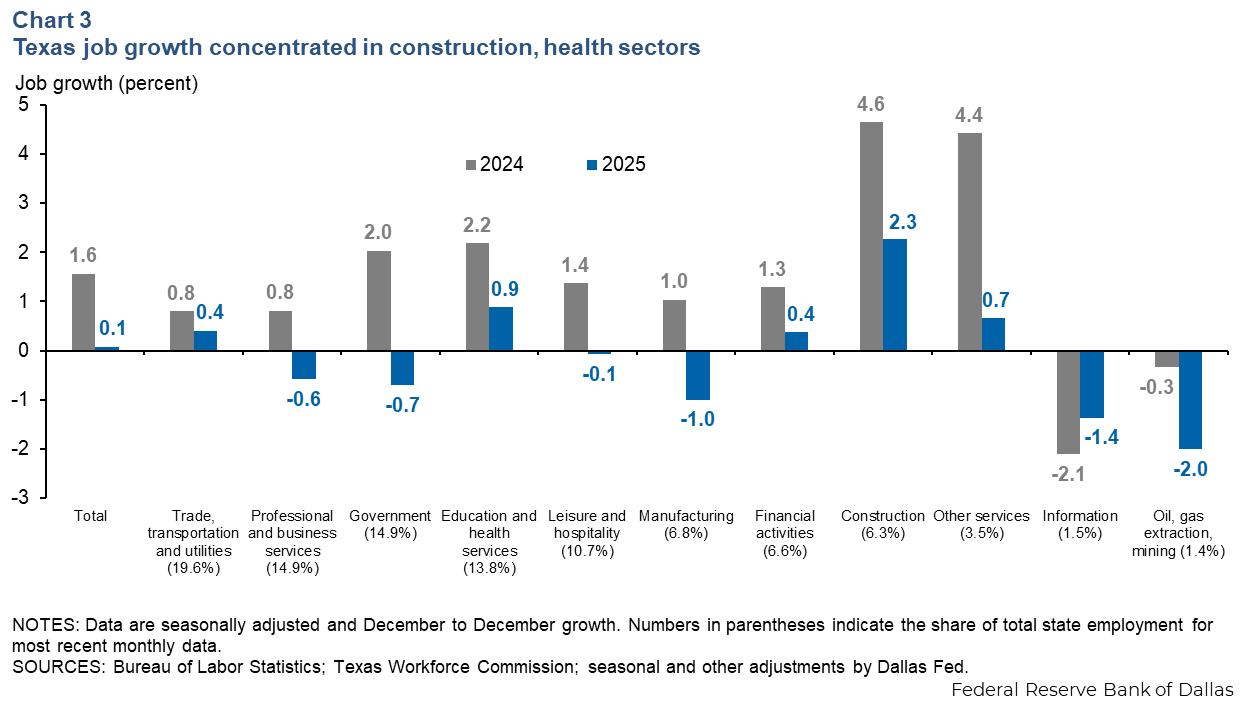

Meaningful job growth in Texas last year was limited to just two sectors, health services and construction (Chart 3).

Construction employment grew 2.3 percent from December 2024 through December 2025, creating 20,000 jobs, the most of any sector. Education and health also added employees, albeit at a below-average pace.

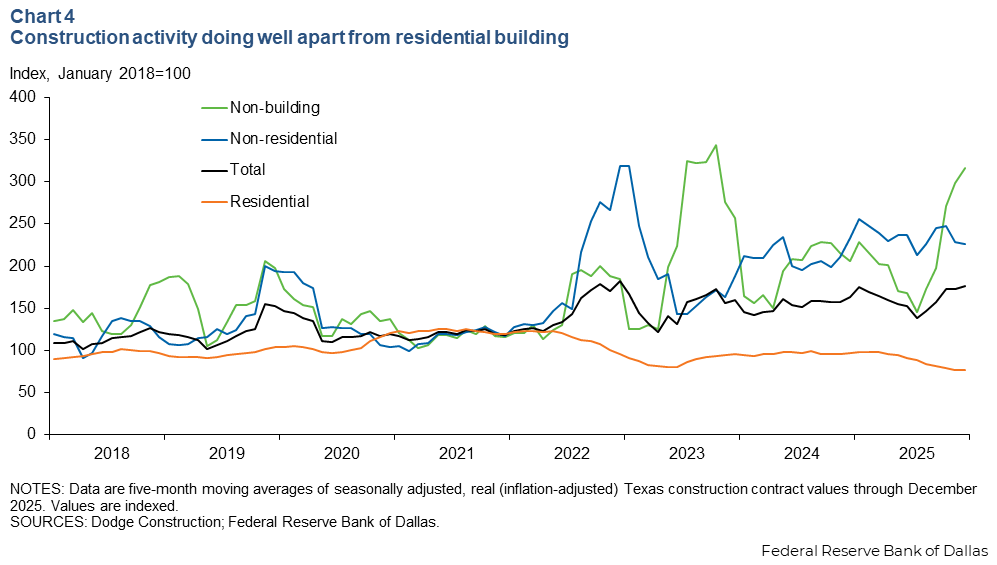

Strong construction employment growth mirrors a flurry of new projects in non-building and non-residential construction (Chart 4). The nonbuilding category includes construction of liquefied natural gas plants, power plants and infrastructure, while non-residential includes manufacturing plants, warehouses, office buildings and data centers. Residential construction projects declined approximately 13 percent last year, as single-family home building permits fell sharply on high interest rates and declining house prices.

In 2025, data center construction contract values totaled $10.7 billion, or 5.7 percent of the value of total state construction projects. Texas consistently ranks second among states for data center building, after Virginia, and has accounted for 15.5 percent of the value of new data center construction in the U.S. since 2022.

Non-building construction also rose sharply last year, increasing 16.8 percent. The rise is related to water infrastructure and power plants, gas and communications projects.

Challenges persist in 2026

Construction and health services are the exceptions to an otherwise broad-based slowdown in job creation in 2025. Weak or even contracting employment across sectors mirrors a national labor market slowdown.

Moreover, Texas’ energy sector did not provide its usual boost to the state economy, as the industry navigated weak oil prices and tariff concerns. The average spot oil price for benchmark West Texas Intermediate crude fell from $76 per barrel in January 2025 to $58 per barrel in December, below industry estimates for the price needed to profitably drill new wells.

Employment in oil and gas extraction and support activities for mining declined 2.0 percent from December 2024 through December 2025. The number of new wells drilled in the state’s major oil and gas fields fell 4.7 percent year over year in December. Despite that, Texas oil and gas production reached new records in 2025, reflecting greater oilfield productivity.

Falling population growth is another constraint. Texas attracts new residents from the rest of the nation and is a major destination for immigrants, helping sustain the state’s job-growth premium over the rest of the nation.

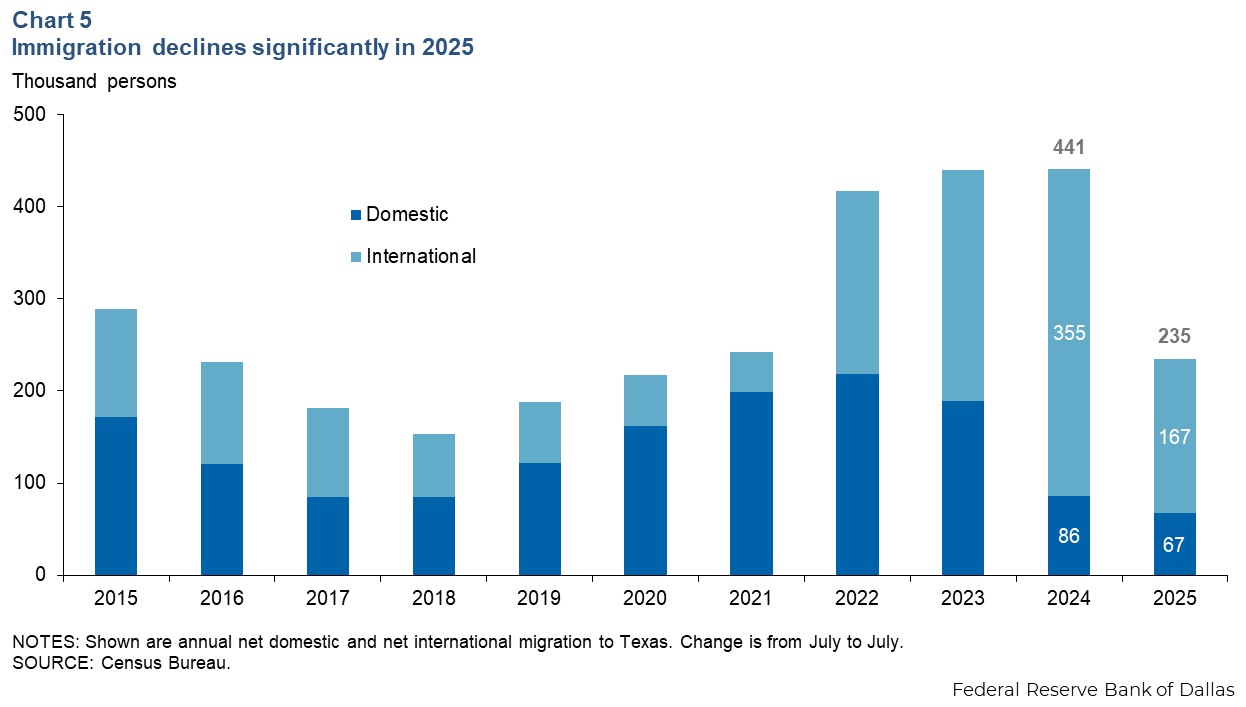

Net international migration to Texas fell to 167,000 in 2025 from nearly 355,000 in 2024 due in part to immigration policies that reduced the inflow of foreigners and increased the outflow (Chart 5).

There was also less migration from other states. Net domestic migration to Texas in 2025 was 67,000, down from 86,000 in 2024. New residents are typically attracted to the state by an abundance of jobs and relatively low cost of living. A slow job market likely eroded the most important pull factor last year.

Migration is important for job growth because these new Texans fill many of the state’s open jobs. More than half of labor force growth in Texas in a typical year is due to migration from another state or country. Migrants to the state also address skill gaps that arise due to a mismatch between the existing workforce and labor demand. For example, Texas relies disproportionately on domestic migrants to fill jobs in STEM fields (science, technology, engineering and mathematics), health care and managerial roles.

Outlook for 2026 is cautiously optimistic

The Dallas Fed Employment Forecast for Texas projects a return to job growth in 2026. Year-over-year employment growth in December 2026 is forecast at 1.1 percent, an improvement from 2025 but still well below the state’s historical average rate of about 2 percent.

Construction is expected to support state growth in 2026, and the state is poised to capture much of the AI-driven data center boom. Last year was also a strong year for water projects and power plant construction. A reversal of this trend is unlikely, as both population and economic growth, including the needs of newly constructed data centers, increase demand for electricity and water across the state.

Federal tax policy changes from the One Big Beautiful Bill Act (signed July 4, 2025) will aid growth this year. Policies such as the reinstatement of 100 percent bonus depreciation, which reduces the costs of investment, may outweigh concerns of firms that have been reluctant to move forward with capital expenditures due to heightened uncertainty.

Deregulation and apparent greater latitude for mergers and acquisitions are also supportive of growth.

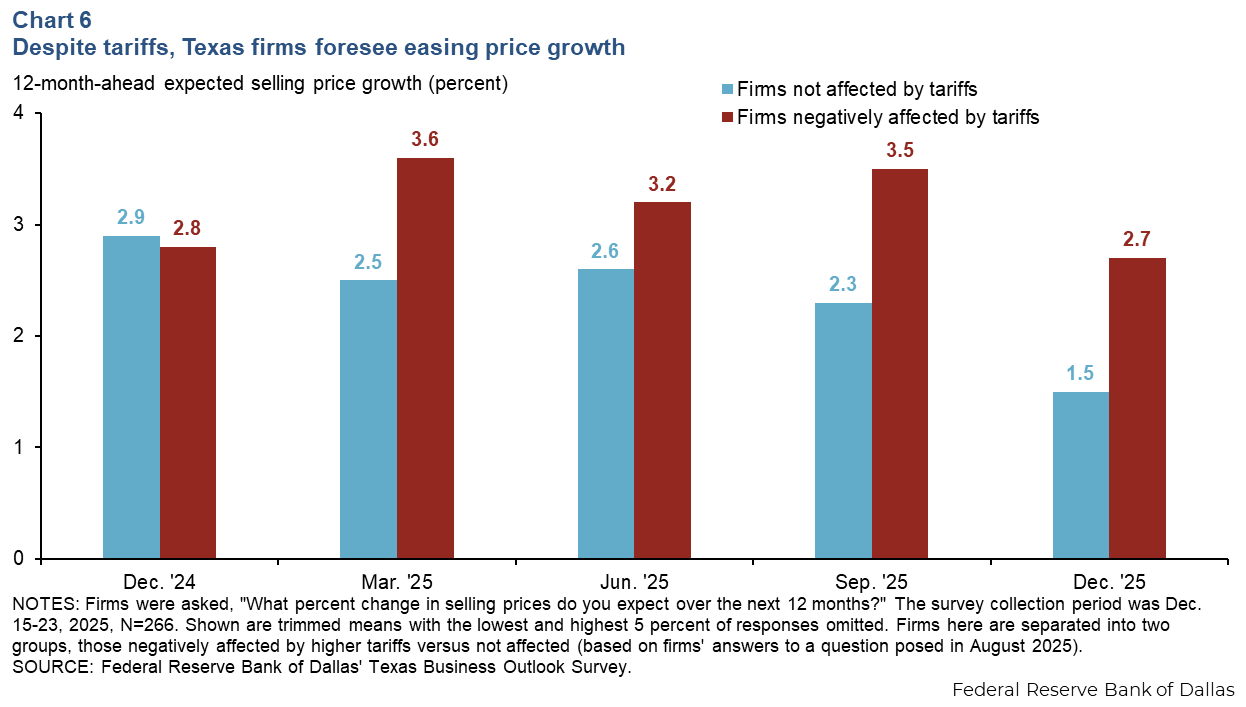

On inflation, Texas businesses anticipate price growth to ease to 2.5 percent in 2026, according to a December 2025 Texas Business Outlook Survey (TBOS) special question. This is well below their expectation of 3.1 percent growth for 2025 when asked in December 2024.

The overall 2026 price growth estimate masks some underlying differences between firms based on tariff impacts. Firms that reported being negatively affected by higher tariffs in an August 2025 TBOS special question anticipate 2.7 percent higher selling prices in 2026, while firms that said they were unaffected by higher tariffs expect price growth of just 1.5 percent (Chart 6). These latest outlooks among both groups represent an easing in price pressures compared with earlier last year, suggesting the expected disinflation is not solely tariff related.

The difference in price expectations for these two groups of firms suggests tariff cost increases have not been fully passed through to consumers. Tariff pass-through has been more protracted than expected due to frictions such as fixed-price contracts and uncertainty. Additionally, many businesses report they cannot raise prices due to weak demand or because they do not want to lose market share to competitors.

Despite a roller coaster of uncertainty and a stalled job market in 2025, a mild uptick in job growth is forecast for Texas in 2026. The job situation should improve slightly. Productivity growth will continue to support greater output, even as the labor market underperforms.

A continuing AI boom and a soaring stock market, along with pro-growth tax and regulatory changes and this summer’s FIFA World Cup games will further boost activity.

Meanwhile, low oil prices and a depressed housing market will drag on the region. Other concerns that bear watching include safety net cuts and federal funding reductions, especially involving health care and education, areas where Texas lags other large states. Meanwhile, review of the United States-Mexico-Canada Agreement, scheduled this summer, casts uncertainty over the future of the North American trade agreement upon which many Texas businesses rely.

About the authors