Trade liberalization reduces entrepreneurship rate

Entrepreneurship is an extremely important driver of economic growth and wealth creation. However, entrepreneurship opportunities may be significantly different in a globally interconnected economy relative to the past.

Our research finds a negative relationship between openness to trade—one measure/indicator of an economy’s global connectivity—and entrepreneurship. That is, the rate of entrepreneurship in an economy decreases as barriers to trade are reduced.

If the world becomes increasingly interconnected through international trade, this relationship suggests that entrepreneurship rates will decrease over time.

Rationalizing the entrepreneurship-trade relationship

It is important to understand why this link between increased trade possibilities—for instance, arising from lower trade costs—and reduced entrepreneurship rates might occur. When viewed through the lens of trade, research about occupational choice and a firm’s choice to export can explain the negative relationship between trade openness and entrepreneurship.

Specifically, individuals in labor markets choose whether to become employees and earn wages or to become entrepreneurs and earn as much profit as they are able to create. Those skilled in entrepreneurship will choose to establish firms to maximize their income, while others will choose employment.

When trade becomes more open, more competing foreign goods flow into the country, reducing the overall price of goods in the home economy. This means domestic real wages, or purchasing power of the employees, will increase.

At the same time, the most productive entrepreneurs expand their operations through exports, increasing the labor demand. This increased labor demand, along with the higher real wages, leads the marginal entrepreneurs (the least productive) to switch from entrepreneurship to regular employment. The overall impact of trade liberalization, therefore, is a reduction in the rate of entrepreneurship.

Real-world data shed additional light

Data regarding the relationship between trade costs and entrepreneurship rates across countries provide further insight. Countries facing higher trade costs also have higher rates of entrepreneurship (Chart 1). In fact, for every 1-percentage-point increase in trade costs—meaning, less openness to international trade—there is a 0.5–0.8-percentage-point increase in entrepreneurship.

This finding continues to hold after controlling for the fraction of urban population in the country, the country’s unemployment, GDP per capita and size.

While these data control for notable confounding factors, there remains a possibility that extraneous differences between countries have influenced the relationships.

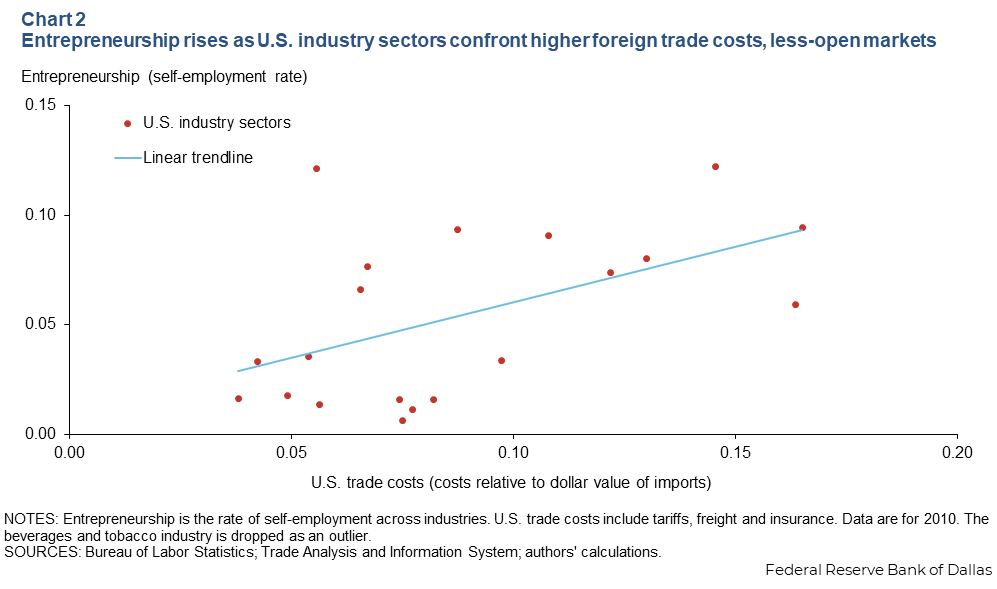

Examining data across U.S. industries provides additional insight. U.S. industry data have the advantage of being drawn from within one country, mitigating the risk of extraneous items influencing the findings.

With each 1-percentage-point increase in trade costs, the entrepreneurship rate increased 0.4–0.6 percentage points, supporting the relationship initially noticed in our cross-country analysis (Chart 2).

This finding continues to hold after controlling for other confounding items, such as the amounts of capital and labor needed in each industry, demographics, lobbying efforts and the substitutability of an industry’s products.

Finally, individual-level data suggest that trade costs affect the choices of individuals, not just the overall entrepreneurship of a country or industry. Individual-level data better focus on those who run an incorporated business and work in managerial and professional occupations—a population more likely to have the skills necessary to run an organization. From there, we analyze whether one self-selects entrepreneurship and compare these data to industry trade costs.

Drawing on this individual-level data indicates that a 1-percentage-point increase in trade costs is associated with a 0.2–0.3-percentage-point increase in the probability of selecting entrepreneurship. These results hold even after controlling for demographic and industry factors.

China trade shock impacts entrepreneurship

While these results point to a clear negative relationship between trade liberalization and entrepreneurship, one could still argue that the relationship is a correlation rather than a causal relationship. The so-called “China shock” provides a natural laboratory to test whether a causal link exists.

The China shock refers to the impact that followed China’s entry to the World Trade Organization (WTO) in 2001, which opened China to trade and foreign investment and granted it most-favored-nation trade status with the U.S. Many U.S. industries experienced a sudden increase in import penetration, providing a unique opportunity to study the reaction of entrepreneurship rates.

Chart 3 displays the relationship found in our regression analysis between entrepreneurship rates and the change in China’s import penetration following its WTO admission. The chart plots the estimated coefficients representing the impact of import penetration on entrepreneurship over time. The coefficient became negative after 2001, indicating the increased import penetration following China’s WTO membership and its negative effect on entrepreneurship.

The chart suggests a causal relationship between trade liberalization and entrepreneurship rather than a simple correlation.

Applying the relationship further, it appears likely that if the world continues to grow more interconnected through international trade, the rate of entrepreneurship will decrease over time as well. Conversely, if the barriers to trade increase—for example, due to new tariffs or geopolitical tensions—the rate of entrepreneurship could well increase.

About the authors